Iowa Change of Beneficiary refers to the legal process through which an individual can alter or update the designated beneficiary for a specific asset or insurance policy in the state of Iowa. This enables the individual to ensure that their assets are distributed as per their wishes even after their demise, providing flexibility and ease to personal estate planning. There are various types of Iowa Change of Beneficiary, including: 1. Life Insurance Change of Beneficiary: This type involves modifying the beneficiary designation for a life insurance policy in Iowa. It allows the policyholder to update the recipient of the policy's death benefit, ensuring that it aligns with their current intentions. 2. Retirement Account Change of Beneficiary: This category covers changing the beneficiary designation for retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k) plans, in the state of Iowa. This alteration ensures that the funds accumulated throughout the individual's working years go to the intended recipient upon their death. 3. Trust Change of Beneficiary: In Iowa, individuals can establish trusts as part of their estate plan. This type of change focuses on modifying the beneficiaries named within the trust documents, allowing the granter (person establishing the trust) to update and adjust the distribution of assets held in the trust. 4. Will Change of Beneficiary: A change of beneficiary can also occur through a modification of a person's last will and testament in Iowa. By updating the beneficiaries named in the will, individuals can ensure their assets are distributed according to their desired allocation after their passing. The Iowa Change of Beneficiary process typically involves filling out the necessary forms provided by the asset-holding institution or insurance company. It is crucial to ensure that the updated information accurately reflects the individual's wishes and is in compliance with Iowa state law. In summary, Iowa Change of Beneficiary encompasses the modifications made to the designated recipients of various assets, insurance policies, retirement accounts, trusts, and wills. By undergoing this process, individuals can ensure that their assets are distributed as intended, providing peace of mind and efficient estate planning.

Iowa Change of Beneficiary

Description

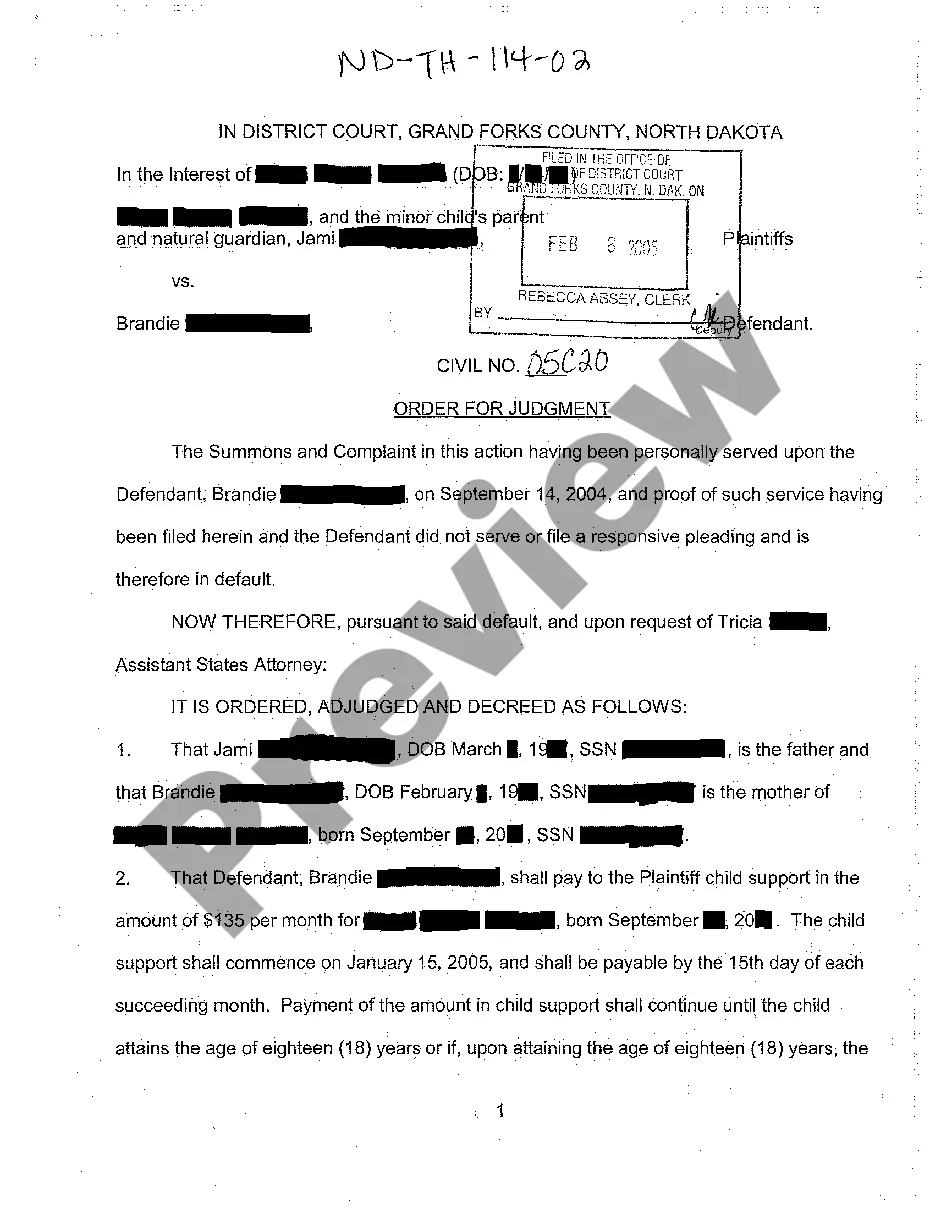

How to fill out Iowa Change Of Beneficiary?

Have you been inside a placement the place you require files for sometimes company or person reasons just about every time? There are plenty of authorized file web templates available on the net, but getting kinds you can trust isn`t easy. US Legal Forms gives thousands of develop web templates, like the Iowa Change of Beneficiary, that are created to satisfy state and federal needs.

Should you be previously acquainted with US Legal Forms internet site and possess an account, basically log in. Afterward, it is possible to obtain the Iowa Change of Beneficiary design.

If you do not provide an bank account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is to the appropriate city/county.

- Take advantage of the Preview button to check the form.

- Look at the outline to ensure that you have selected the correct develop.

- If the develop isn`t what you`re searching for, utilize the Research area to get the develop that meets your requirements and needs.

- Whenever you get the appropriate develop, click on Purchase now.

- Pick the costs plan you need, submit the desired details to make your account, and pay money for your order with your PayPal or charge card.

- Select a convenient document structure and obtain your version.

Locate each of the file web templates you have bought in the My Forms menu. You can aquire a additional version of Iowa Change of Beneficiary at any time, if necessary. Just click the required develop to obtain or print out the file design.

Use US Legal Forms, the most comprehensive selection of authorized varieties, to save lots of efforts and avoid faults. The service gives expertly manufactured authorized file web templates which can be used for a selection of reasons. Generate an account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

The beneficiary can be either revocable or irrevocable. A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent.

The policy owner is the only person who can change the beneficiary designation in most cases. If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes. A power of attorney can give someone else the ability to change your beneficiaries.

The wording of the beneficiary designation must stipulate ?irrevocable.? If an irrevocable beneficiary has been named at the time the insured enrolls for life coverage, both the insured and irrevocable beneficiary must sign the enrollment form. To change the beneficiary will require both signatures.

Change a beneficiary Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online.

Generally, you will need to fill out a change of beneficiary form which includes information such as the policyholder's name, the new beneficiary's name, and the reason for the change. You may also need to provide a copy of the policyholder's death certificate if the beneficiary is being changed due to their death.

Irrevocable beneficiaries cannot be removed once designated unless they agree to it?even if they are divorced spouses. Children are often named irrevocable beneficiaries to ensure their inheritance or secure child support payments.

An irrevocable beneficiary is a more ironclad version of a beneficiary. Their entitlements are guaranteed, and they often must approve any changes in the policy. Irrevocable beneficiaries cannot be removed once designated unless they agree to it?even if they are divorced spouses.

You cannot name a beneficiary or successor holder/annuitant on non-registered accounts. You can have more than one beneficiary, and this information can be updated on your account at any time. A successor annuitant (RRIF) or successor holder (TFSA) can only be your spouse or common-law partner.