Title: Iowa Letter to Creditors Notifying Them of Identity Theft for New Accounts Introduction: In Iowa, victims of identity theft can use a specific letter format to notify their creditors about fraudulent new accounts opened in their name. This letter serves as an essential tool to inform creditors regarding the theft and protect the victim from any financial liabilities. In this comprehensive guide, we will explore everything you need to know about an Iowa Letter to Creditors Notifying Them of Identity Theft for New Accounts, including its purpose, key elements, and variations. Key Elements of an Iowa Letter to Creditors: 1. Victim's Information: — Provide your full name, address, phone number, and email address (if available). This information helps credit institutions to identify the victim accurately and contact them if needed. 2. Declaration of Identity Theft: — Clearly state that you are a victim of identity theft and that an unauthorized account has been opened in your name. — Mention the date (or estimated date) when you discovered the fraudulent activity. 3. Account Details: — List the specific account(s) that have been opened fraudulently by providing the account names, numbers (if known), and the institutions where they were opened. — If available, include any relevant account statements or documentation as evidence of the fraudulent activity. 4. Request for Action: — Clearly state your expectations from the creditor, such as freezing the account, investigating the issue, and stopping any further transactions related to the fraudulent account(s). — Request the removal of any unauthorized charges or fees associated with the fraudulent account(s). — Ask for written confirmation from the creditor regarding their actions taken. 5. Supporting Documents: — Enclose copies of any documentation you possess related to the identity theft incident, including police reports, FTC affidavit, credit monitoring service alerts, or other relevant evidence. — Attach a copy of your ID to establish your identity and authenticity. 6. Contact Information for Follow-up: — Provide your preferred contact information, including alternate phone numbers and email addresses, to ensure that the creditor can easily reach you for further inquiries or updates. — Mention your willingness to cooperate throughout the investigation process. Types of Iowa Letters to Creditors Notifying Them of Identity Theft for New Accounts: 1. Initial Notification Letter: — Sent to creditors when the victim initially discovers the fraudulent account(s). — Requests immediate action to freeze the accounts and halt any further unauthorized transactions. 2. Follow-up Letter: — Sent if the initial response from the creditor is inadequate or unsatisfactory. — Urges the creditor to take further action to resolve the issue promptly. — May also express the intent to escalate the matter to legal authorities if necessary. Conclusion: An Iowa Letter to Creditors Notifying Them of Identity Theft for New Accounts is an essential step in protecting one's financial well-being after falling victim to identity theft. By providing accurate details, clear instructions, and supporting evidence, victims can increase their chances of resolving the issue satisfactorily. Remember to adapt the letter to fit your specific circumstances and consult legal professionals if required.

Iowa Letter to Creditors Notifying Them of Identity Theft for New Accounts

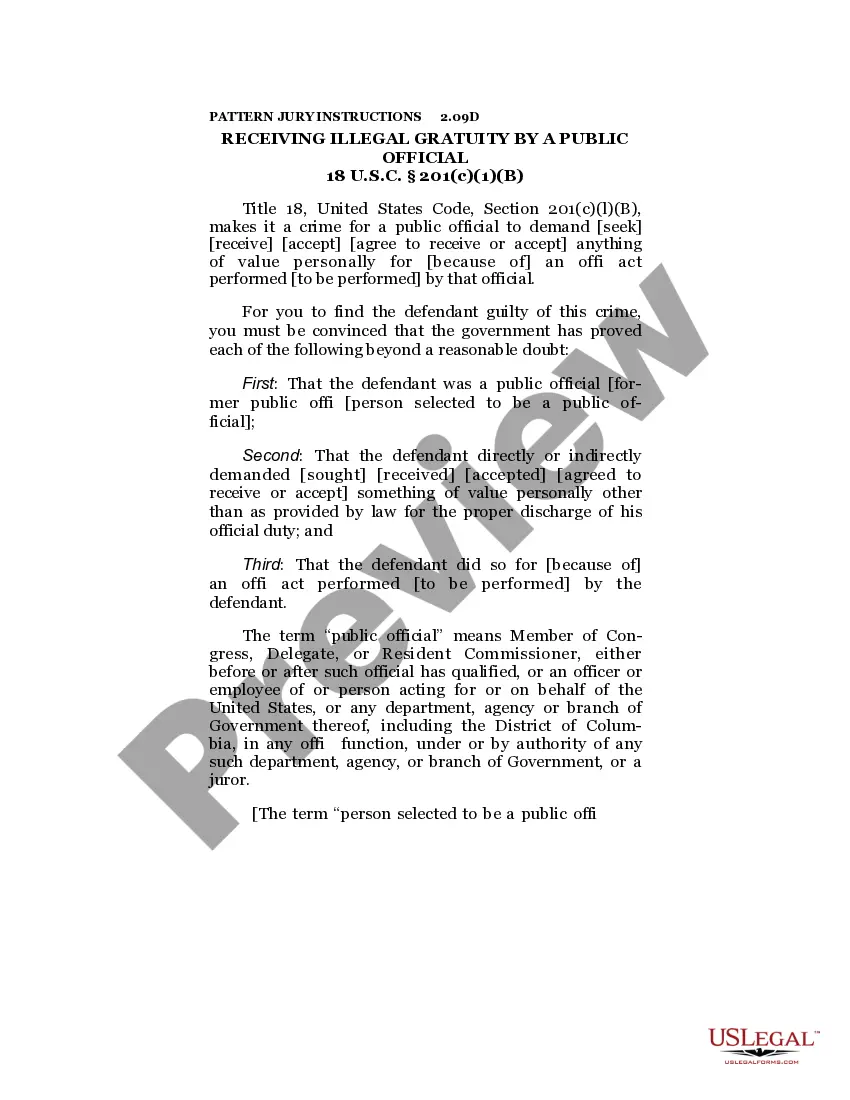

Description

How to fill out Iowa Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Choosing the right lawful file template might be a struggle. Obviously, there are a variety of layouts accessible on the Internet, but how would you find the lawful type you require? Take advantage of the US Legal Forms site. The services delivers a huge number of layouts, including the Iowa Letter to Creditors Notifying Them of Identity Theft for New Accounts, which you can use for enterprise and private needs. Each of the kinds are examined by experts and meet up with state and federal requirements.

Should you be presently authorized, log in to the account and click on the Acquire button to have the Iowa Letter to Creditors Notifying Them of Identity Theft for New Accounts. Utilize your account to check throughout the lawful kinds you have bought formerly. Check out the My Forms tab of your own account and get yet another copy of the file you require.

Should you be a brand new customer of US Legal Forms, listed here are easy directions that you can comply with:

- Initially, ensure you have chosen the right type for the town/area. You are able to examine the form while using Preview button and read the form description to make certain it will be the right one for you.

- In the event the type fails to meet up with your requirements, utilize the Seach area to discover the proper type.

- Once you are positive that the form is proper, click the Acquire now button to have the type.

- Pick the pricing prepare you want and enter the needed info. Build your account and buy the transaction with your PayPal account or bank card.

- Pick the submit format and acquire the lawful file template to the gadget.

- Complete, change and print and indication the acquired Iowa Letter to Creditors Notifying Them of Identity Theft for New Accounts.

US Legal Forms is the most significant library of lawful kinds for which you can discover various file layouts. Take advantage of the service to acquire skillfully-produced files that comply with express requirements.