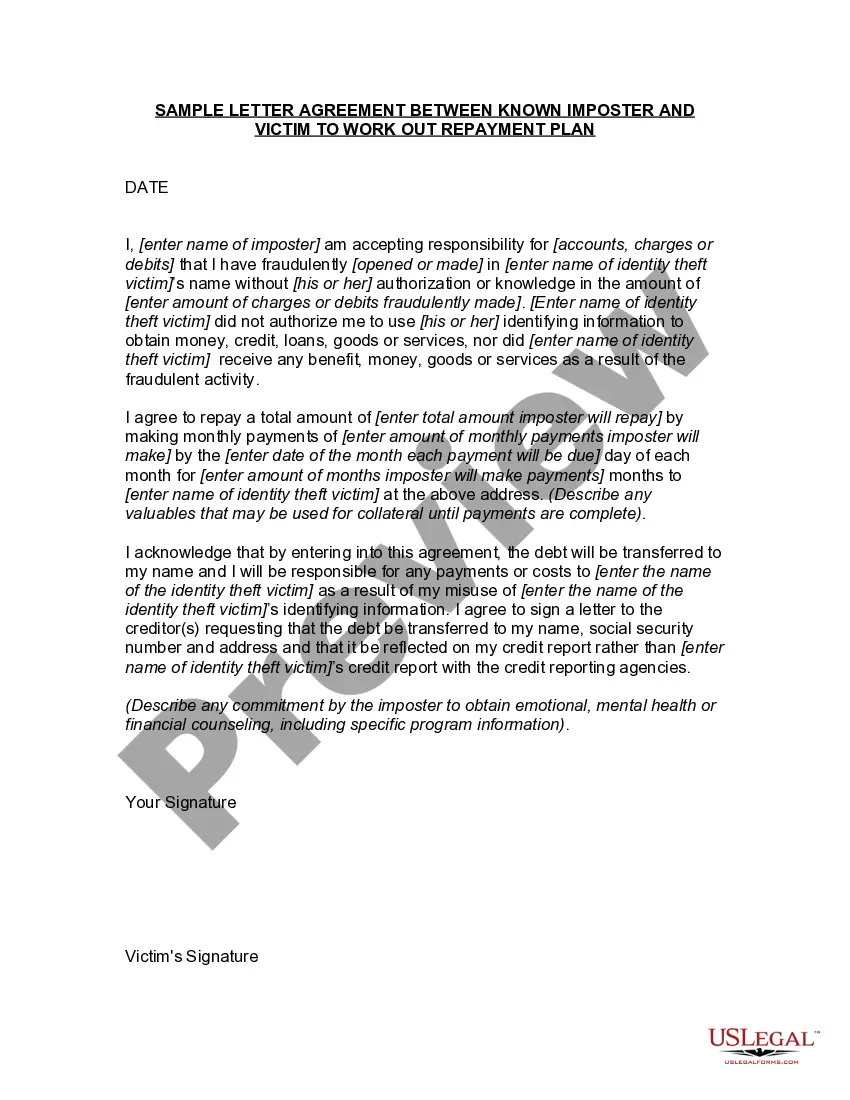

Title: Iowa Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan Introduction: In the state of Iowa, a Letter Agreement plays a crucial role in facilitating communication between a known imposter and their victim to establish a repayment plan. This agreement aims to address the financial damages incurred by the victim due to the imposter's fraudulent activities. The following description will provide an in-depth understanding of this Iowa-specific Letter Agreement, its purpose, components, and potential variations. Components of an Iowa Letter Agreement: 1. Parties Involved: The agreement identifies the known imposter (the party who perpetrated the fraud) and the victim (the individual who suffered financial harm due to the imposter's actions). The parties' names, contact details, and any applicable legal representatives should be stated. 2. Background Summary: This section outlines the circumstances leading to the identification of the imposter and acknowledges the fraudulent acts committed by the imposter. It highlights the victim's financial losses resulting from the imposter's actions. 3. Repayment Plan: The primary objective of this agreement is to establish a repayment plan to compensate the victim for their losses. This section details the terms and conditions of the repayment plan, including the agreed-upon amount, mode of payment, and a timeline for reimbursement. It may also include provisions for interest, late payment penalties, and negotiations for a reduced amount if necessary. 4. Acknowledgment of Responsibility: The imposter acknowledges their responsibility for the fraudulent activities and agrees to work collaboratively with the victim to resolve the financial dispute. It is essential for the imposter to admit guilt and demonstrate their commitment to fulfilling the agreed-upon repayment terms. 5. Confidentiality Agreement: Both parties may choose to include a confidentiality clause to protect sensitive information shared during negotiations and the terms of the agreement itself. This clause ensures that discussions regarding the repayment plan remain confidential and restricts the parties from disclosing any details to third parties. Variations of Iowa Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: 1. Iowa Letter Agreement for Identity Theft: This variation specifically addresses cases where the imposter has stolen the victim's identity and incurred financial damages in their name. It focuses on resolving issues related to fraudulent credit card usage, loans, or purchases made under the victim's name, outlining steps to rectify such violations. 2. Iowa Letter Agreement for Financial Fraud: This agreement type pertains to situations where the imposter has deceived the victim into providing financial assistance or investment opportunities resulting in significant monetary losses. It establishes a framework for repaying the defrauded funds and may involve discussions on restitution, legal consequences, and further actions against the imposter. Conclusion: In Iowa, a Letter Agreement facilitates the communication and negotiation between a known imposter and the victim, aiming to settle financial disputes caused by fraudulent activities. By addressing the components mentioned above, varying based on the type of fraud committed, this agreement serves as a crucial tool in seeking repayment and working towards resolution lawfully.

Iowa Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

How to fill out Iowa Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

You are able to invest hours on the web looking for the lawful record web template that suits the state and federal requirements you want. US Legal Forms supplies a huge number of lawful varieties that are analyzed by pros. It is possible to download or produce the Iowa Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan from your service.

If you already have a US Legal Forms accounts, you may log in and click on the Acquire switch. Afterward, you may complete, change, produce, or signal the Iowa Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan. Each lawful record web template you purchase is your own property eternally. To obtain one more version of the bought develop, go to the My Forms tab and click on the related switch.

If you work with the US Legal Forms internet site the first time, stick to the easy recommendations beneath:

- Initially, ensure that you have chosen the correct record web template for that area/town that you pick. Browse the develop explanation to ensure you have selected the proper develop. If offered, make use of the Preview switch to search throughout the record web template also.

- If you would like locate one more model of your develop, make use of the Research discipline to obtain the web template that suits you and requirements.

- Upon having found the web template you would like, click Acquire now to continue.

- Pick the prices program you would like, enter your credentials, and sign up for a free account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal accounts to cover the lawful develop.

- Pick the structure of your record and download it to the product.

- Make modifications to the record if possible. You are able to complete, change and signal and produce Iowa Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan.

Acquire and produce a huge number of record themes using the US Legal Forms Internet site, which offers the greatest assortment of lawful varieties. Use skilled and express-specific themes to handle your small business or personal needs.

Form popularity

FAQ

An IOU ( I Owe You ) is a legal document that sets out the details of a loan made between two people, a borrower, and a lender.

Structure of an I-Owe-You Contract The lender's full name. The borrower's full name. The amount of money ($) borrowed. The due date for the borrowed money. The amount ($) the borrower will pay per month/week. The date the borrower and seller signed the document.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

This legal document, called a promissory note, is a written instrument that contains a promise by one party to pay another party a definite sum of money either on demand or at a specified future date.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.