An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

Are you currently inside a placement that you need to have files for sometimes enterprise or personal uses almost every day time? There are a lot of legal papers layouts available on the net, but locating kinds you can rely on isn`t easy. US Legal Forms gives 1000s of type layouts, just like the Iowa Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage, that are published to satisfy federal and state demands.

When you are currently knowledgeable about US Legal Forms site and have your account, just log in. Following that, you are able to down load the Iowa Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage format.

If you do not offer an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for that right town/area.

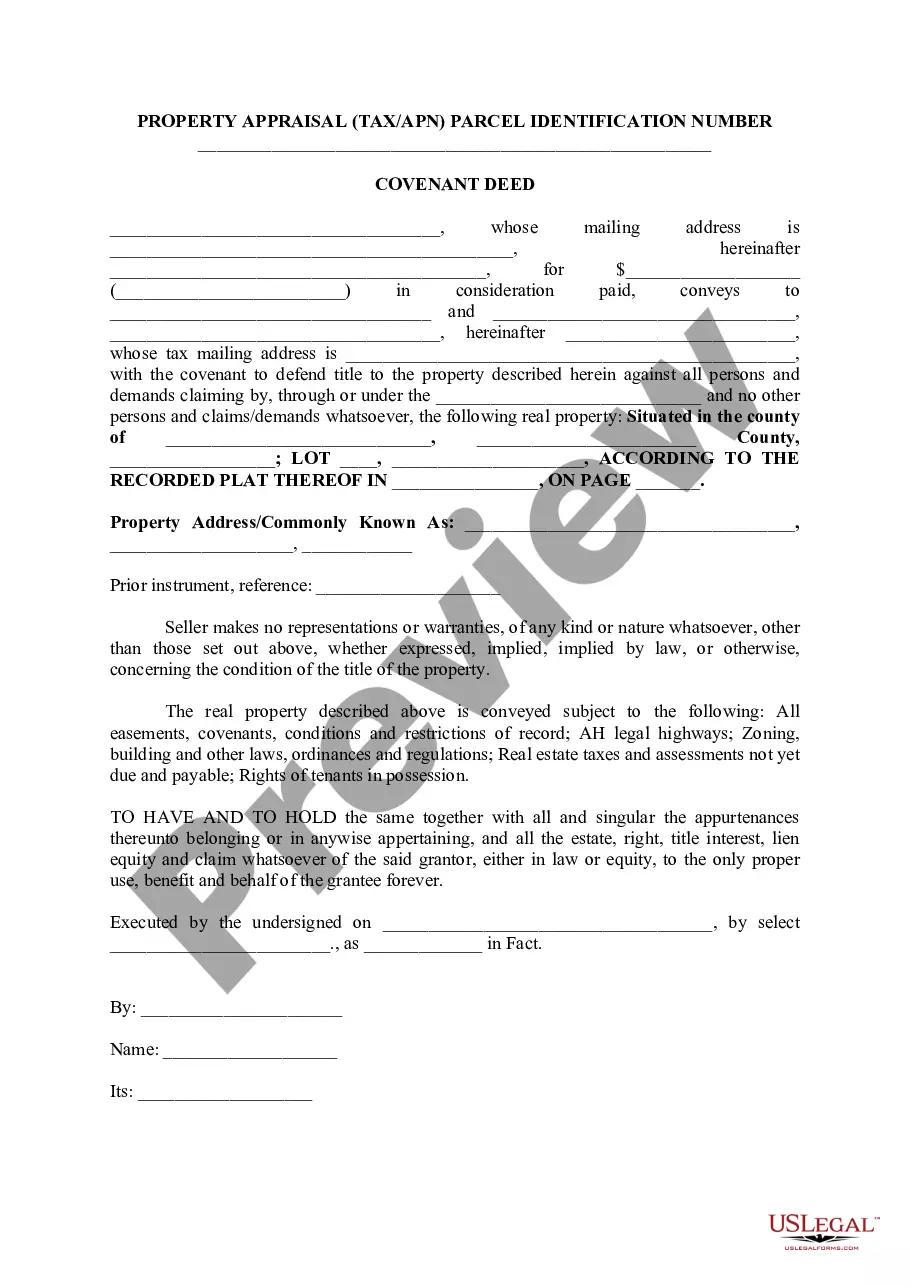

- Use the Review switch to review the shape.

- Read the description to ensure that you have chosen the correct type.

- In the event the type isn`t what you are looking for, make use of the Lookup field to get the type that fits your needs and demands.

- If you discover the right type, simply click Purchase now.

- Opt for the rates prepare you need, fill in the desired info to create your account, and pay money for the order using your PayPal or credit card.

- Decide on a handy file formatting and down load your version.

Find every one of the papers layouts you have purchased in the My Forms food list. You can get a extra version of Iowa Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage at any time, if necessary. Just click on the essential type to down load or print out the papers format.

Use US Legal Forms, probably the most substantial variety of legal forms, to save some time and prevent errors. The services gives appropriately manufactured legal papers layouts which you can use for a selection of uses. Generate your account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

On its face, Iowa Code section 654.12A states that ?loans and advances made under the mortgage, up to the maximum amount of credit together with interest thereon, are senior to indebtedness to other creditors under subsequently recorded mortgages.? Iowa Code § 654.12A.

Mortgage Note: --is a type of promissory note that is secured by a mortgage loan. --provides security for the loan held by the promissory note. --agreements between the borrower and lender that allow the lender to demand full repayment of a loan should the borrower default on the loan.

In simple terms, a loan modification is just like it sounds. It is a negotiation with your mortgage lender to create a new agreement that modifies the original terms of your mortgage. If you have a long-term inability to pay your mortgage, a loan modification could be an option if you wish to keep your home.

If you aren't able to make your mortgage payments and you want to stay in your home, a modification is usually a good option, ing to Roitburg. "The single largest benefit that borrowers would expect is that they avoid foreclosure," he says. A loan modification can affect your credit.

What Is Loan Modification? Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

Paying more interest over time. If you have agreed to a lower monthly payment without significantly reducing your interest rate, you may end up paying more money in total because you are paying interest for a longer time than you otherwise would have.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

A loan modification involves changing your existing mortgage so it's easier for you to keep up with your payments. These changes can include a new interest rate or a different repayment schedule. It likely won't reduce the amount you owe on the balance of your mortgage.