Title: Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft Introduction: Identity theft is a growing concern that affects individuals across the United States, including residents of Iowa. To combat this issue, the state of Iowa allows its residents to submit detailed letters to credit reporting companies or bureaus to report known cases of imposter identity theft. This letter serves as a formal means of informing the credit reporting entity about the fraudulent activity and taking appropriate actions to rectify the situation. In Iowa, there may be different types of letters concerning imposter identity theft, each catering to specific circumstances. Let's explore these variations below: 1. Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft — General: This type of letter provides a comprehensive account of the imposter identity theft situation. It includes relevant details such as the fraudulent accounts or activities discovered, dates of fraudulent transactions, and any supporting evidence available. The individual can request an immediate investigation into the matter and ask for an appropriate resolution, such as the removal of fraudulent accounts or correction of credit reports. 2. Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft — Account Specific: Some individuals may find imposter identity theft limited to a specific account, such as a credit card or loan account. This type of letter focuses on notifying the credit reporting company or bureau solely about the fraudulent activity affecting a particular account. The letter should provide account details, evidence of fraud, and request prompt action, such as freezing the account or initiating a fraud investigation. 3. Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft — Criminal Report Attached: In certain cases, the identity theft may have been reported to the local authorities, resulting in a criminal case. This type of letter states that an official police report is attached, mentioning the case number, date of report, and law enforcement agency handling the investigation. This letter emphasizes the seriousness of the imposter identity theft and requests an immediate resolution in collaboration with law enforcement. 4. Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft — Identity Theft Victim Assistance Request: This variation of the letter focuses on seeking assistance and guidance from credit reporting companies or bureaus after falling victim to imposter identity theft. The letter requests detailed instructions on how to proceed, such as contacting other relevant entities, placing fraud alerts, freezing credit reports, and accessing available identity theft resources. It may also seek clarification on the individual's rights in relation to identity theft and the subsequent credit reporting implications. Conclusion: When writing an Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft, it is essential to provide accurate, detailed, and specific information, depending on the situation. The letter should clearly state the intention, outline the imposter identity theft incidents, and indicate the desired action from the credit reporting entity. By promptly reporting imposter identity theft and seeking assistance, residents of Iowa can protect their financial well-being and work towards resolving any credit reporting issues caused by the fraud.

Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

How to fill out Iowa Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

US Legal Forms - among the greatest libraries of lawful types in the USA - provides a wide array of lawful file layouts you can obtain or produce. Utilizing the website, you can get thousands of types for company and personal functions, sorted by categories, states, or keywords and phrases.You can find the most recent variations of types like the Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft within minutes.

If you already possess a registration, log in and obtain Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft from your US Legal Forms collection. The Download option will appear on every type you perspective. You get access to all previously downloaded types inside the My Forms tab of your respective profile.

If you would like use US Legal Forms initially, allow me to share easy guidelines to help you started off:

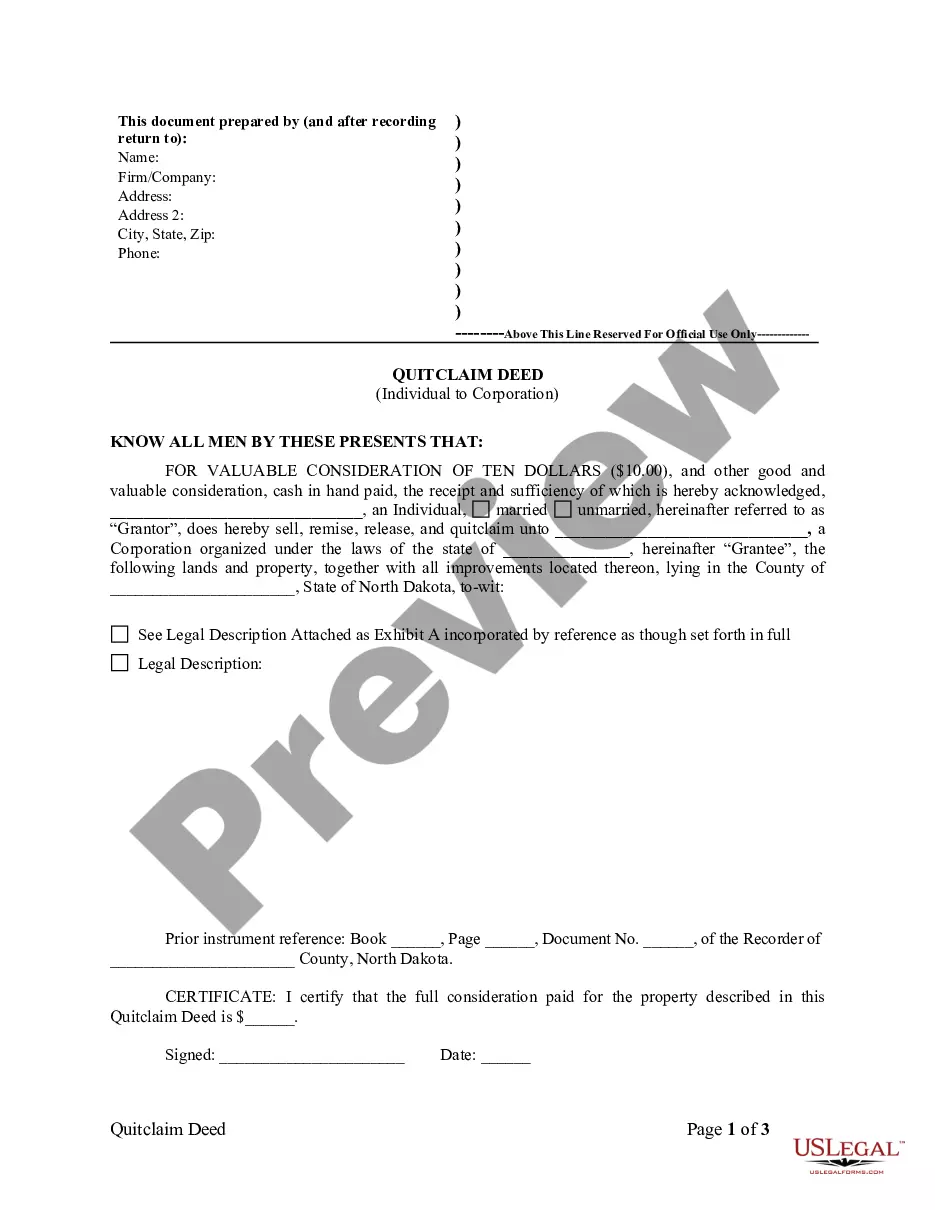

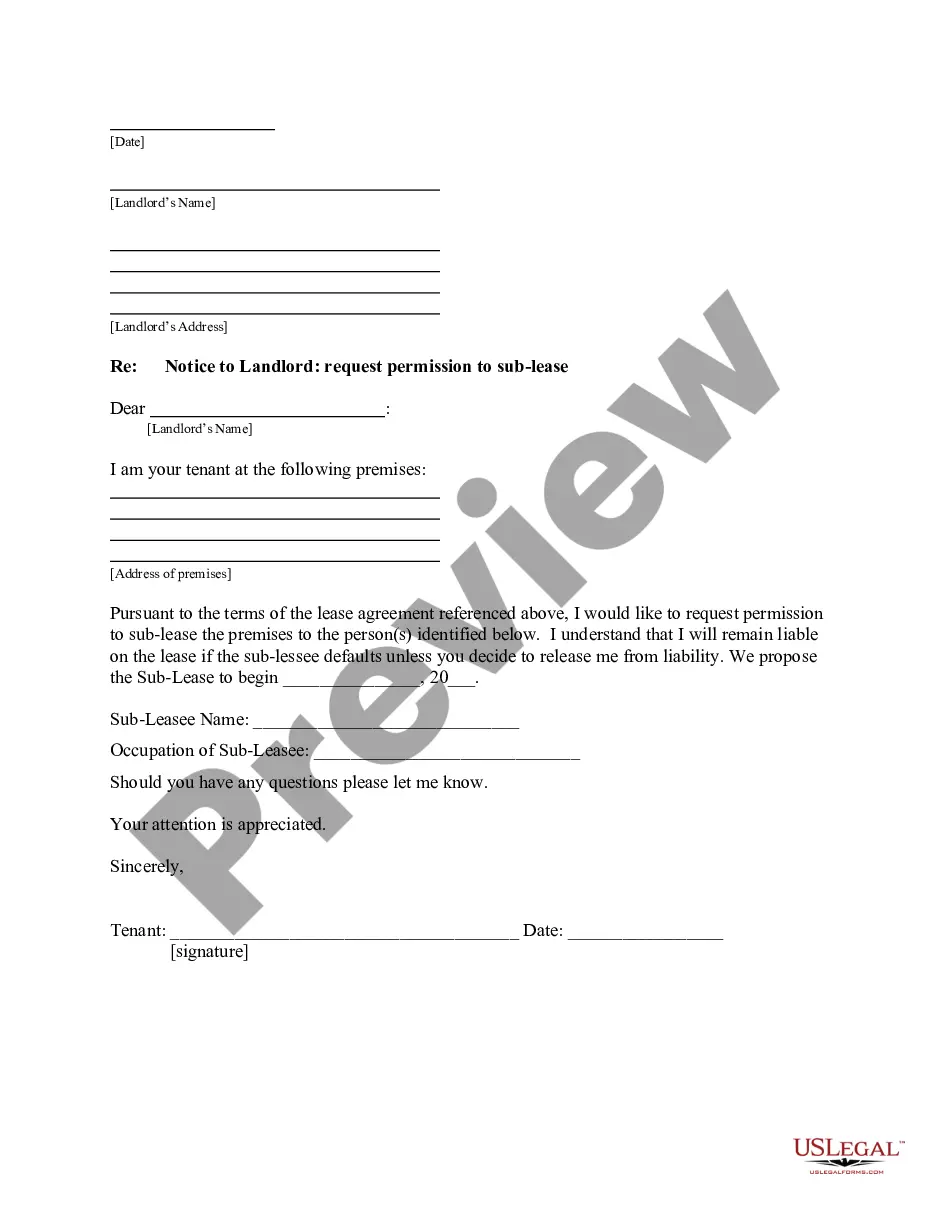

- Ensure you have selected the proper type to your city/region. Select the Review option to review the form`s information. Read the type outline to ensure that you have chosen the proper type.

- In the event the type does not suit your demands, use the Lookup discipline towards the top of the screen to obtain the one who does.

- In case you are content with the form, confirm your decision by visiting the Buy now option. Then, opt for the rates strategy you like and give your credentials to register for an profile.

- Method the financial transaction. Make use of bank card or PayPal profile to accomplish the financial transaction.

- Find the formatting and obtain the form on your own product.

- Make adjustments. Fill up, modify and produce and sign the downloaded Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.

Every single template you added to your money does not have an expiry time which is yours for a long time. So, if you would like obtain or produce an additional version, just proceed to the My Forms section and click on around the type you require.

Get access to the Iowa Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft with US Legal Forms, probably the most substantial collection of lawful file layouts. Use thousands of professional and condition-specific layouts that satisfy your small business or personal demands and demands.

Form popularity

FAQ

Each of the three major credit reporting agencies (Equifax, Experian and TransUnion) offers consumers the ability to place a ?security freeze,? or deny access to, their credit reports. A security freeze means that your credit file cannot be shared with potential creditors.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful ? when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.

An Identity Theft Affidavit is a document used by victims of identity theft to prove to businesses that their personal information was used to open a fraudulent account.

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

How To Know if Someone Stole Your Identity Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. ... Check your bank account statement. ... Get and review your credit reports.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.