Iowa Account Stated for Construction Work is a legal concept that refers to an agreement between parties involved in construction projects in the state of Iowa. It is essentially a means of establishing a clear and agreed upon account of work performed and related financial transactions. This description will delve into the intricacies of Iowa Account Stated for Construction Work, explaining its purpose, requirements, and potential types. The primary purpose of Iowa Account Stated for Construction Work is to ensure transparency and clarity in terms of the work performed, costs incurred, and payments made during a construction project. It acts as a binding agreement between the contractor, subcontractors, suppliers, and property owner, outlining the scope of work, materials used, and the associated costs. This agreement helps prevent disputes and provides a basis for resolving any potential conflicts that may arise during or after the construction project. To establish an Iowa Account Stated for Construction Work, certain requirements need to be met. First and foremost, there should be a clear and mutual understanding between all parties involved regarding the work to be performed. The scope of work, specifications, and any necessary blueprints should be properly documented and agreed upon. Additionally, the parties should agree on the payment terms, including the rates, milestones, and due dates. Once the construction project is underway, regular documentation and record-keeping become essential for maintaining an Iowa Account Stated. Contractors, subcontractors, and suppliers should maintain accurate and detailed records of the work completed, payments received, and any changes or additions to the original agreement. These records act as evidence in establishing the final account stated. There are several types of Iowa Account Stated for Construction Work that may be encountered, depending on the specific circumstances of the project. Some common types include: 1. General Contractor Account Stated: This refers to the agreement between the general contractor and the property owner. It encompasses the overall scope of work, payment terms, and any changes or additions made throughout the project. 2. Subcontractor Account Stated: This involves the agreement between the general contractor and subcontractors hired to perform specific tasks. It includes the details of the subcontracted work, payment terms, and any modifications made during the project. 3. Supplier Account Stated: This type of account stated involves the agreement between the contractor or subcontractor and the suppliers of construction materials. It outlines the materials provided, their costs, payment terms, and any adjustments made throughout the project. 4. Construction Manager Account Stated: In cases where a construction manager is hired to oversee the project, this type of account stated establishes the agreement between the manager, property owner, and other contractors involved. It defines the manager's responsibilities, compensation, and the terms of reimbursement for expenses incurred. In conclusion, Iowa Account Stated for Construction Work is a vital component in ensuring transparency, accountability, and effective communication among all parties involved in a construction project. By establishing a clear and agreed-upon account of work performed and related financial transactions, it helps prevent disputes and facilitates the smooth completion of projects. Understanding the various types of Iowa Account Stated for Construction Work can further aid in navigating the intricacies of construction contracts and project management.

Iowa Account Stated for Construction Work

Description

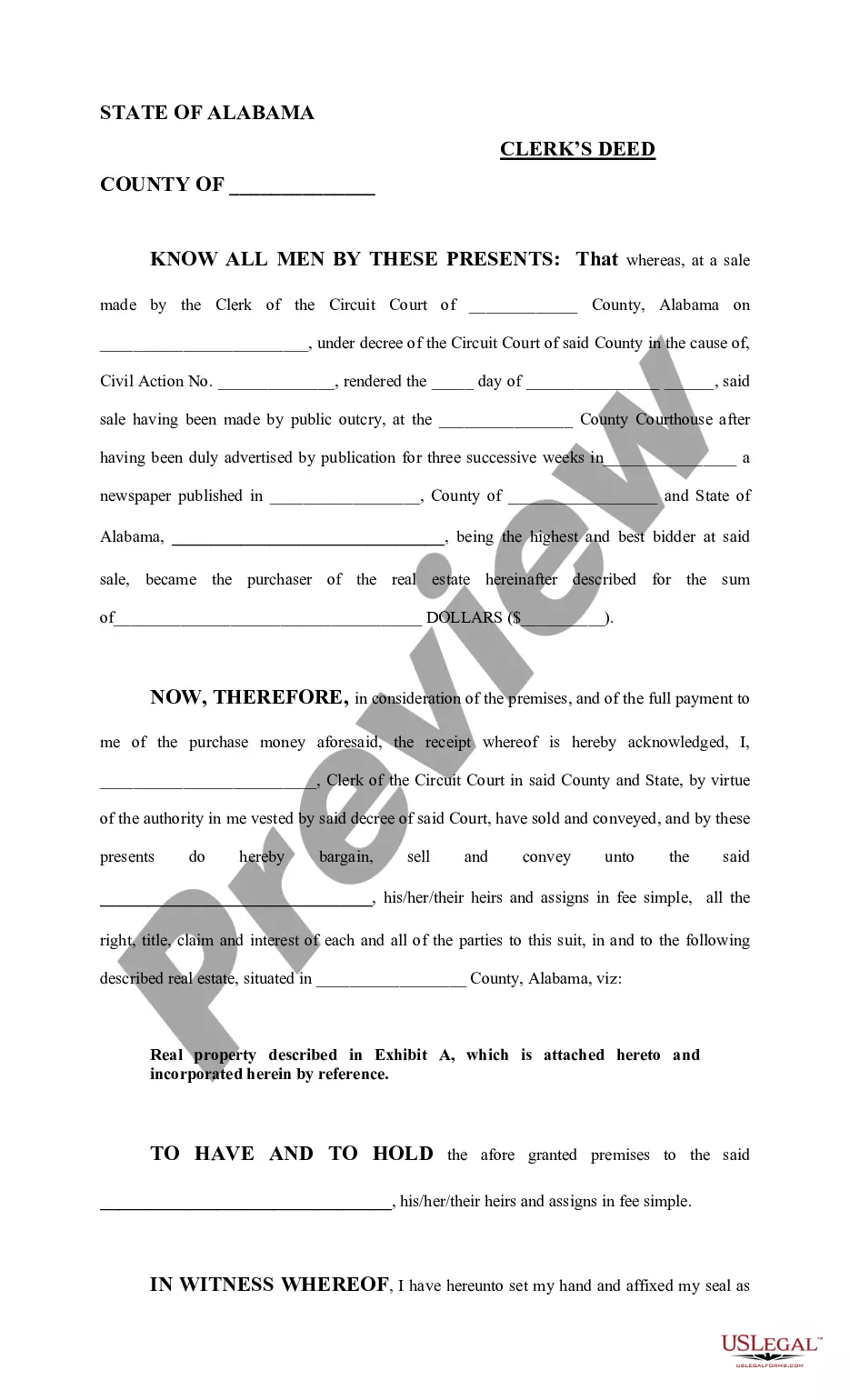

How to fill out Iowa Account Stated For Construction Work?

Finding the right lawful file template might be a have a problem. Obviously, there are tons of themes available on the Internet, but how would you discover the lawful kind you will need? Use the US Legal Forms web site. The assistance offers thousands of themes, like the Iowa Account Stated for Construction Work, that can be used for business and private needs. All of the forms are checked out by experts and fulfill federal and state needs.

Should you be already signed up, log in to the profile and click the Obtain switch to have the Iowa Account Stated for Construction Work. Utilize your profile to check throughout the lawful forms you might have purchased previously. Check out the My Forms tab of your profile and acquire another duplicate of the file you will need.

Should you be a whole new end user of US Legal Forms, allow me to share easy guidelines that you can adhere to:

- Initially, make certain you have chosen the proper kind for your personal area/county. You can examine the form using the Review switch and look at the form information to make certain it is the right one for you.

- In case the kind will not fulfill your requirements, use the Seach field to find the appropriate kind.

- Once you are sure that the form is acceptable, go through the Get now switch to have the kind.

- Select the pricing strategy you would like and enter the necessary information and facts. Build your profile and buy an order with your PayPal profile or bank card.

- Opt for the submit file format and acquire the lawful file template to the system.

- Comprehensive, edit and printing and indication the attained Iowa Account Stated for Construction Work.

US Legal Forms is definitely the greatest local library of lawful forms that you can see different file themes. Use the service to acquire expertly-manufactured papers that adhere to express needs.