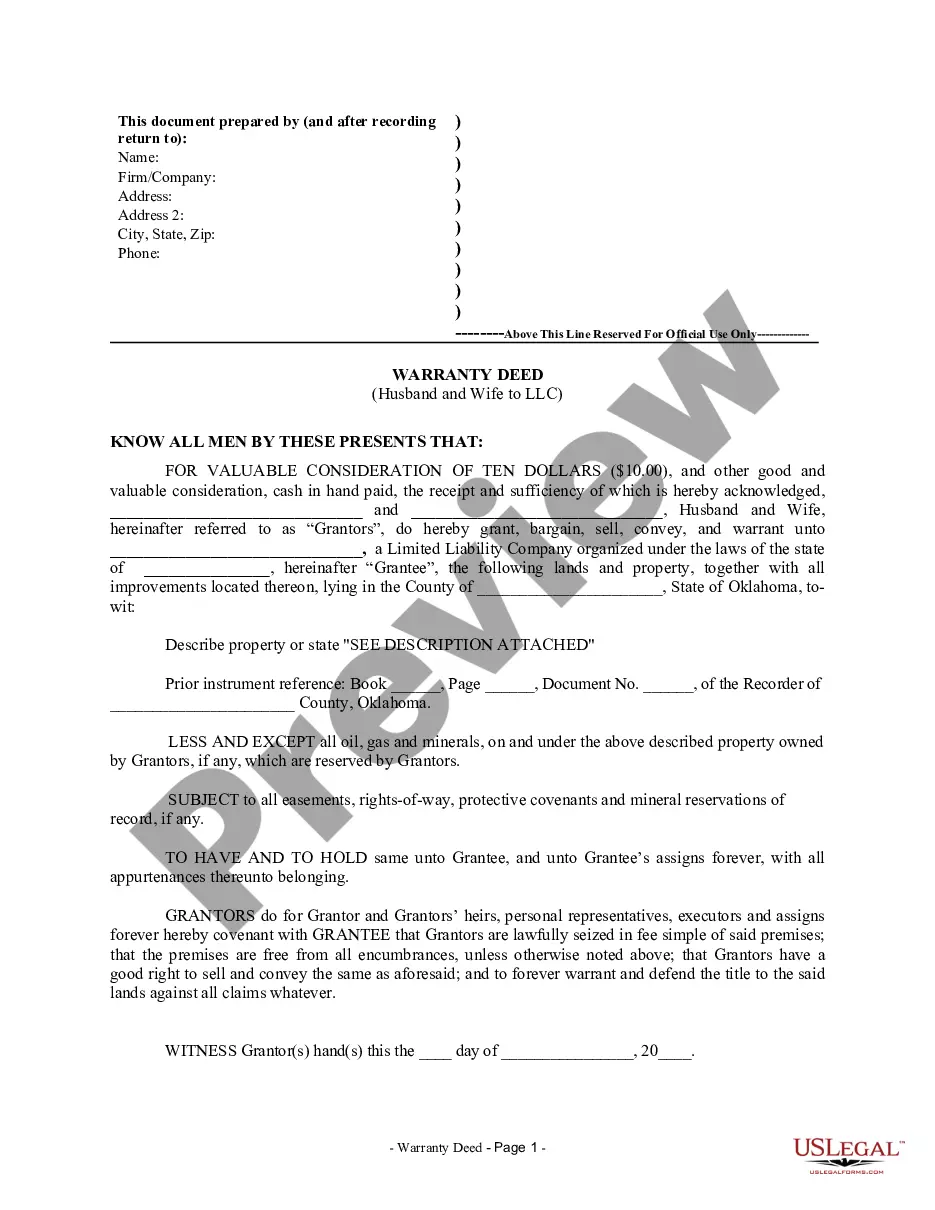

Title: Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership: Explained Introduction: In the state of Iowa, partners looking to convert their existing partnership into a corporation can rely on an Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership. This legal document serves as a blueprint for the conversion process, ensuring clear guidelines and provisions are established for the transition. In this article, we will delve into the specifics of this agreement, highlighting its purpose, key components, and possible variations. Key Concepts: 1. Definition — An Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership outlines the terms and conditions under which a partnership is transformed into a corporation. 2. Partnership Conversion — This agreement initiates the process of converting a partnership into a corporation, signifying a change in the legal structure and associated rights and responsibilities. 3. Legal Compliance — The agreement ensures compliance with Iowa law and regulations, guaranteeing that all necessary filings and paperwork are completed accurately. 4. Absolute Authority — Partners in the existing partnership have the authority to determine the terms of the agreement and make decisions related to the conversion process consensually. 5. Tax Implications — The agreement addresses potential tax consequences resulting from the partnership's conversion, providing the partners with guidance to minimize adverse tax implications. Key Components of an Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership: 1. Identifying Parties — The agreement begins by stating the names and roles of each partner within the existing partnership. It may also mention the partnership's name and address. 2. Conversion Decision — Clearly outlines the partners' unanimous decision to convert the partnership into a corporation and describes the rationale behind this decision. 3. Incorporation Process — Provides a detailed explanation of the steps required to incorporate the partnership, including the necessary forms to be filed with the appropriate authorities. 4. Corporate Structure — Defines the intended corporate structure, highlighting the roles and responsibilities of officers, directors, and shareholders within the newly formed corporation. 5. Allocation of Shares — Specifies how ownership shares will be distributed among partners in the new corporation, based on their respective contributions to the partnership. 6. Financial Provisions — Outlines the financial aspects of the conversion process, including accounting methods, valuation of partnership assets, and handling of existing debts and liabilities. 7. Tax Elections — Discusses any desired or required tax elections that may impact the partnership's conversion, ensuring proper compliance with local and federal tax regulations. 8. Dissolution of Partnership — States the terms and conditions related to the dissolution of the existing partnership, protecting the partners' interests during this transition phase. 9. Effective Date — Specifies the agreed-upon effective date of the partnership's conversion into a corporation, signifying the moment when the newly formed corporation assumes full legal existence. Types of Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership: 1. Standard Iowa Agreement to Incorporate — This agreement serves as a comprehensive template for converting an existing partnership into a corporation, suitable for most scenarios. 2. Customized Iowa Agreement — Partners may choose to modify the standard agreement to accommodate specific needs or unique circumstances related to their partnership conversion. 3. Joint Venture Incorporation Agreement — In cases where the partnership intends to continue as a joint venture within the new corporation, a specialized agreement can be created to reflect this arrangement. 4. Limited Liability Company (LLC) Conversion Agreement — For partners considering the conversion of their existing partnership into an LLC, a separate agreement can be formulated to address this type of conversion. Conclusion: An Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership is a crucial legal document that guides the transformation of a partnership into a corporation in Iowa. By addressing key aspects such as corporate structure, allocation of shares, and tax implications, this agreement ensures a smooth conversion process while safeguarding the rights and interests of the involved partners. Whether partners opt for a standard agreement or a specialized version, incorporating their existing partnership provides numerous benefits and opportunities for growth.

Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Iowa Agreement To Incorporate By Partners Incorporating Existing Partnership?

You may invest hours on-line searching for the authorized document web template which fits the federal and state specifications you want. US Legal Forms provides 1000s of authorized forms that happen to be examined by professionals. You can actually download or produce the Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership from my service.

If you have a US Legal Forms accounts, you are able to log in and then click the Down load option. Afterward, you are able to total, modify, produce, or indicator the Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership. Every authorized document web template you buy is your own permanently. To get an additional backup associated with a obtained type, proceed to the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms internet site the very first time, adhere to the simple instructions beneath:

- Initial, make certain you have selected the correct document web template to the region/town of your liking. See the type description to ensure you have picked out the appropriate type. If offered, take advantage of the Review option to appear throughout the document web template also.

- If you want to find an additional edition of your type, take advantage of the Lookup area to discover the web template that suits you and specifications.

- After you have found the web template you would like, simply click Purchase now to proceed.

- Find the prices strategy you would like, type in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal accounts to cover the authorized type.

- Find the format of your document and download it to the product.

- Make alterations to the document if possible. You may total, modify and indicator and produce Iowa Agreement to Incorporate by Partners Incorporating Existing Partnership.

Down load and produce 1000s of document web templates utilizing the US Legal Forms web site, that offers the largest collection of authorized forms. Use expert and express-certain web templates to tackle your business or specific demands.