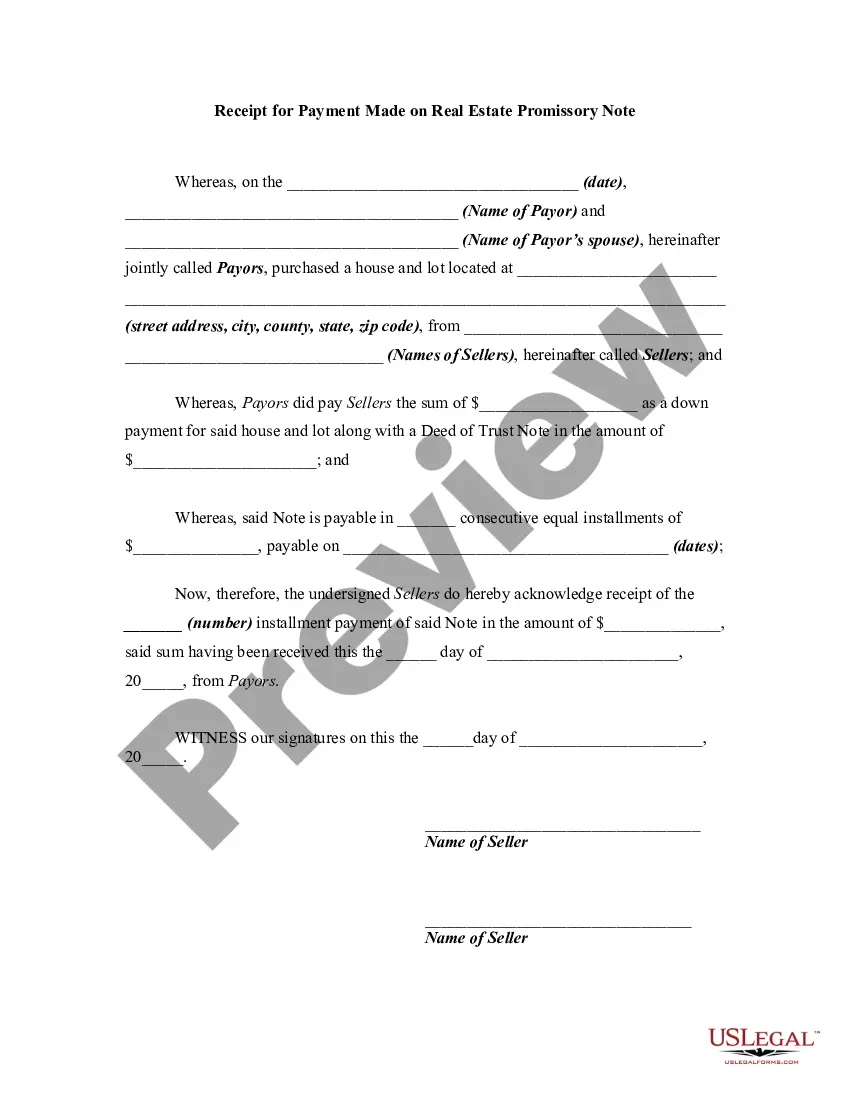

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Receipt for Payment of Trust Fund and Release

Description

How to fill out Receipt For Payment Of Trust Fund And Release?

Finding the appropriate valid document template can be a struggle. Certainly, there are numerous templates accessible on the web, but how can you find the authentic form you seek? Use the US Legal Forms website.

The service offers a wide array of templates, including the Iowa Receipt for Payment of Trust Fund and Release, suitable for both business and personal purposes. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and then click the Obtain button to get the Iowa Receipt for Payment of Trust Fund and Release. Use your account to browse the legal forms you have previously acquired. Go to the My documents section of your account and obtain another version of the document you desire.

US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to download professionally created paperwork that meets state requirements.

- First, ensure you have selected the correct form for your region/area. You can explore the form using the Review option and read the form description to confirm it is the appropriate one for you.

- If the form does not satisfy your requirements, utilize the Search field to locate the suitable form.

- Once you are confident that the form is adequate, click on the Buy now button to obtain the form.

- Choose your pricing plan and input the necessary information. Create your account and complete your purchase with your PayPal account or Visa or MasterCard.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the received Iowa Receipt for Payment of Trust Fund and Release.

Form popularity

FAQ

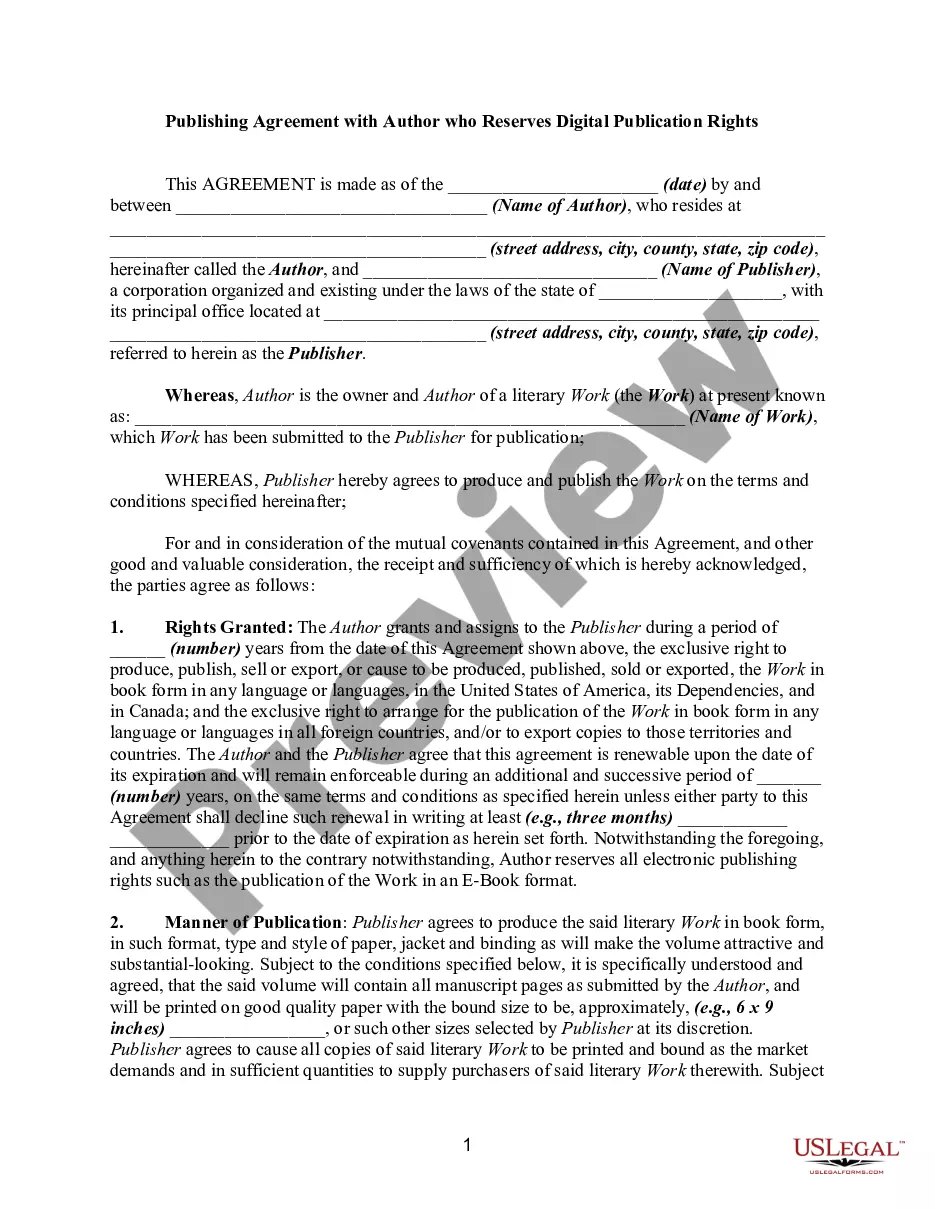

In Iowa, the buyer's agreement law dictates the terms and conditions that govern the sale of goods and services between buyers and sellers. It ensures that both parties understand their rights and obligations during the transaction. If you are involved in a transaction that includes an Iowa Receipt for Payment of Trust Fund and Release, this law is essential for protecting your interests. Understanding these legal requirements can streamline your agreements and enhance your overall purchasing experience.

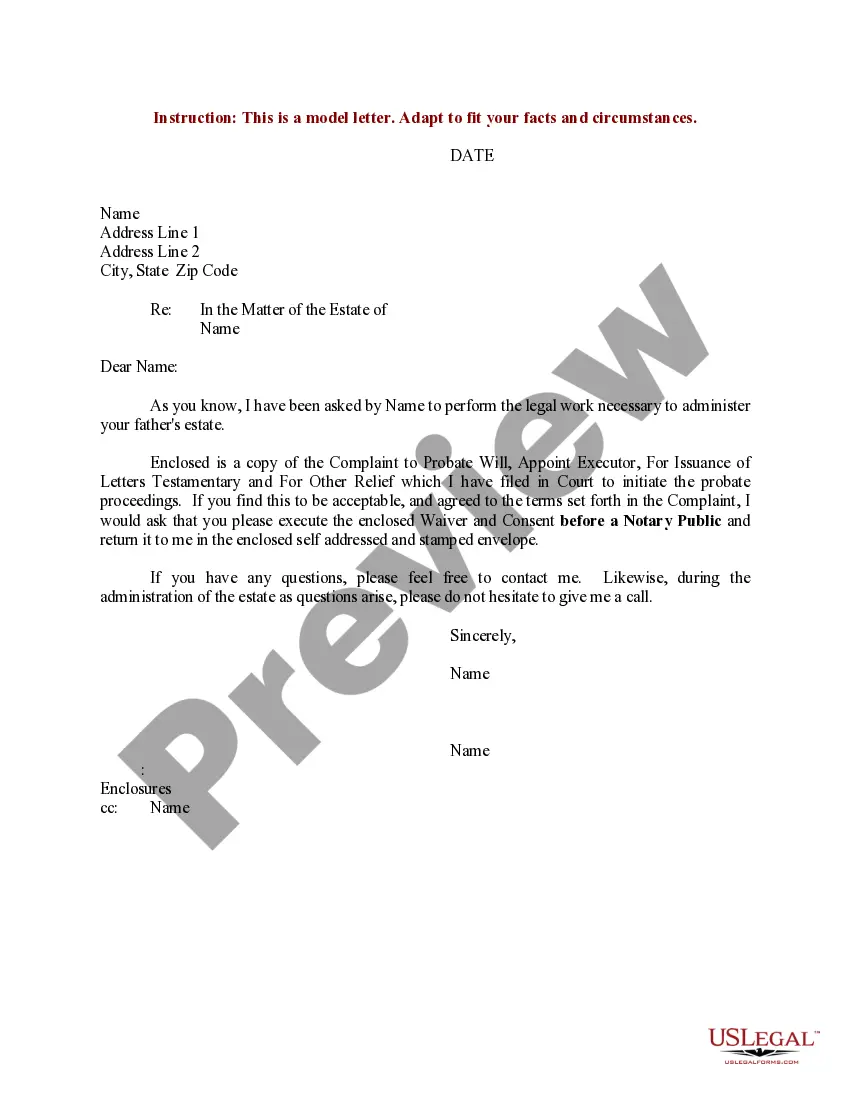

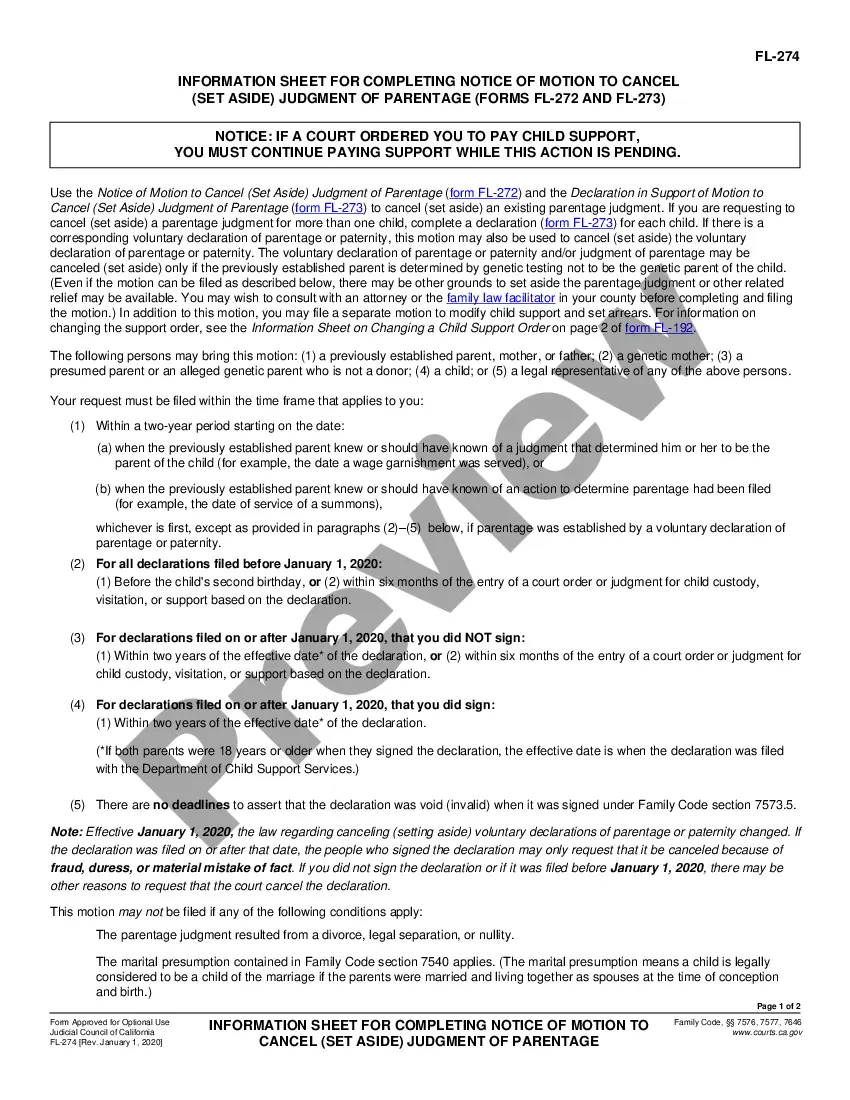

A trust can be terminated in three common ways: by the expiration of the trust term, through the completion of its purpose, or by the agreement of the beneficiaries. It’s important that all parties clearly understand the conditions under which the trust will close. The Iowa Receipt for Payment of Trust Fund and Release ensures that any financial transactions related to the trust are properly documented. USLegalForms can guide users in managing these processes efficiently, making trust termination straightforward.

One of the biggest mistakes parents often make is failing to include clear terms for managing and distributing the trust fund. When setting up a trust, it is vital to outline specific instructions to avoid confusion or disputes later. Additionally, not utilizing an Iowa Receipt for Payment of Trust Fund and Release can lead to complications when funds are dispersed. USLegalForms offers comprehensive resources and templates to help avoid these pitfalls and streamline the process.

Yes, trust funds can only be disposed of following the proper authorization, which is a crucial step in managing these funds. The trustee must ensure compliance with legal requirements and the terms of the trust. This is where the Iowa Receipt for Payment of Trust Fund and Release comes into play, as it provides a documented approval for any disbursements. Users can rely on USLegalForms to obtain the necessary forms and ensure they meet legal standards.

Trust disbursements are payments made from trust accounts to various parties involved in a real estate transaction, such as property sellers or service providers. Upon receiving the Iowa Receipt for Payment of Trust Fund and Release, the disbursement can happen smoothly, provided that all conditions are met. Using platforms like UsLegalForms can simplify the tracking and management of these trust disbursements and keep your records organized.

Trust receipts disbursements must follow a clear organizational structure for transparency and accuracy. It’s advisable to record each disbursement chronologically, including the amount, date, and purpose of the payment. This practice aligns with the Iowa Receipt for Payment of Trust Fund and Release, ensuring an easy retrieval of transaction details whenever needed.

When managing real estate transactions, it’s crucial to know which funds belong in a trust account. Personal funds, unearned fees, and general operational expenses should not be placed in the real estate trust account. Misplacing these funds may lead to legal repercussions, which is why understanding Iowa Receipt for Payment of Trust Fund and Release is important.