Iowa Sample Letter for Request for Credit Report of a Minor

Description

How to fill out Sample Letter For Request For Credit Report Of A Minor?

If you require to complete, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Utilize the site’s straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Iowa Sample Letter for Request for Credit Report of a Minor in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to access the Iowa Sample Letter for Request for Credit Report of a Minor.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

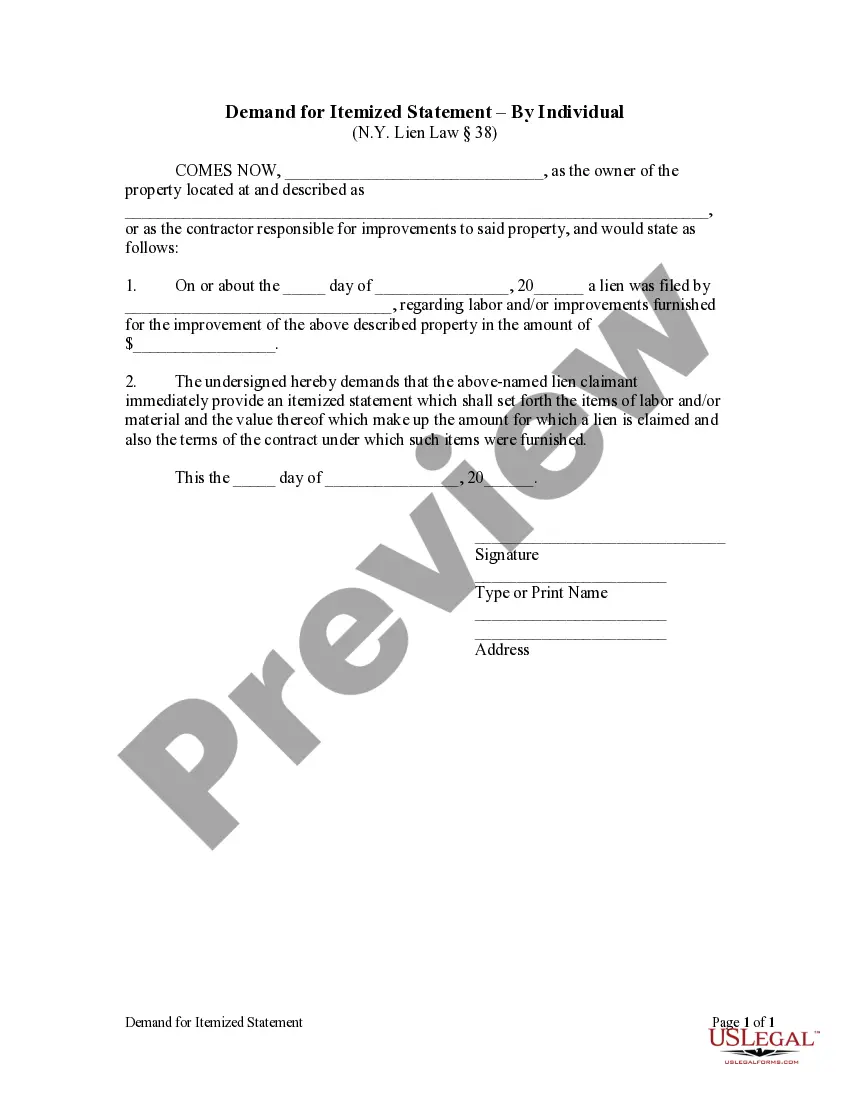

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Send the request and information to all three credit reporting companies. Please note that, due to federal requirements, requests for children under 13 cannot be requested online. Minors between the ages of 13 through 17 can also order a report through the AnnualCreditReport.com website.

Sample Letter to Request a Credit Report Dear Sir or Madam: I would like to request a copy of my credit report file. I am providing the following information to obtain the report. Please contact me if you have any questions or need additional information.

Who Qualifies. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. To be a qualifying child for the 2022 tax year, your dependent generally must: Be under age 17 at the end of the year.

Alternatively, you can check for your child's credit report by submitting a written request and supporting documents to Experian via mail or Experian's site. You can find the official form on its website. You should include: A copy of your government-issued ID, such as a state ID card or driver's license.

Alternatively, you can check for your child's credit report by submitting a written request and supporting documents to Experian via mail or Experian's site. You can find the official form on its website. You should include: A copy of your government-issued ID, such as a state ID card or driver's license.

If over the age of 13, you can check directly (for FREE) at annualcreditreport.com to see if a credit report exists. For a child under the age of 13, you should go directly to Equifax, TransUnion and Experian's websites to find out what information that you need to mail to them.

I am requesting that this item be removed [or request another specific change to correct the information]. [List and describe any other items you are disputing.] Enclosed is documentation supporting my request: [describe the documents you're sending, for instance: my credit report, with the disputed items circled.]

As a legal guardian, you can request a free copy of your child's credit report by completing the request form on annualcreditreport.com . This will help you access one free credit report per year from each of the three credit reporting agencies: Equifax, Experian, and TransUnion.