Title: Iowa Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert Keywords: Iowa, letter, credit reporting bureaus, credit reporting agencies, deceased person, credit report, deceased alert. I. Introduction In Iowa, individuals may need to write a letter to credit reporting bureaus or agencies requesting a copy of a deceased person's credit report and the placement of a deceased alert. These requests are essential to protect the deceased individual's personal information and prevent potential identity theft. This article provides a detailed description of the process, including different types of Iowa letters that can be used for this purpose. II. Purpose of a Deceased Person's Credit Report A deceased person's credit report is necessary to assess and manage their financial affairs, prevent unauthorized access, and address any outstanding debts or financial obligations. Obtaining a credit report enables family members or authorized representatives to gain visibility into the deceased individual's financial status, ensuring a smooth transition of their affairs. III. Importance of Placing a Deceased Alert To safeguard the deceased person's identity and minimize the risk of fraud, it is crucial to place a deceased alert with credit reporting bureaus or agencies. This alert notifies potential lenders and creditors that the individual has passed away, preventing the issuance of additional credit in their name. The deceased alert serves as a valuable tool in preventing identity theft and unauthorized access to financial resources. IV. Writing an Iowa Letter to Credit Reporting Bureaus or Agencies When writing a letter to credit reporting bureaus or agencies in Iowa, it's important to ensure its effectiveness and clarity. The following are the essential components to include in the letter: 1. Deceased Individual's Information: Funnymanam— - Date of birth - Social Security number — Date of death 2. Request for a Copy of the Deceased Person's Credit Report: — Clearly state the purpose of the letter — Request a copy of the deceased person's credit report — Mention that the request is being made as an authorized representative or family member 3. Placement of Deceased Alert: — Request the credit bureaus or agencies to place a deceased alert on the deceased person's credit file — Emphasize the importance of this alert in preventing identity theft 4. Supporting Documentation: — Enclose a copy of the death certificate or any other supporting documentation to validate the deceased person's passing and their relationship with the requester V. Types of Iowa Letters for Credit Report and Deceased Alert Requests 1. Individual Family Member Request: This letter is used when a family member is handling the deceased individual's affairs. 2. Executor/Administrator Request: If an executor or administrator has been appointed to manage the deceased person's estate, this letter is written by them on behalf of the estate. 3. Power of Attorney Request: When an individual has a valid power of attorney for the deceased person's affairs, they should utilize this type of letter to request the credit report and deceased alert. VI. Conclusion Properly addressing credit reporting bureaus or agencies in Iowa with a well-crafted letter is essential to obtain a copy of a deceased person's credit report and place a deceased alert. By following the guidelines outlined in this article and utilizing the appropriate type of Iowa letter, individuals can protect the personal information of the deceased and minimize the risk of identity theft.

Iowa Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert

Description

How to fill out Iowa Letter To Credit Reporting Bureaus Or Agencies Requesting Copy Of Deceased Person's Credit Report And Placement Of Deceased Alert?

Choosing the right legitimate file format could be a battle. Obviously, there are a variety of layouts available on the Internet, but how do you get the legitimate form you will need? Make use of the US Legal Forms web site. The service provides a large number of layouts, for example the Iowa Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert, which you can use for business and personal demands. All of the varieties are inspected by professionals and meet federal and state demands.

If you are currently signed up, log in to your account and then click the Obtain key to obtain the Iowa Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert. Utilize your account to search through the legitimate varieties you may have acquired in the past. Go to the My Forms tab of your own account and get an additional duplicate in the file you will need.

If you are a new user of US Legal Forms, allow me to share simple directions that you can stick to:

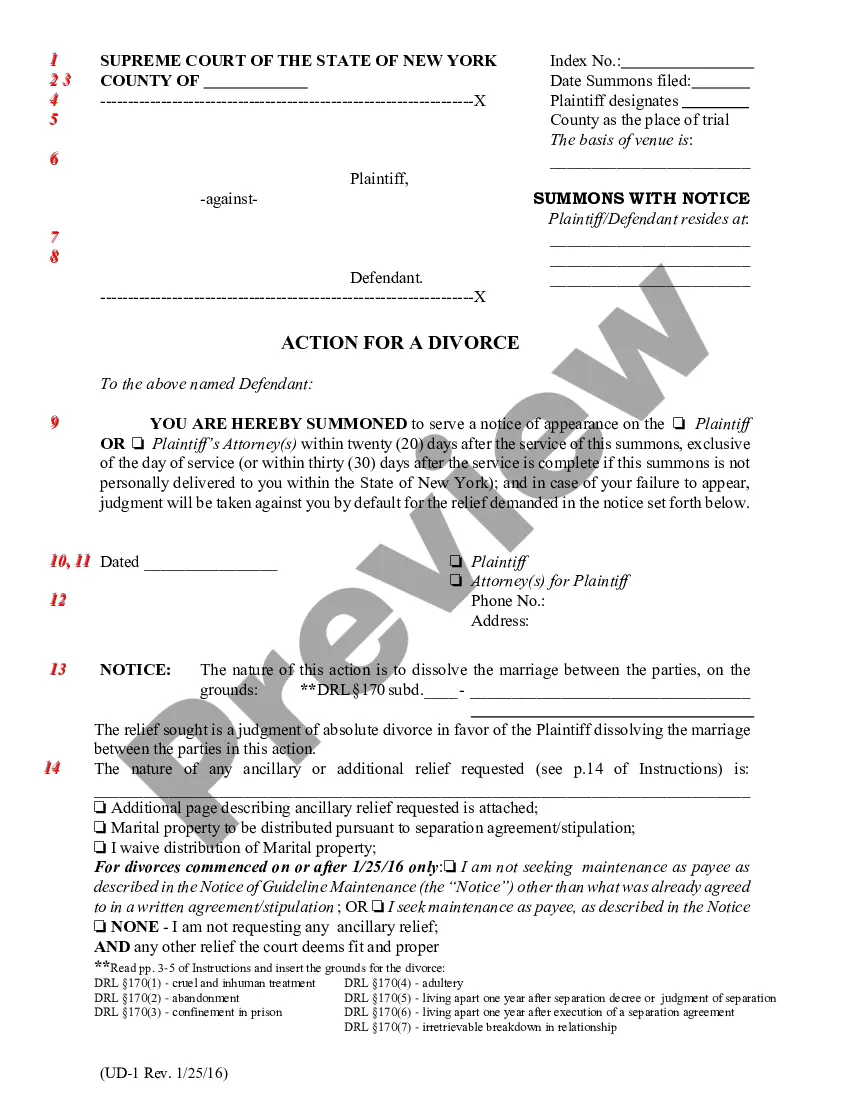

- Initial, ensure you have selected the correct form for your personal area/region. You can check out the form while using Review key and read the form explanation to make certain this is basically the best for you.

- When the form fails to meet your expectations, take advantage of the Seach area to get the proper form.

- Once you are certain the form is suitable, select the Purchase now key to obtain the form.

- Opt for the prices strategy you desire and enter in the needed details. Build your account and pay for an order utilizing your PayPal account or charge card.

- Select the data file file format and acquire the legitimate file format to your system.

- Complete, revise and produce and sign the received Iowa Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert.

US Legal Forms may be the largest collection of legitimate varieties where you will find different file layouts. Make use of the service to acquire appropriately-manufactured paperwork that stick to state demands.