Are you presently within a place that you will need documents for both company or personal reasons nearly every day time? There are plenty of legitimate file web templates available on the net, but finding kinds you can rely on isn`t effortless. US Legal Forms offers a large number of kind web templates, just like the Iowa Satisfaction of Mortgage by a Corporation, which are composed in order to meet state and federal needs.

Should you be already familiar with US Legal Forms web site and also have a merchant account, just log in. Following that, it is possible to obtain the Iowa Satisfaction of Mortgage by a Corporation web template.

Should you not come with an profile and need to begin using US Legal Forms, abide by these steps:

- Find the kind you want and make sure it is for that right city/area.

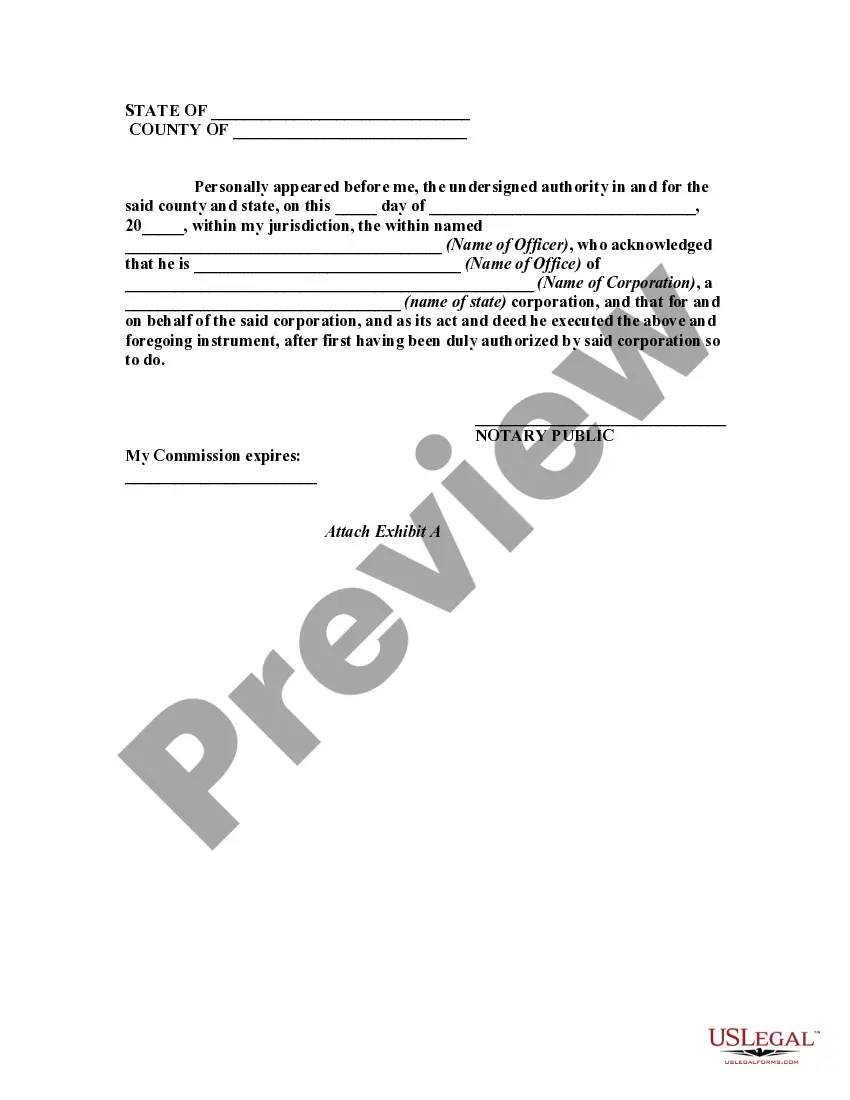

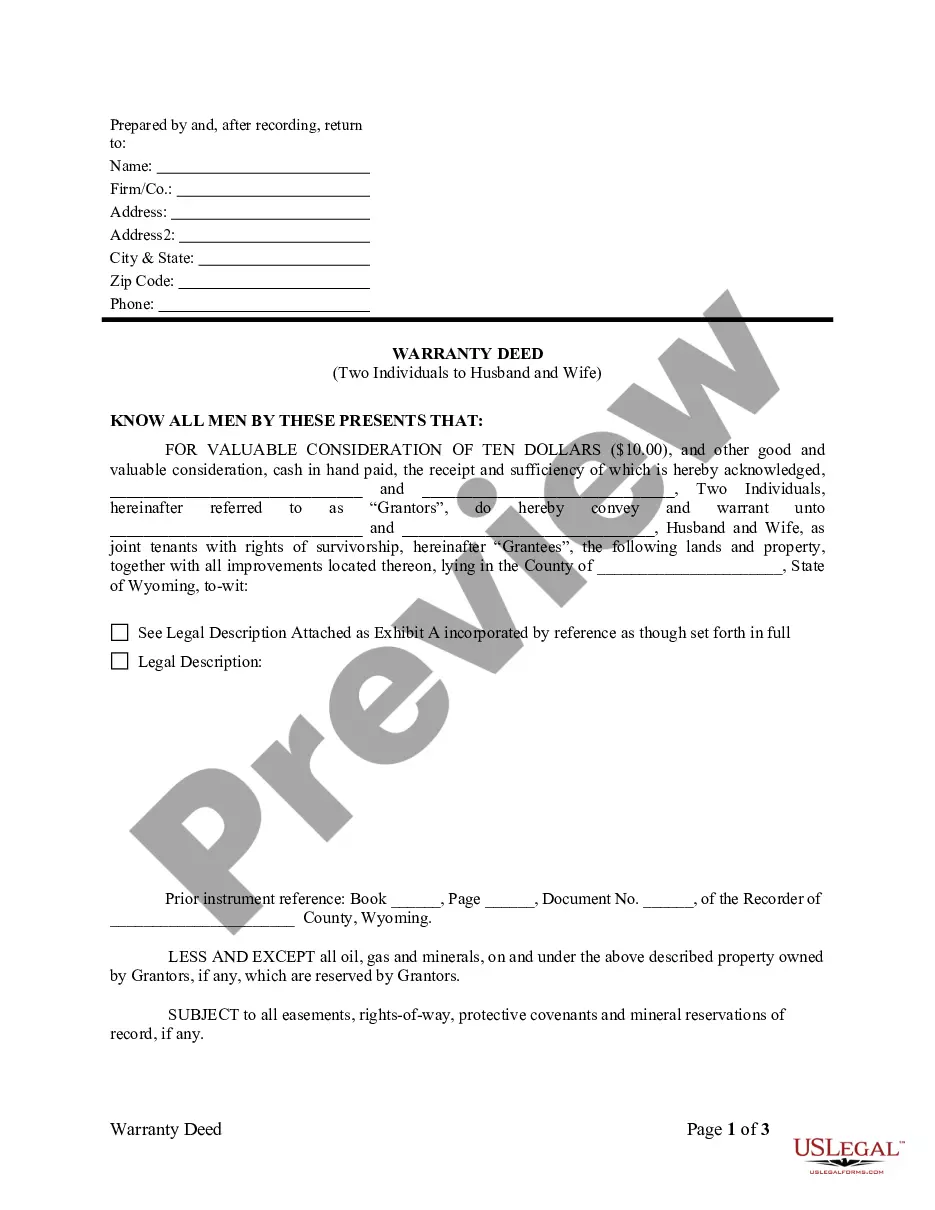

- Use the Preview switch to analyze the shape.

- Read the description to ensure that you have selected the appropriate kind.

- When the kind isn`t what you are seeking, use the Research industry to obtain the kind that meets your requirements and needs.

- When you obtain the right kind, click Purchase now.

- Select the costs prepare you need, fill out the required info to produce your account, and pay money for your order making use of your PayPal or bank card.

- Choose a hassle-free data file format and obtain your version.

Discover every one of the file web templates you have purchased in the My Forms food list. You can obtain a more version of Iowa Satisfaction of Mortgage by a Corporation whenever, if necessary. Just click the necessary kind to obtain or produce the file web template.

Use US Legal Forms, by far the most considerable assortment of legitimate varieties, in order to save some time and stay away from blunders. The assistance offers expertly produced legitimate file web templates that can be used for a range of reasons. Produce a merchant account on US Legal Forms and initiate making your way of life a little easier.