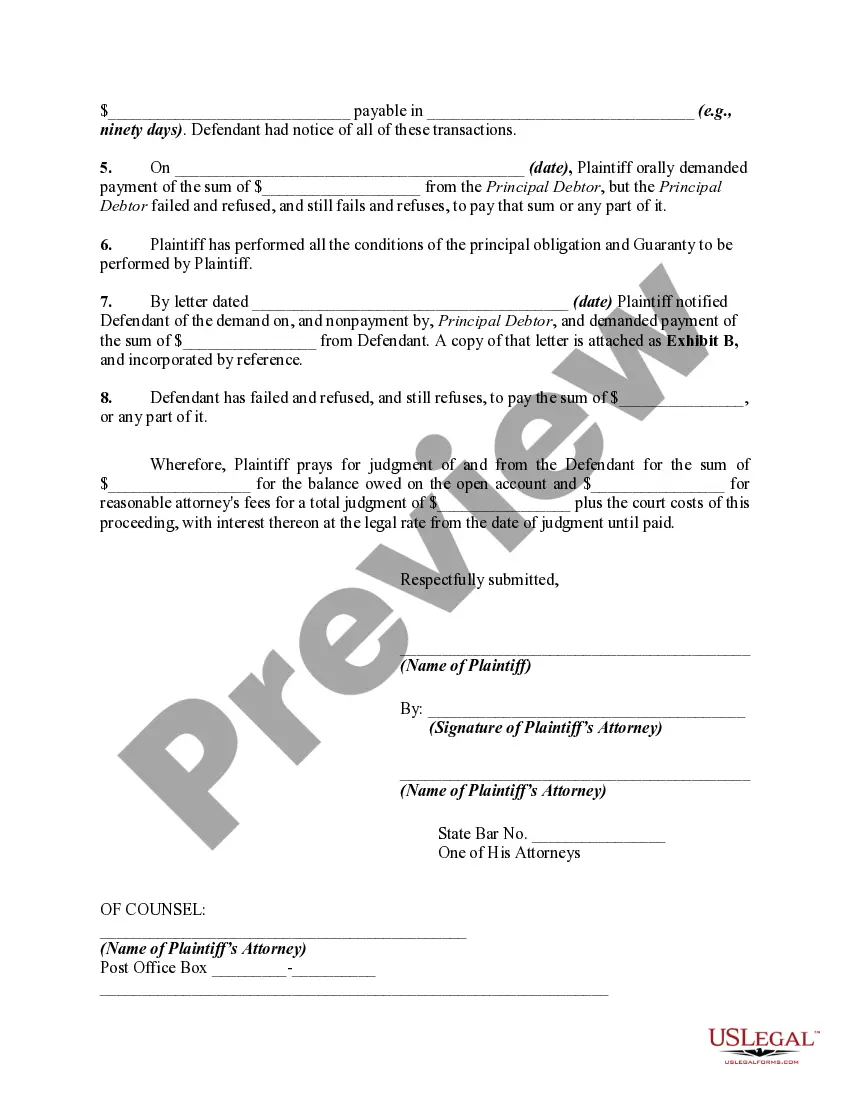

An open account is an account based on continuous dealing between the parties, which has not been closed, settled or stated, and which is kept open with the expectation of further transactions. An open account is created when the parties intend that the individual items of the account will not be considered independently, but as a connected series of transactions. In addition, the parties must intend that the account will be kept open and subject to a shifting balance as additional related entries of debits and credits are made, until either party decides to settle and close the account. This form is a complaint against a guarantor of such an account.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts Keywords: Iowa, complaint, guarantor, open account credit transactions, breach, oral contracts, implied contracts. Description: An Iowa complaint against a guarantor of open account credit transactions alleges a breach of oral or implied contracts between the parties involved. This legal document serves as a formal way to initiate legal action against a guarantor who has failed to meet their obligations under the agreement. Open account credit transactions involve a creditor extending credit to a debtor for the purchase of goods or services. In many cases, a guarantor agrees to be responsible for the debtor's debts if they default on repayment. A breach occurs when the guarantor fails to fulfill this obligation, causing financial harm to the creditor. The complaint highlights the specific details of the oral or implied contracts that were established between the parties involved. It provides a comprehensive account of the terms and conditions governing the open account credit transactions, including the agreed-upon credit limit, payment terms, interest rates, or any other relevant provisions. The complaint will typically outline how the guarantor breached the contractual agreement. This may involve non-payment of debt, failure to make timely payments, exceeding the credit limit, or any other actions that violate the terms laid out in the oral or implied contracts. The complaining party may also provide evidence to substantiate their claim, such as invoices, account statements, or correspondence. Different types of Iowa complaints against guarantors of open account credit transactions for breach of oral or implied contracts may include: 1. Individual Guarantor Complaint: This type of complaint is filed against an individual who has acted as a guarantor for open account credit transactions. The complaint outlines their breach of the oral or implied contracts and seeks compensation for the resulting damages. 2. Corporate Guarantor Complaint: In cases where a business entity served as the guarantor, a corporate guarantor complaint is filed. This type of complaint holds the corporation accountable for breaching their obligation under the oral or implied contracts, seeking legal remedies on behalf of the creditor. 3. Multiple Guarantors Complaint: In situations where multiple guarantors are involved in open account credit transactions, a complaint can be filed against all the parties responsible for the breach. This allows the complaining party to pursue legal action against each guarantor individually or jointly. Overall, an Iowa complaint against a guarantor of open account credit transactions for breach of oral or implied contracts is a crucial legal document to seek appropriate recourse when a guarantor fails to meet their contractual obligations. It aims to protect the rights and interests of the creditor by seeking compensation for the financial harm caused by the breach.Iowa Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts Keywords: Iowa, complaint, guarantor, open account credit transactions, breach, oral contracts, implied contracts. Description: An Iowa complaint against a guarantor of open account credit transactions alleges a breach of oral or implied contracts between the parties involved. This legal document serves as a formal way to initiate legal action against a guarantor who has failed to meet their obligations under the agreement. Open account credit transactions involve a creditor extending credit to a debtor for the purchase of goods or services. In many cases, a guarantor agrees to be responsible for the debtor's debts if they default on repayment. A breach occurs when the guarantor fails to fulfill this obligation, causing financial harm to the creditor. The complaint highlights the specific details of the oral or implied contracts that were established between the parties involved. It provides a comprehensive account of the terms and conditions governing the open account credit transactions, including the agreed-upon credit limit, payment terms, interest rates, or any other relevant provisions. The complaint will typically outline how the guarantor breached the contractual agreement. This may involve non-payment of debt, failure to make timely payments, exceeding the credit limit, or any other actions that violate the terms laid out in the oral or implied contracts. The complaining party may also provide evidence to substantiate their claim, such as invoices, account statements, or correspondence. Different types of Iowa complaints against guarantors of open account credit transactions for breach of oral or implied contracts may include: 1. Individual Guarantor Complaint: This type of complaint is filed against an individual who has acted as a guarantor for open account credit transactions. The complaint outlines their breach of the oral or implied contracts and seeks compensation for the resulting damages. 2. Corporate Guarantor Complaint: In cases where a business entity served as the guarantor, a corporate guarantor complaint is filed. This type of complaint holds the corporation accountable for breaching their obligation under the oral or implied contracts, seeking legal remedies on behalf of the creditor. 3. Multiple Guarantors Complaint: In situations where multiple guarantors are involved in open account credit transactions, a complaint can be filed against all the parties responsible for the breach. This allows the complaining party to pursue legal action against each guarantor individually or jointly. Overall, an Iowa complaint against a guarantor of open account credit transactions for breach of oral or implied contracts is a crucial legal document to seek appropriate recourse when a guarantor fails to meet their contractual obligations. It aims to protect the rights and interests of the creditor by seeking compensation for the financial harm caused by the breach.