Iowa Letter to Creditors Notifying Them of Identity Theft of Minor

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor?

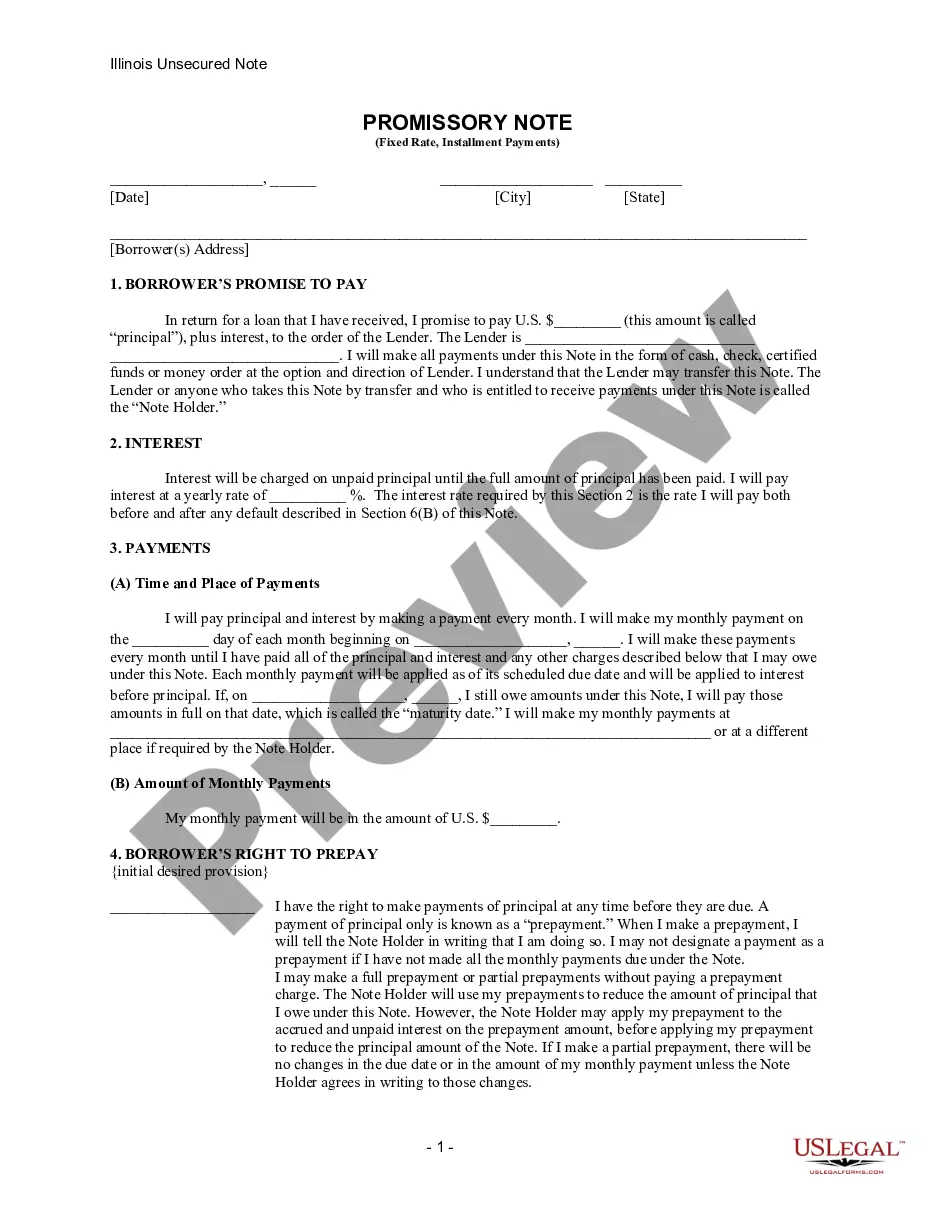

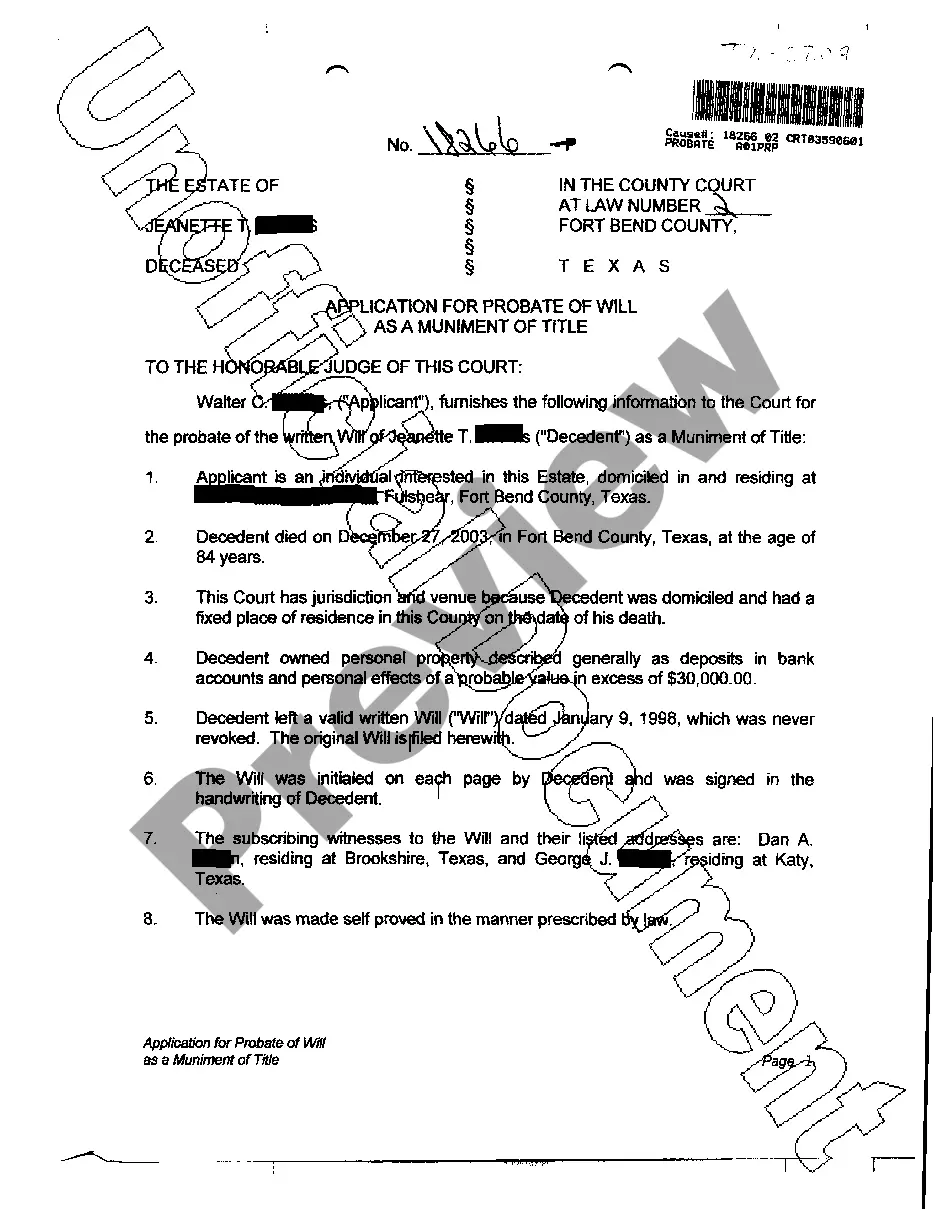

Discovering the right lawful record format might be a struggle. Needless to say, there are tons of layouts available on the Internet, but how will you discover the lawful form you need? Take advantage of the US Legal Forms internet site. The support delivers 1000s of layouts, such as the Iowa Letter to Creditors Notifying Them of Identity Theft of Minor, which you can use for company and private needs. Each of the forms are inspected by specialists and satisfy state and federal demands.

Should you be already listed, log in to your profile and click on the Acquire switch to obtain the Iowa Letter to Creditors Notifying Them of Identity Theft of Minor. Make use of your profile to appear with the lawful forms you may have acquired in the past. Go to the My Forms tab of the profile and acquire another version from the record you need.

Should you be a brand new user of US Legal Forms, here are straightforward recommendations so that you can stick to:

- Initially, make certain you have selected the correct form for your personal town/area. You may examine the shape utilizing the Preview switch and look at the shape explanation to make certain it is the right one for you.

- When the form does not satisfy your requirements, take advantage of the Seach field to discover the correct form.

- Once you are certain that the shape would work, click the Get now switch to obtain the form.

- Choose the rates prepare you want and type in the required information and facts. Design your profile and pay money for the transaction using your PayPal profile or Visa or Mastercard.

- Pick the submit formatting and obtain the lawful record format to your gadget.

- Full, modify and print and signal the obtained Iowa Letter to Creditors Notifying Them of Identity Theft of Minor.

US Legal Forms is definitely the largest collection of lawful forms that you will find various record layouts. Take advantage of the service to obtain skillfully-made papers that stick to condition demands.

Form popularity

FAQ

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report. An FTC Identity Theft Report subjects the person filing the report to criminal penalties if the information is false, and businesses can treat it as they would a police report.

Contact the Iowa Attorney General's Consumer Protection Division to request "A Guide for Victims of Identity Theft". This contains additional information as well as contact information for reporting the fraud to various agencies. Phone: (515) 281-5926 or toll free 1-888-777-4590.

In Iowa, victims of identity theft can apply for the Identity Theft Passport Program, which was created by Iowa Code section 715A. 9A and is also covered in Iowa Administrative Rule 61-35.4(715A). The Iowa Attorney General's Office website gives detailed information about the program, including how to apply.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

If you have been a victim of identity theft, the Identity Theft Statement helps you notify financial institutions, credit card issuers and other companies that the identity theft occurred, tell them that you did not create the debt or charges, and give them information they need to begin an investigation.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.