Title: Detailed Description of Iowa Sample Letter Transmitting UCC-1 Forms for a Loan Closing Introduction: In the loan closing process, it is necessary to submit UCC-1 (Uniform Commercial Code) forms to the appropriate authorities. These forms serve as legal documentation of a lender's security interest in a borrower's assets. This detailed description explores the Iowa Sample Letter Transmitting UCC-1 Forms for a Loan Closing, providing essential information and guidelines. Keywords: Iowa, Sample Letter, Transmitting UCC-1 Forms, Loan Closing 1. Importance of UCC-1 Forms in Loan Closing: UCC-1 forms are crucial for loan closings as they allow lenders to establish their claim on the borrower's collateral, typically tangible assets such as equipment, inventory, or accounts receivable. By transmitting these forms, lenders protect their interests in case of borrower default or bankruptcy. 2. Purpose of Iowa Sample Letter Transmitting UCC-1 Forms: The Iowa Sample Letter Transmitting UCC-1 Forms is a standardized document designed to accompany the submission of UCC-1 forms to the Iowa Secretary of State's office. This letter serves as a formal communication and informs the state authorities of the lender's intent to establish a security interest in the borrower's assets. 3. Key Details to Include in the Sample Letter: a. Lender Information: Begin the letter by providing comprehensive details about the lender, including the name of the lending institution, mailing address, contact information, and UCC filing number (if applicable). b. Borrower Information: Clearly state the borrower's name and address to ensure accurate identification and association with the submitted UCC-1 forms. c. Loan Details: Include specific loan information, such as loan amount, loan date, and loan duration, to establish the context and purpose of the UCC-1 forms. d. Collateral Description: Clearly describe the assets that will serve as collateral, ensuring accuracy and specificity to avoid any ambiguity or confusion. e. UCC-1 Forms: Attach the completed UCC-1 forms, ensuring that they are properly filled out, signed, and notarized where necessary. Label and organize each form to facilitate the process. f. Filing Fee: Confirm and enclose the required fee for UCC-1 filing as required by the Iowa Secretary of State's office, ensuring a smoother transaction process. g. Contact Information: Provide contact details of the lender's representative to allow state authorities to communicate with any queries or updates regarding the UCC-1 submission. Iowa Sample Letter Transmitting UCC-1 Forms for Specific Loan Closings: 1. Agricultural Loan Closing: Tailored to loans related to agriculture, this variation of the sample letter may highlight specific collateral such as crops, livestock, or agricultural equipment. 2. Commercial Real Estate Loan Closing: This variation may focus on the borrower's commercial property, outlining the specifics of the real estate collateral in the UCC-1 forms accompanying the letter. 3. Equipment Financing Loan Closing: A specific version of the sample letter designed for loans related to equipment financing. It may highlight the details of the equipment, including make, model, serial numbers, and other relevant information to properly establish a security interest. Conclusion: A thorough understanding of the Iowa Sample Letter Transmitting UCC-1 Forms for a Loan Closing is essential for loan officers, lenders, and legal professionals involved in the loan closing process. Adhering to the provided guidelines and tailoring the letter to specific loan types ensures accurate and efficient submission of UCC-1 forms in compliance with Iowa state regulations.

Iowa Sample Letter Transmitting UCC-1 Forms for a Loan Closing

Description

How to fill out Iowa Sample Letter Transmitting UCC-1 Forms For A Loan Closing?

Selecting the finest legal document web template can be quite challenging. Certainly, there are numerous templates accessible on the web, but how can you locate the legal format you require.

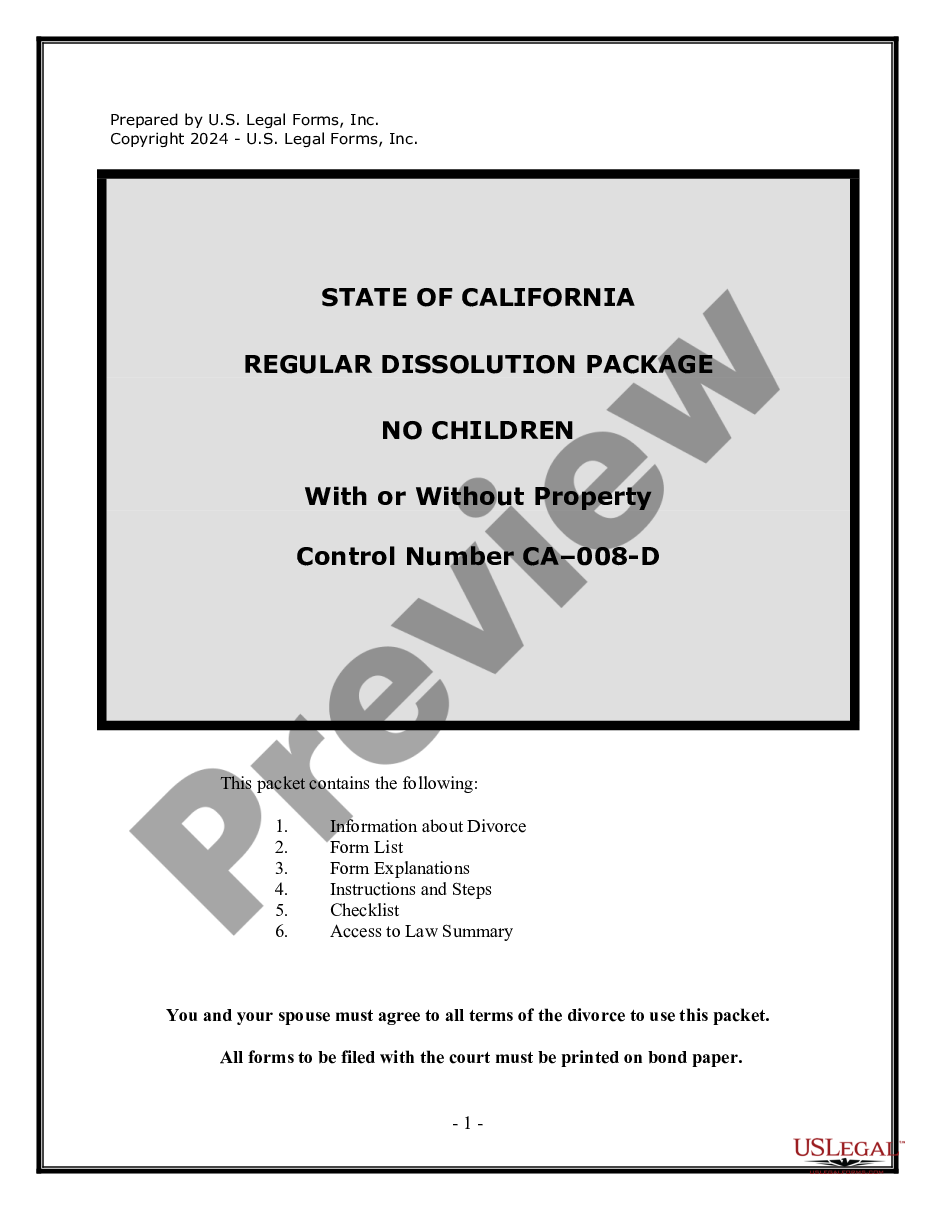

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Iowa Sample Letter Transmitting UCC-1 Forms for a Loan Closing, that can be utilized for both business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download option to obtain the Iowa Sample Letter Transmitting UCC-1 Forms for a Loan Closing. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents tab of your account to download another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can discover various document templates. Leverage the service to obtain well-crafted paperwork that adheres to state standards.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the appropriate form for your locality. You can preview the form using the Preview option and read the form description to confirm it is the correct one for you.

- If the form does not meet your needs, utilize the Search field to find the right form.

- Once you are confident that the form is suitable, click the Get Now option to acquire the form.

- Select the pricing plan you desire and fill in the necessary information. Create your account and complete your order using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document template to your device.

- Complete, edit, and print and sign the acquired Iowa Sample Letter Transmitting UCC-1 Forms for a Loan Closing.

Form popularity

FAQ

This might be a piece of equipment, a vehicle, property, or even a blanket lien naming all your assets. A UCC-1 protects a lender's interests for five years (unless the lender refiles) and will typically be included on your business credit reports.

By Mail: send the completed form with the processing fee of $40 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

How to complete a UCC1 (Step by Step)Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address.Secured Party Information. Organization or individual's name. Mailing address.Collateral Information. Description of collateral.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC1 filing. A Termination for personal property is accomplished by completing and filing form UCC3 with the Secretary of State's office in the appropriate state.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

1 financing statement contains three important pieces of information: Parts 1 and 2 contain the personal and contact information of the borrower. Part 3 contains the personal and contact information of the secured partyotherwise known as the creditor. Part 4 describes the collateral covered in the UCC lien.

Interesting Questions

More info

Businesses registered in the state are subjected to rigorous oversight to ensure that no unlicensed individuals are operating within the area and that a proper mix of licensed and unlicensed businesses operate within this market. Alabama Commerce was created on April 1, 1995, through the enactment of Act No. 87 of the 95th General Assembly. All entities licensed by the department must register with and pay fees to the department. Alabama Commerce maintains a complete listing of commercial license holders and forms of action by the department on all pending and pending license revocation cases. All licensing and registration procedures require a completed Commercial Business Application for Alabama Business License for Residential, Foreign and Business Enterprises, and may be accessed at the department's website:.