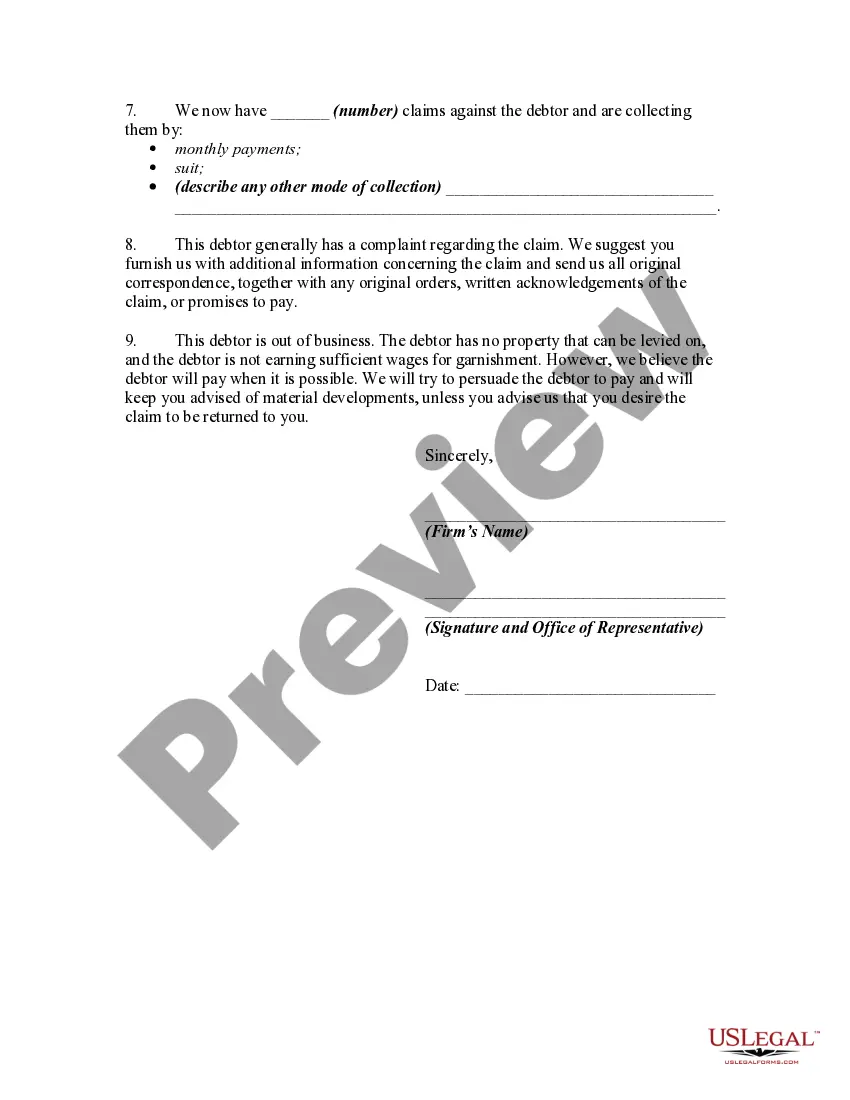

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Iowa Acceptance of Claim and Report of Experience with Debtor is a legal document used in the state of Iowa to acknowledge and validate a claim made by a creditor against a debtor. This document serves as an acceptance of the creditor's claim and provides a detailed report of the experiences between the two parties. Keywords: Iowa, Acceptance of Claim, Report of Experience, Debtor, Creditor. The Iowa Acceptance of Claim and Report of Experience with Debtor helps creditors in Iowa to formalize their claims and establish a clear history of interactions with the debtor. By filing this document, creditors can assert their rights and ensure fair treatment in legal proceedings, should they arise. It is important to note that there might be variations or specific types of Iowa Acceptance of Claim and Report of Experience with Debtor, depending on the nature of the claim or the specific court proceedings. Some common types include: 1. Iowa Acceptance of Claim and Report of Experience with Debtor for Unpaid Invoices: This type of acceptance of claim pertains to a creditor's unpaid invoices, highlighting the detailed experiences of providing goods or services to the debtor and the subsequent non-payment. 2. Iowa Acceptance of Claim and Report of Experience with Debtor for Loan Repayment: This version focuses on a creditor's claim relating to a loan made to the debtor. It specifies the terms of the loan, details the experiences of disbursing the funds, and documents any missed payments or defaults. 3. Iowa Acceptance of Claim and Report of Experience with Debtor for Breach of Contract: In cases where a debtor has breached a contract with a creditor, this type of acceptance of claim would outline the specific terms of the contract, highlight the debtor's experiences in fulfilling the contractual obligations, and document any breaches that have occurred. Regardless of the specific type, the Iowa Acceptance of Claim and Report of Experience with Debtor typically requires detailed information about both the creditor and the debtor. This includes their legal names, addresses, contact information, as well as specific dates and details related to the claim being made. In conclusion, the Iowa Acceptance of Claim and Report of Experience with Debtor is a crucial legal document that helps protect the rights of creditors in Iowa. By providing a comprehensive report of experiences with the debtor, it plays a vital role in the legal process, ensuring that creditors' claims are properly acknowledged and considered by the court.