Iowa Certificate of Trust for Successor Trustee: A Comprehensive Overview In Iowa, a Certificate of Trust for Successor Trustee is a vital document that provides essential information about the trust, its terms, and the authority of the new trustee(s) to third parties. This document serves as proof of the trust's existence and helps facilitate various transactions, property transfers, or other legal activities involving the trust assets. A Certificate of Trust for Successor Trustee contains key information about the trust such as its name, date of formation, and the names of the initial trustees. It also outlines the powers and authority vested in the successor trustee(s), enabling them to assume control and make decisions on behalf of the trust when the need arises. Keywords: Iowa, Certificate of Trust, Successor Trustee, trust assets, proof of existence, legal activities, trust terms, trustee authority, property transfers, trust formation, trustee powers. Types of Iowa Certificate of Trust for Successor Trustee: 1. General Certificate of Trust: This type of certificate provides a comprehensive overview of the trust, its terms, and trustee authority. It is used in a wide range of situations where the successor trustee(s) need to demonstrate their authority, such as selling trust property, entering into contracts, or managing trust assets. 2. Limited Certificate of Trust: A limited certificate is a condensed version of the general certificate and includes only the essential information necessary for specific transactions or interactions. It is often used when the successor trustee(s) want to protect the confidentiality of the trust's details while providing sufficient evidence of their authority for a particular purpose. 3. Certification of Trustee Authority under Iowa Code §633A.3106: In some cases, the Iowa Code specifically requires a certificate of trustee authority to establish the successor trustee(s) power to act. This type of certificate is used for specific legal proceedings or transactions where the statute mandates its submission, adding an extra layer of legal validity to the trustee's actions. 4. Certification of Trust in Real Estate Transactions: When a trust holds real estate assets in Iowa, a certification of trust tailored specifically for real estate transactions may be required. This type of certificate includes the necessary information about the trust, trustee authority, and any additional provisions relevant to real estate dealings, ensuring compliance with state regulations. Keywords: General Certificate of Trust, Limited Certificate of Trust, Iowa Code §633A.3106, Certification of Trustee Authority, real estate transactions, trust details, trustee power, confidentiality, legal proceedings, compliance with state regulations. Understanding the significance of the Iowa Certificate of Trust for Successor Trustee is crucial for both the successor trustee(s) and any third parties involved in trust-related interactions. By providing the necessary information and proof of authority, this document ensures the smooth execution of trust affairs while safeguarding the interests of all parties involved.

Iowa Certificate of Trust for Successor Trustee

Description

How to fill out Iowa Certificate Of Trust For Successor Trustee?

If you wish to total, obtain, or print out legitimate papers templates, use US Legal Forms, the most important collection of legitimate forms, that can be found on the web. Take advantage of the site`s basic and hassle-free research to obtain the papers you will need. Various templates for business and individual functions are sorted by types and claims, or keywords and phrases. Use US Legal Forms to obtain the Iowa Certificate of Trust for Successor Trustee with a couple of mouse clicks.

When you are currently a US Legal Forms consumer, log in to your accounts and click on the Down load button to have the Iowa Certificate of Trust for Successor Trustee. You may also accessibility forms you earlier saved within the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, follow the instructions below:

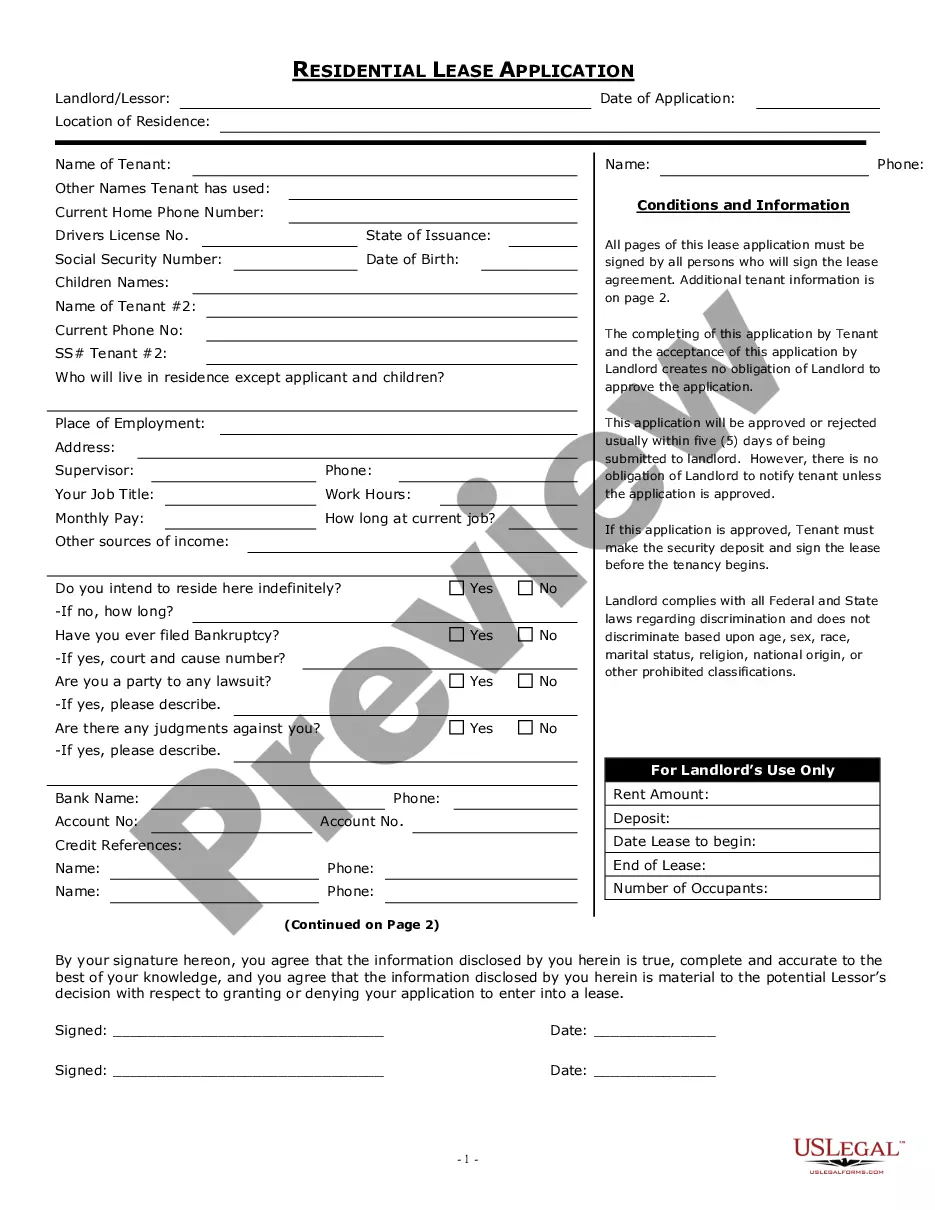

- Step 1. Be sure you have chosen the shape for the correct area/region.

- Step 2. Take advantage of the Review solution to examine the form`s information. Do not overlook to read through the description.

- Step 3. When you are not happy together with the form, take advantage of the Look for area at the top of the screen to get other variations from the legitimate form web template.

- Step 4. Once you have located the shape you will need, click on the Get now button. Choose the rates plan you prefer and include your references to sign up for the accounts.

- Step 5. Method the purchase. You may use your credit card or PayPal accounts to accomplish the purchase.

- Step 6. Choose the structure from the legitimate form and obtain it on the system.

- Step 7. Complete, revise and print out or signal the Iowa Certificate of Trust for Successor Trustee.

Each and every legitimate papers web template you get is your own permanently. You might have acces to each and every form you saved inside your acccount. Click on the My Forms section and choose a form to print out or obtain yet again.

Remain competitive and obtain, and print out the Iowa Certificate of Trust for Successor Trustee with US Legal Forms. There are thousands of professional and state-distinct forms you can utilize to your business or individual demands.