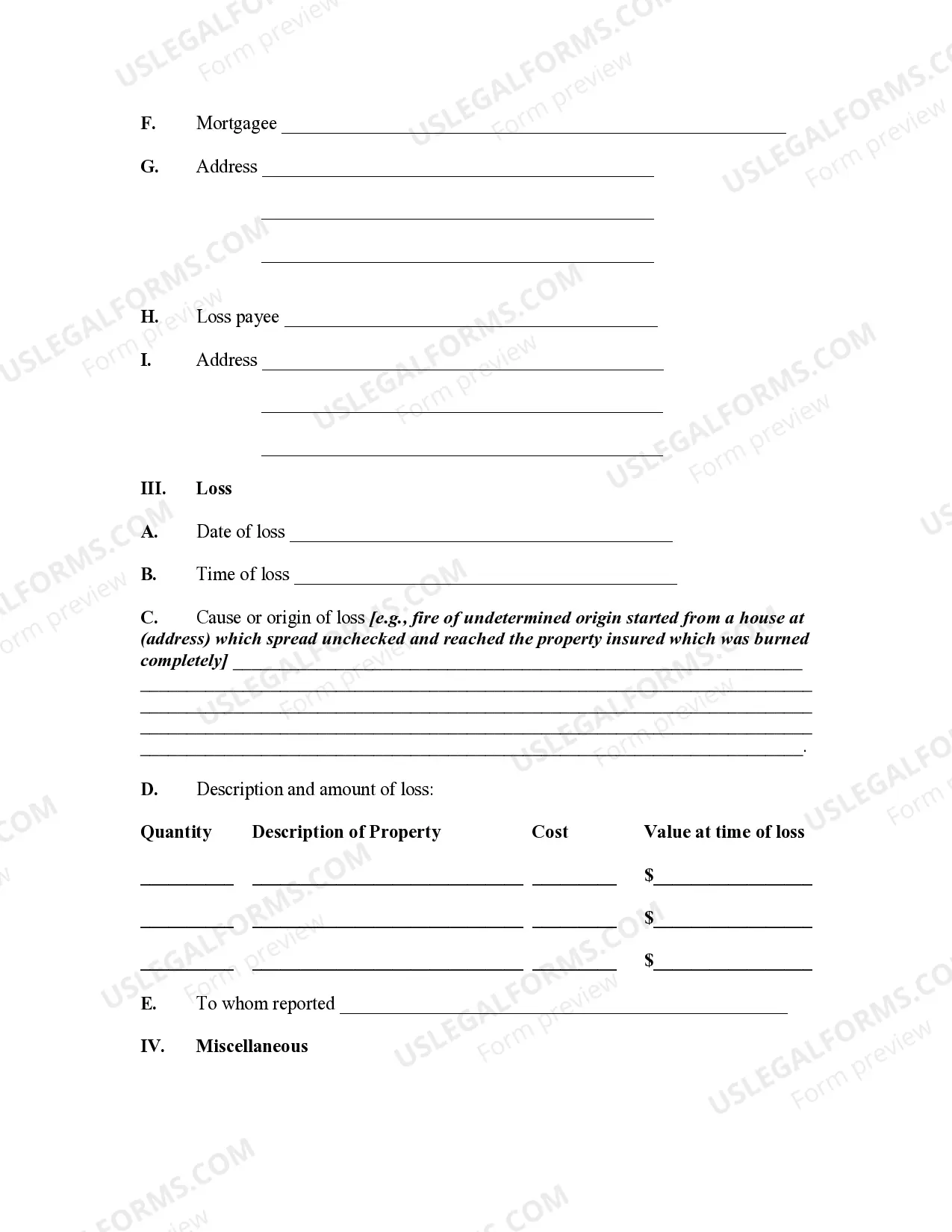

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

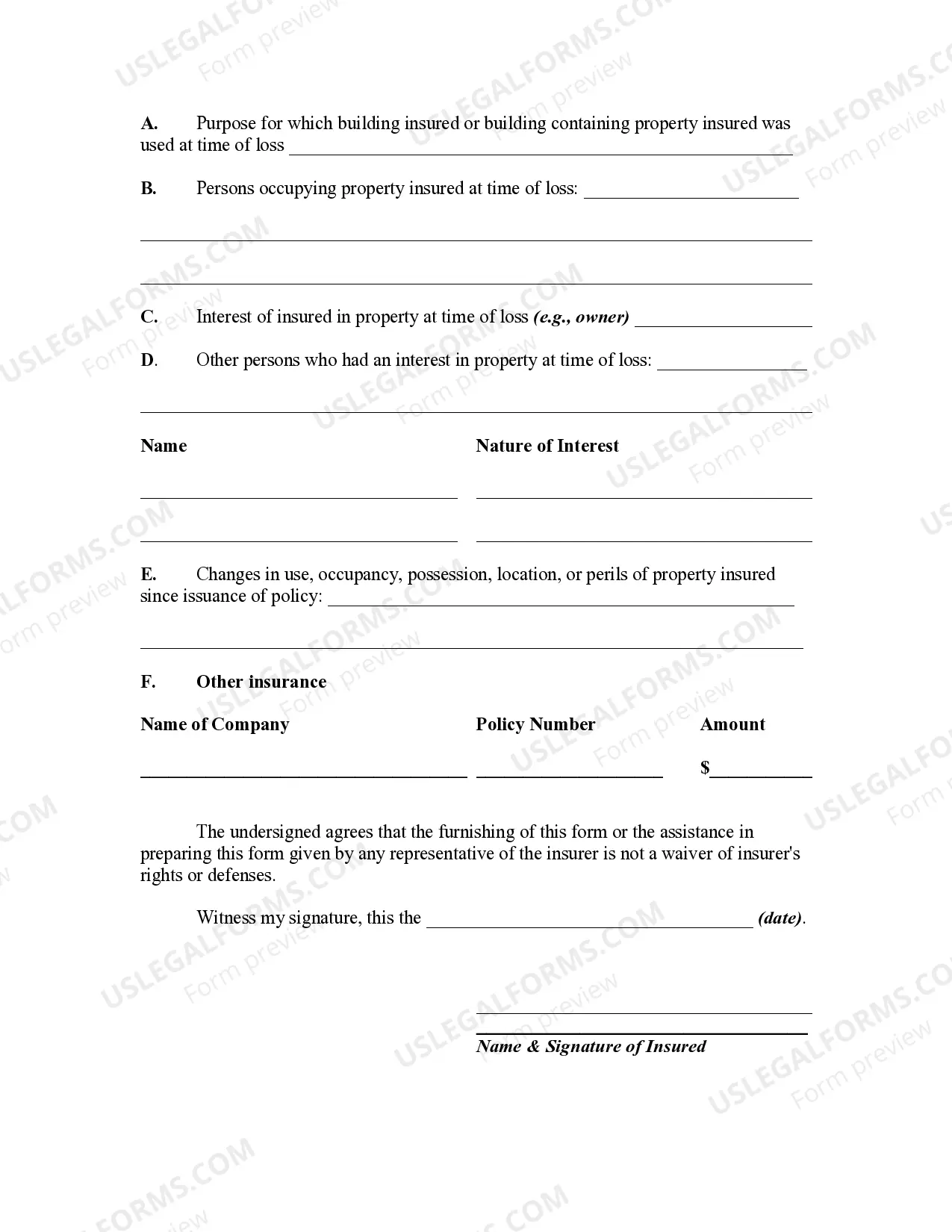

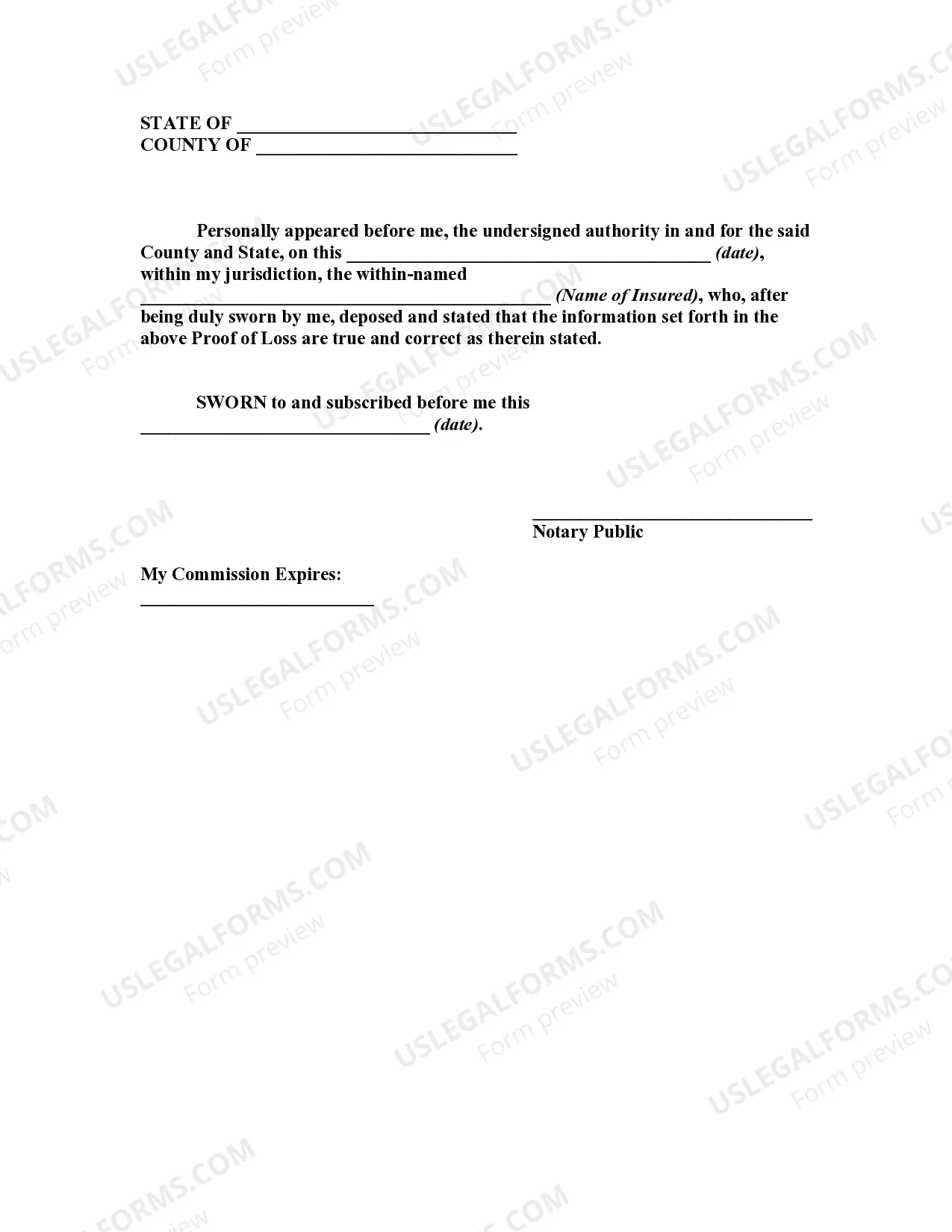

Iowa Proof of Loss for Fire Insurance Claim: A Comprehensive Guide If you have experienced a fire incident and are seeking compensation for your losses from your insurance company, it is crucial to be familiar with the Iowa Proof of Loss for Fire Insurance Claim. This document serves as a detailed record of the damages you have incurred, the estimated costs of repairs or replacements, and other essential information required by your insurers. Iowa's law mandates that policyholders submit a properly completed and accurate Proof of Loss within a specific timeframe, usually 60 days from the occurrence of the fire. Failing to comply with this requirement may result in delays or potential denial of your insurance claim. Keywords: Iowa Proof of Loss, Fire Insurance Claim, damages, estimated costs, repairs, replacements, policyholders, properly completed, accurate record, required information, insurers, timeframe, delays, denial, insurance claim. Different Types of Iowa Proof of Loss for Fire Insurance Claim: 1. Standard Iowa Proof of Loss Form: This is the most common type of Proof of Loss utilized by policyholders to report fire damages to their insurance company. It involves providing detailed information about the loss, including the date, location, cause, and extent of the fire, as well as a comprehensive list of damaged or destroyed items with their corresponding values. Keywords: Standard Iowa Proof of Loss Form, policyholders, report, fire damages, insurance company, date, location, cause, extent of fire, damaged items, destroyed items, corresponding values. 2. Sworn Statement / Affidavit Proof of Loss: In some cases, insurers may require policyholders to submit a sworn statement or affidavit as part of their Proof of Loss. This type of documentation entails a legally binding declaration made under oath, affirming the truthfulness and accuracy of the reported damages. The statement should include all relevant details surrounding the fire incident and any supporting evidence, such as photographs or receipts. Keywords: Sworn Statement, Affidavit Proof of Loss, insurers, policyholders, documentation, legally binding declaration, truthfulness, accuracy, damages, fire incident, supporting evidence, photographs, receipts. 3. Independent Appraiser's Report: In more complex fire insurance claims, Iowa law allows policyholders to hire an independent appraiser to evaluate and assess the damages. The appraiser's report, when included as part of the Proof of Loss, carries significant weight in determining the proper compensation. This report details the extent of the damages, estimated costs of repairs or replacements, and the overall value of the loss. Keywords: Independent Appraiser's Report, complex fire insurance claims, policyholders, evaluation, assessment, damages, Proof of Loss, compensation, repairs, replacements, overall value, estimated costs. It is important to consult with an experienced attorney or insurance professional to ensure the accurate completion and submission of your Iowa Proof of Loss for a fire insurance claim. Taking the time to gather all necessary documentation, provide comprehensive information, and meet the required deadlines can significantly enhance the likelihood of a successful claim settlement.Iowa Proof of Loss for Fire Insurance Claim: A Comprehensive Guide If you have experienced a fire incident and are seeking compensation for your losses from your insurance company, it is crucial to be familiar with the Iowa Proof of Loss for Fire Insurance Claim. This document serves as a detailed record of the damages you have incurred, the estimated costs of repairs or replacements, and other essential information required by your insurers. Iowa's law mandates that policyholders submit a properly completed and accurate Proof of Loss within a specific timeframe, usually 60 days from the occurrence of the fire. Failing to comply with this requirement may result in delays or potential denial of your insurance claim. Keywords: Iowa Proof of Loss, Fire Insurance Claim, damages, estimated costs, repairs, replacements, policyholders, properly completed, accurate record, required information, insurers, timeframe, delays, denial, insurance claim. Different Types of Iowa Proof of Loss for Fire Insurance Claim: 1. Standard Iowa Proof of Loss Form: This is the most common type of Proof of Loss utilized by policyholders to report fire damages to their insurance company. It involves providing detailed information about the loss, including the date, location, cause, and extent of the fire, as well as a comprehensive list of damaged or destroyed items with their corresponding values. Keywords: Standard Iowa Proof of Loss Form, policyholders, report, fire damages, insurance company, date, location, cause, extent of fire, damaged items, destroyed items, corresponding values. 2. Sworn Statement / Affidavit Proof of Loss: In some cases, insurers may require policyholders to submit a sworn statement or affidavit as part of their Proof of Loss. This type of documentation entails a legally binding declaration made under oath, affirming the truthfulness and accuracy of the reported damages. The statement should include all relevant details surrounding the fire incident and any supporting evidence, such as photographs or receipts. Keywords: Sworn Statement, Affidavit Proof of Loss, insurers, policyholders, documentation, legally binding declaration, truthfulness, accuracy, damages, fire incident, supporting evidence, photographs, receipts. 3. Independent Appraiser's Report: In more complex fire insurance claims, Iowa law allows policyholders to hire an independent appraiser to evaluate and assess the damages. The appraiser's report, when included as part of the Proof of Loss, carries significant weight in determining the proper compensation. This report details the extent of the damages, estimated costs of repairs or replacements, and the overall value of the loss. Keywords: Independent Appraiser's Report, complex fire insurance claims, policyholders, evaluation, assessment, damages, Proof of Loss, compensation, repairs, replacements, overall value, estimated costs. It is important to consult with an experienced attorney or insurance professional to ensure the accurate completion and submission of your Iowa Proof of Loss for a fire insurance claim. Taking the time to gather all necessary documentation, provide comprehensive information, and meet the required deadlines can significantly enhance the likelihood of a successful claim settlement.