In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Amendment of Trust Agreement and Revocation of Particular Provision

Description

How to fill out Amendment Of Trust Agreement And Revocation Of Particular Provision?

If you require to complete, obtain, or print official document templates, utilize US Legal Forms, the largest selection of official forms, which are available online.

Employ the site`s user-friendly and straightforward search to find the documents you need.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to access the Iowa Amendment of Trust Agreement and Revocation of Specific Provision in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Iowa Amendment of Trust Agreement and Revocation of Specific Provision.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct state/region.

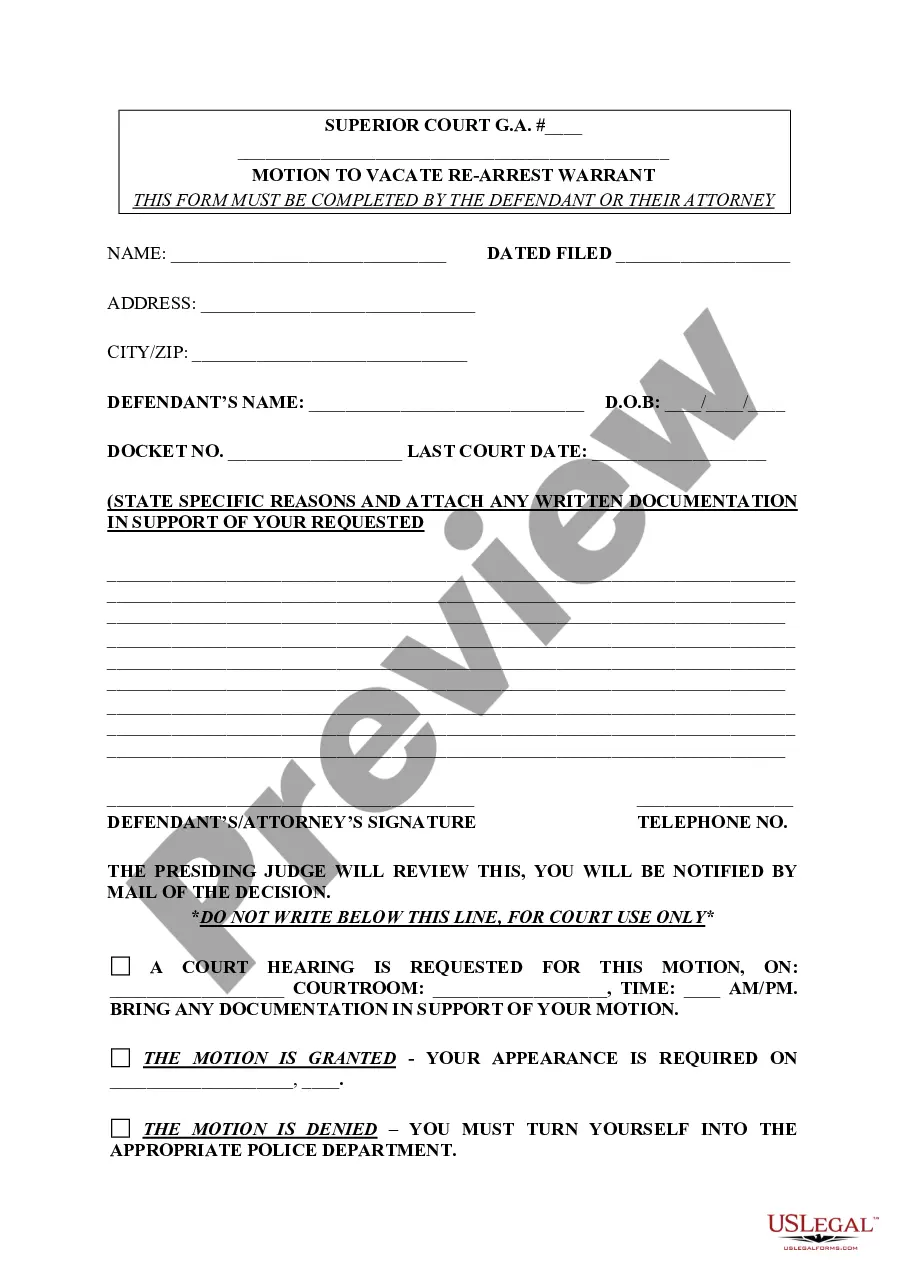

- Step 2. Use the Preview option to review the form`s content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms of the legal document template.

Form popularity

FAQ

To obtain a trust amendment form, you can easily access reliable resources online. Specifically, USLegalForms provides a variety of templates tailored for the Iowa Amendment of Trust Agreement and Revocation of Particular Provision. Simply visit their website, select the relevant form, and you can download it quickly. This resource simplifies the process, ensuring that you can amend your trust effectively and in compliance with Iowa laws.

To write a trust amendment, start by drafting a clear document that specifies the changes you wish to make, including the existing terms and the new provisions. Incorporating the Iowa Amendment of Trust Agreement and Revocation of Particular Provision ensures compliance with legal requirements. Once completed, the amendment typically requires your signature and may need to be notarized to be enforceable.

A trust becomes revoked when the grantor takes deliberate action to terminate it, which may involve creating a formal revocation document. The Iowa Amendment of Trust Agreement and Revocation of Particular Provision provides clarity on this process. It is advisable to follow specific legal steps to prevent future disputes and ensure all parties understand the trust's status.

An example of trust revocation occurs when a grantor decides they no longer wish to continue the trust. They would typically execute a written document indicating their desire to revoke the trust, following guidelines set by the Iowa Amendment of Trust Agreement and Revocation of Particular Provision. Proper documentation is essential to ensure the revocation is legally binding and recognized.

A irrevocable trust cannot be changed or modified once established, which means the terms set forth cannot be altered. This type of trust ensures that assets are permanently removed from your estate for tax purposes but comes with less flexibility. Understanding the implications of the Iowa Amendment of Trust Agreement and Revocation of Particular Provision is crucial before creating such a trust.

A trust can indeed be altered, amended, or revoked, depending on the type of trust and the specific legal guidelines. For those in Iowa, the Amendment of Trust Agreement and Revocation of Particular Provision outlines the necessary steps to follow. Engaging a professional can help navigate this process smoothly.

Yes, a trust can be amended, allowing you to modify terms or conditions to reflect changing circumstances or intentions. In Iowa, the Amendment of Trust Agreement and Revocation of Particular Provision provides a structured process for making these changes. It is essential, however, to ensure that the amendments comply with state laws to maintain the trust's validity.

One of the biggest mistakes parents make when establishing a trust fund is failing to clearly outline their intentions and the distribution of assets. This often leads to confusion and disputes among beneficiaries. Additionally, neglecting the Iowa Amendment of Trust Agreement and Revocation of Particular Provision can cause complications if circumstances change later.

An amendment to the agreement refers to any alterations made to the terms of an existing legal agreement. It signifies that both parties agree to the changes, thereby ensuring clarity and compliance. This concept is important when navigating the Iowa Amendment of Trust Agreement and Revocation of Particular Provision, allowing you to keep your trusts in line with your evolving needs.

An amendment to contract terms involves changing specific clauses or provisions within an existing contract. This process helps ensure that the agreement continues to reflect the current intentions of the parties involved. When dealing with the Iowa Amendment of Trust Agreement and Revocation of Particular Provision, understanding amendments is crucial for keeping your trusts accurate and legally binding.