Iowa Certificate of Trust for Mortgage

Description

How to fill out Certificate Of Trust For Mortgage?

If you want to total, obtain, or produce authorized papers layouts, use US Legal Forms, the greatest assortment of authorized types, which can be found online. Use the site`s simple and easy practical research to discover the papers you need. A variety of layouts for organization and personal reasons are sorted by groups and states, or keywords. Use US Legal Forms to discover the Iowa Certificate of Trust for Mortgage with a couple of click throughs.

In case you are currently a US Legal Forms consumer, log in for your profile and then click the Download switch to get the Iowa Certificate of Trust for Mortgage. You may also entry types you earlier saved inside the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form for the correct city/nation.

- Step 2. Use the Preview choice to examine the form`s articles. Never forget to read the outline.

- Step 3. In case you are unsatisfied with all the kind, make use of the Search discipline at the top of the display to get other models from the authorized kind web template.

- Step 4. Upon having identified the form you need, go through the Acquire now switch. Select the costs program you favor and include your qualifications to register to have an profile.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal profile to accomplish the transaction.

- Step 6. Pick the structure from the authorized kind and obtain it in your gadget.

- Step 7. Complete, change and produce or indicator the Iowa Certificate of Trust for Mortgage.

Each and every authorized papers web template you purchase is your own property permanently. You possess acces to every kind you saved within your acccount. Click the My Forms area and choose a kind to produce or obtain once more.

Contend and obtain, and produce the Iowa Certificate of Trust for Mortgage with US Legal Forms. There are many skilled and state-specific types you can use for your personal organization or personal demands.

Form popularity

FAQ

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

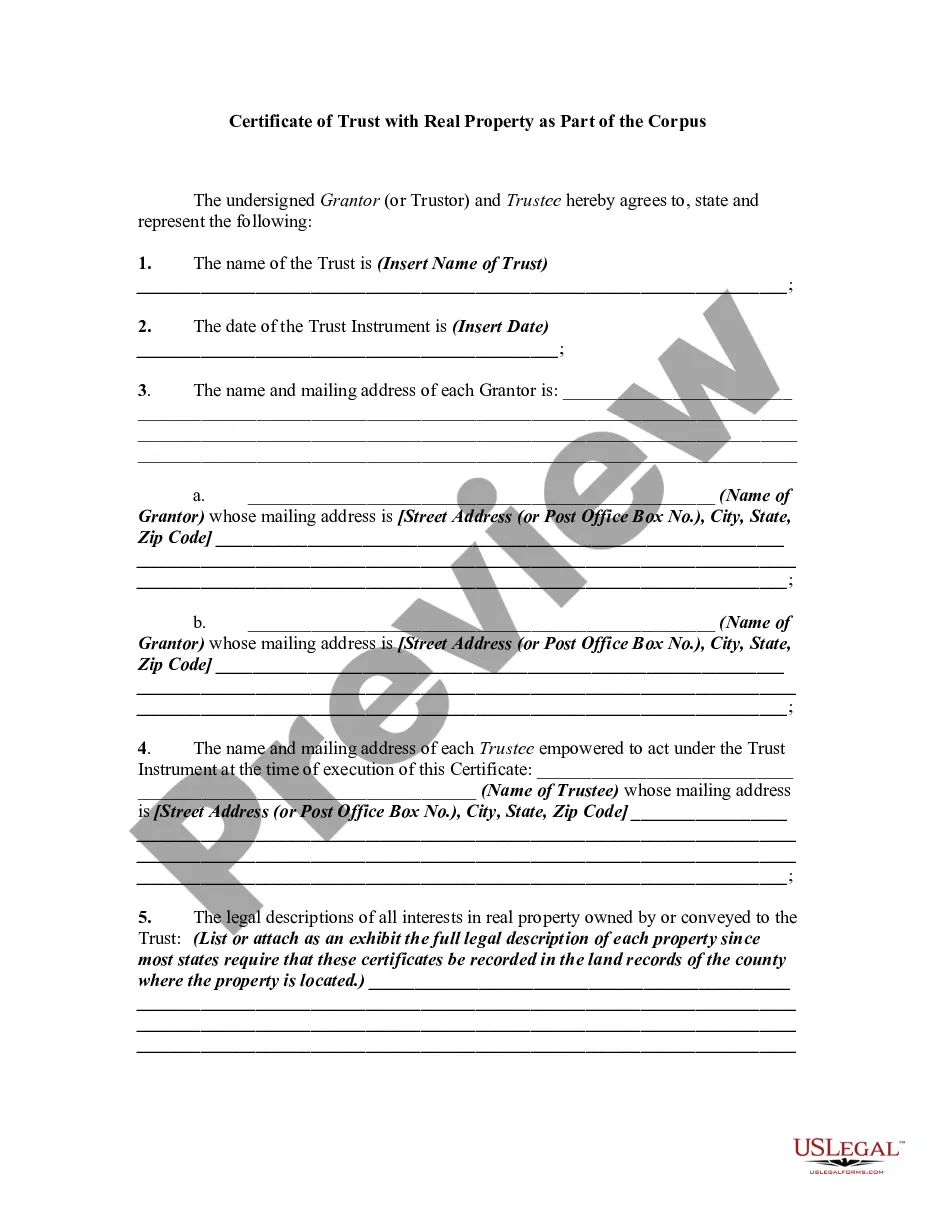

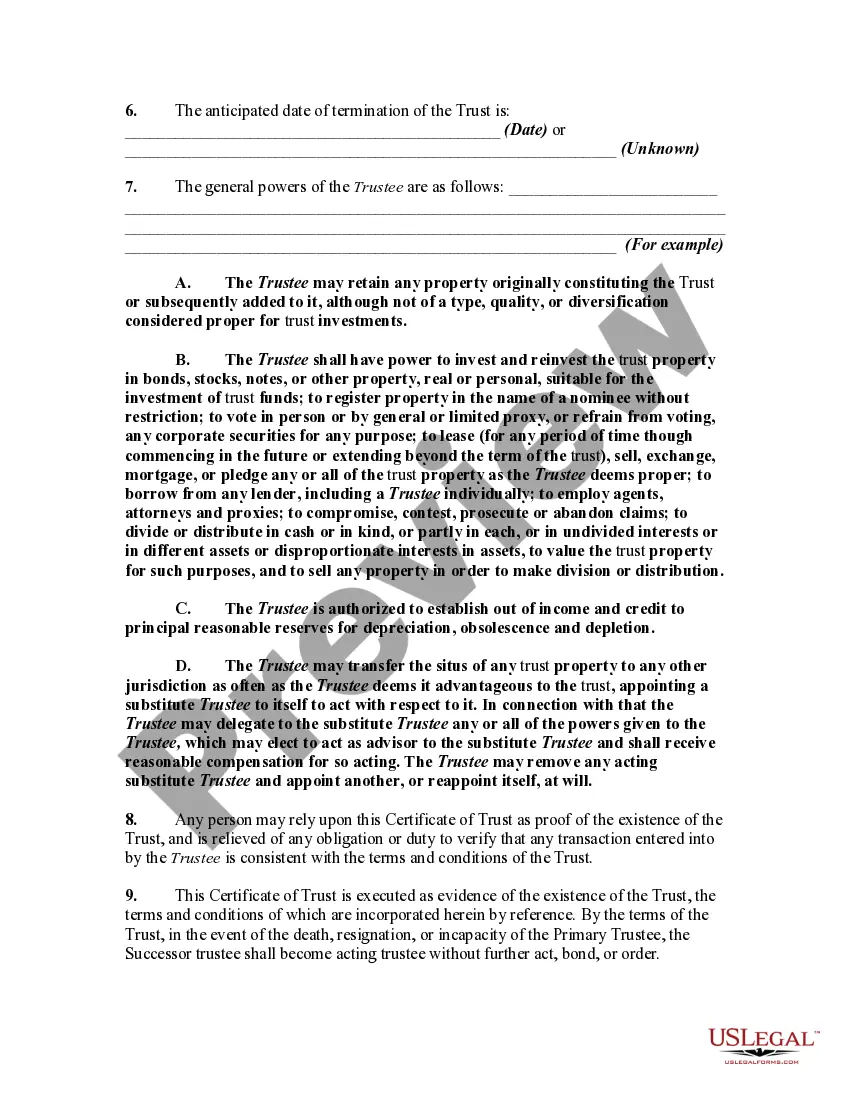

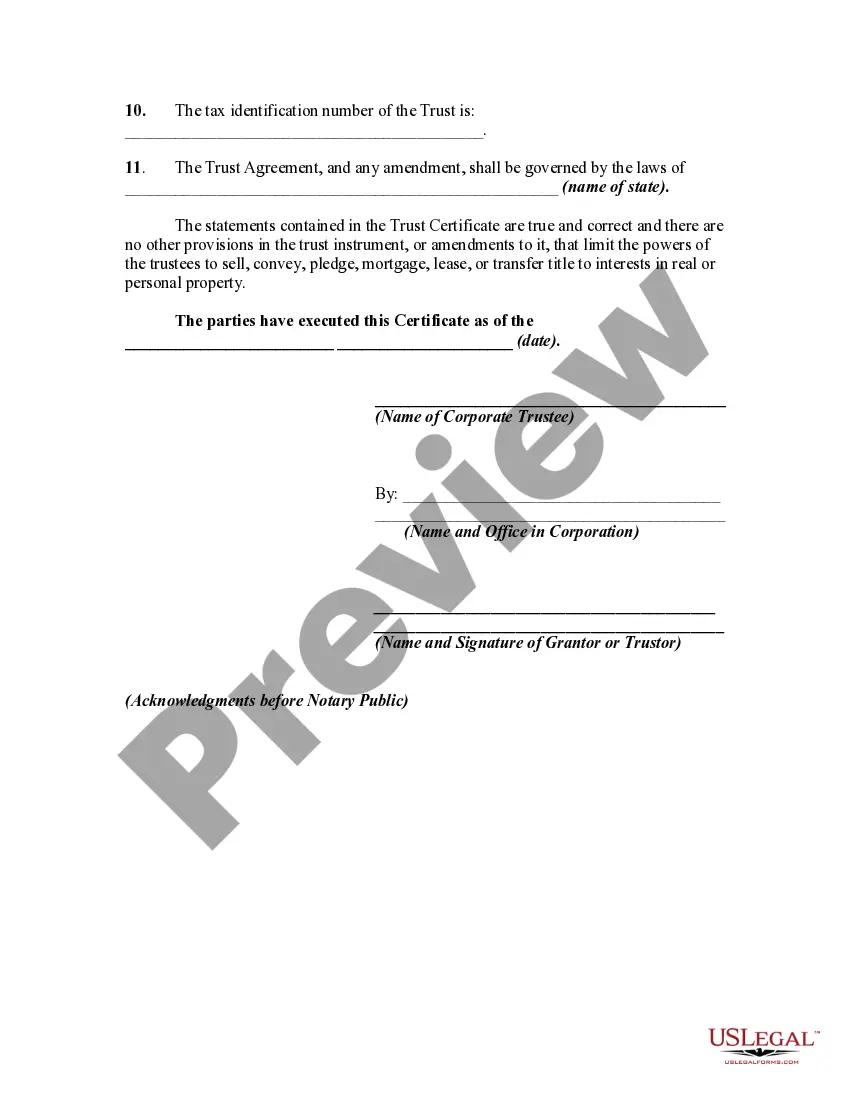

A Trust Certification gives a Trustee the ability to provide anyone who needs it (think: financial institutions or other third parties) important information about the Trust - like the date it was formed, the legal/formal name of the Trust, who the Trustee is (or Trustees are) and other information institutions may ...

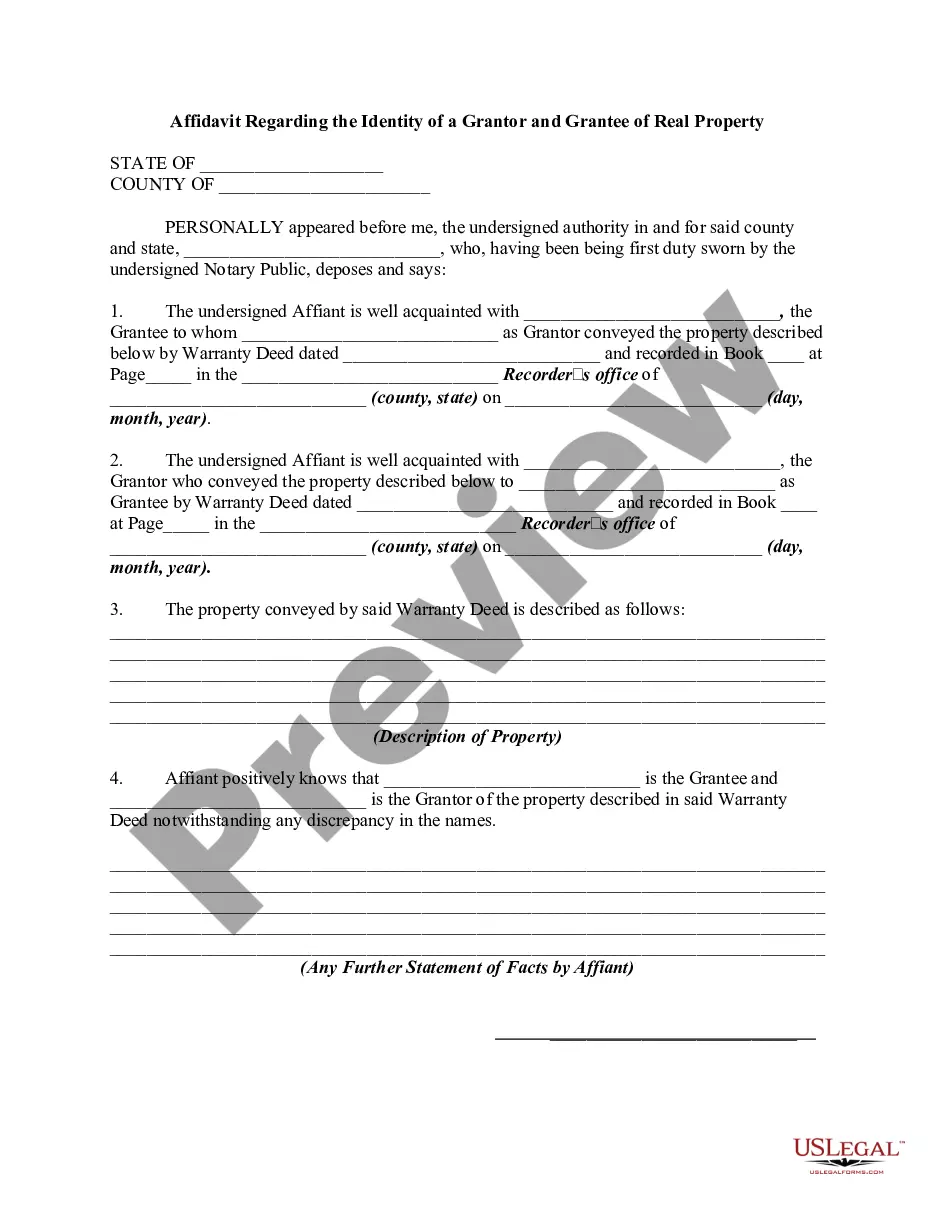

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

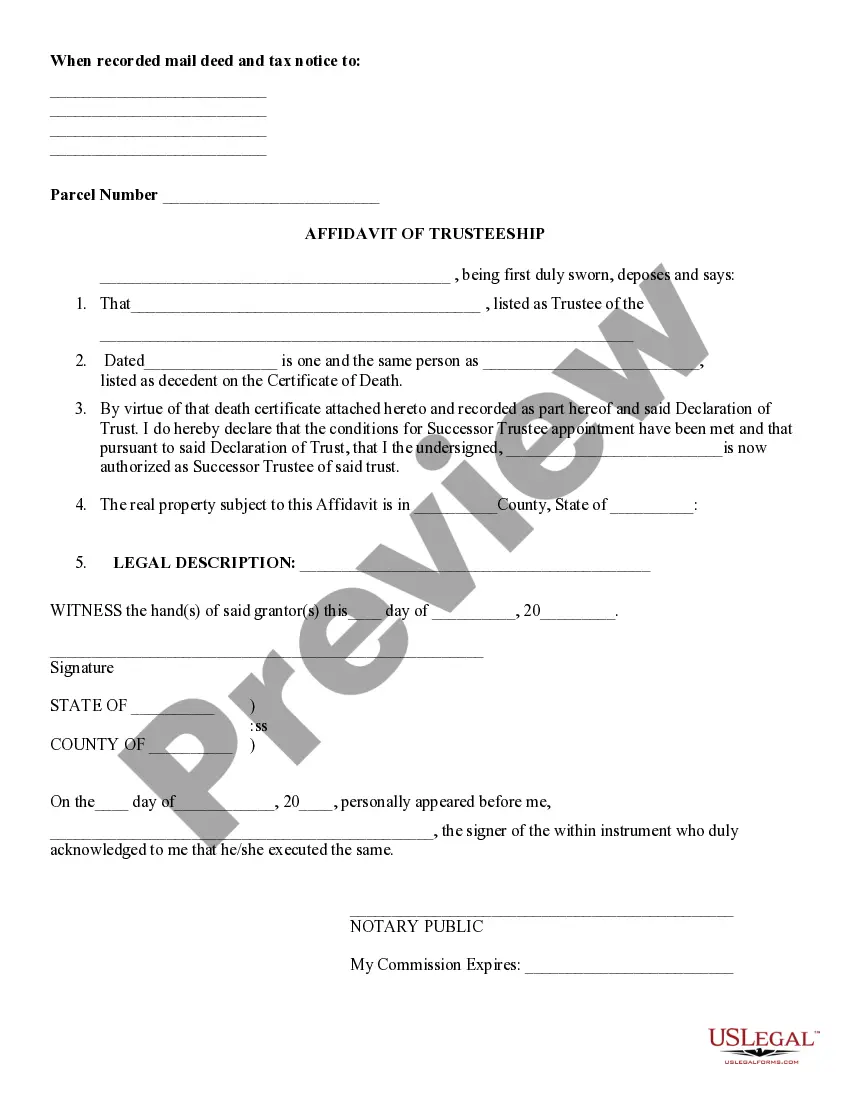

A certification of trust is a document certifying that a trust was established, exists, and is under the management of a certain trustee. Certifications of trust prove the trustee's legal authority to act as such. Certifications of trust also serve as an abbreviated version of the trust.

A certificate of trust ? also called a ?trust certificate? or ?memorandum of trust? ? is a legal document that's often used to prove (or ?certify?) a trust exists and to provide information about its important terms.

To make a living trust in Iowa, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Trust certificates offer investors a high degree of safety in comparison with unsecured or uncollateralized bonds. They also typically pay a lower level of interest than those investors willing to take greater risks.

A trust certificate provides just enough information to prove a trust exists and share information about its key terms ? without disclosing any sensitive information. It also verifies that the trustee has the legal authority to act on behalf of the trust (either in general or with respect to certain transactions).

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act. It's shorter than the actual Trust document, and it can offer pertinent information without making every aspect of the Trust public.

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.