A revocable trust is a legal arrangement that allows individuals in Iowa to manage and distribute their assets, specifically their homes, while still maintaining control over them during their lifetime. This trust structure offers flexibility and control for estate planning purposes, ensuring the smooth transfer of property upon the trust or's passing. The Iowa Revocable Trust for House, also known as an Iowa Living Trust, is a popular estate planning tool that provides several benefits to homeowners. It allows them to avoid probate, protect their privacy, and provide for the seamless transfer of their house or real estate holdings to their desired beneficiaries. This trust can be modified or revoked by the trust or (also referred to as the granter or the settler) at any time during their lifetime, allowing for flexibility and adaptation to changing circumstances. There are different types or variations of Iowa Revocable Trusts for Houses, namely: 1. Individual or Single Trust: This type of trust is established by a single person, enabling them to transfer the ownership of their house to the trust and name beneficiaries who will eventually receive the property. It provides the trust or with complete control and the ability to modify or revoke the trust as needed. 2. Joint Trust: A joint trust allows married couples or domestic partners in Iowa to create a single trust that combines both partners' assets, including their home. This trust structure offers the benefit of joint management and simplified administration, ensuring the smooth transition of the property to the surviving spouse or designated beneficiaries. 3. Pour-Over Trust: This type of trust is often used in conjunction with a will. It allows the trust or to transfer any assets not specifically mentioned in the trust to be "poured over" into the trust upon their passing. This includes the house or any other real estate, ensuring it is governed by the terms of the Iowa Revocable Trust. 4. Minor's Trust: For individuals who wish to leave their house or real estate to minor children or grandchildren, a minor's trust can be established within the revocable trust. This trust structure appoints a trustee to manage and administer the assets until the beneficiaries reach a predetermined age, as specified by the trust or. In conclusion, the Iowa Revocable Trust for House provides homeowners with a versatile and efficient means to manage the distribution of their property. Whether creating an individual trust, a joint trust, a pour-over trust, or a minor's trust, the revocable trust allows the trust or to exert control over their assets while providing for the seamless transition and avoidance of probate for the house or any other real estate. It is essential to consult with an experienced attorney specializing in estate planning to determine the most suitable type of trust based on individual circumstances.

Iowa Revocable Trust for House

Description

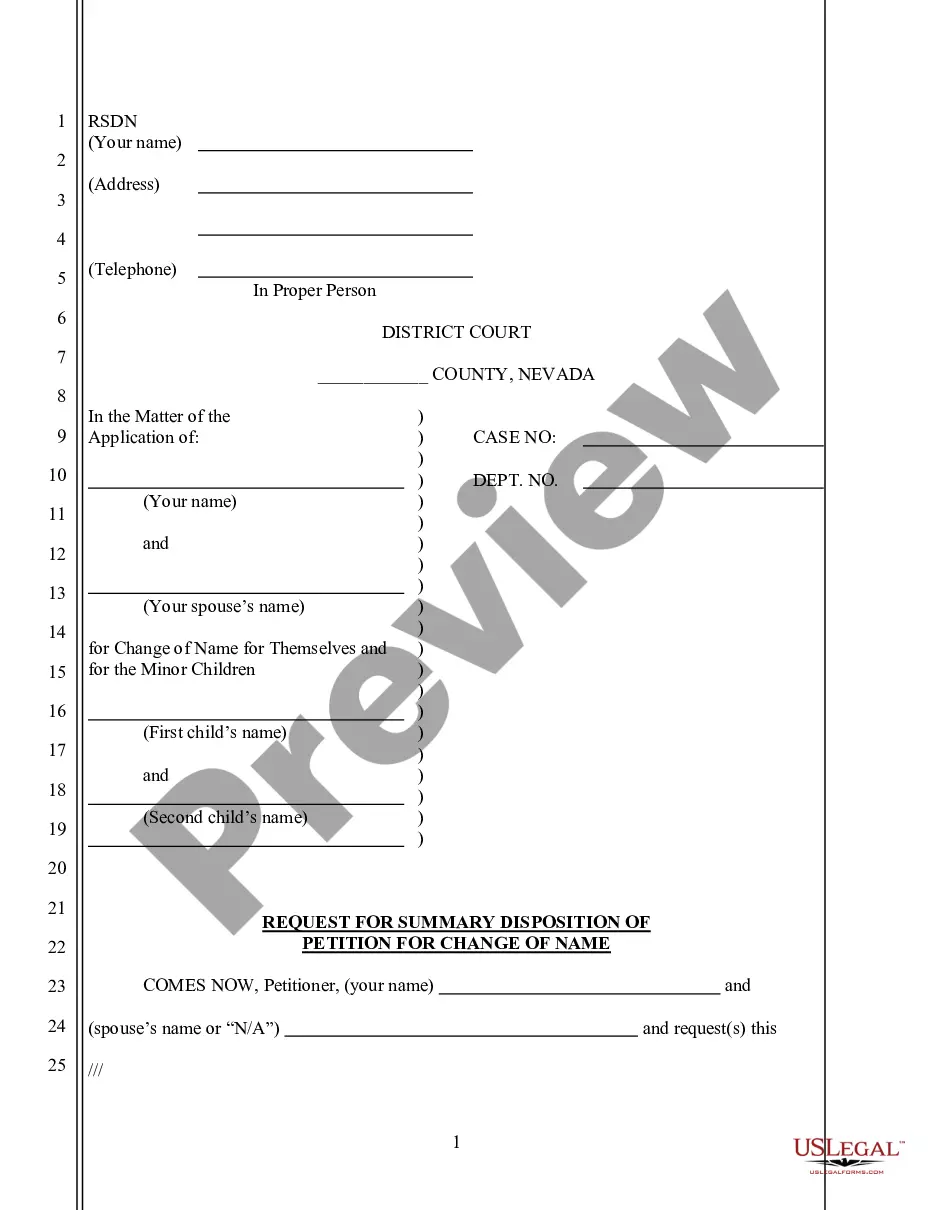

How to fill out Iowa Revocable Trust For House?

Selecting the appropriate legal document format can be a challenge. Of course, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms website. The service provides a vast array of templates, including the Iowa Revocable Trust for Property, that can be utilized for both business and personal needs. Each of the documents is reviewed by experts and complies with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to receive the Iowa Revocable Trust for Property. Use your account to browse the legal forms you have previously acquired. Navigate to the My documents tab of your account to obtain another copy of the document you need.

Select the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired Iowa Revocable Trust for Property. US Legal Forms is indeed the largest repository of legal documents from which you can find various document templates. Use the service to download professionally crafted paperwork that adheres to state regulations.

- First, ensure you have selected the correct form for your city/state.

- You can review the document using the Review button and examine the document summary to confirm it's the correct one for you.

- If the document does not meet your requirements, use the Search section to find the suitable form.

- Once you are certain that the document is appropriate, click the Buy Now button to acquire it.

- Choose the pricing plan you desire and fill in the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Creating an Iowa Revocable Trust for House allows you to streamline the transfer of your property upon your passing, avoiding the often lengthy probate process. This trust provides you with flexibility, as you can change or revoke it at any time during your life. Additionally, it simplifies estate management, ensuring your loved ones can access your home easily when needed.

One significant disadvantage of the Iowa Revocable Trust for House is that transferring your house into the trust may involve some costs and paperwork. Additionally, you will lose some degree of control since the trust will legally own the property, although you can still manage it as the trustee. It's vital to weigh these factors against the benefits of avoiding probate and ensuring a smooth transition of assets.

When you create an Iowa Revocable Trust for House, the assets within that trust, including your home, are generally protected from nursing home creditors. However, if you need to qualify for Medicaid coverage, the value of the trust may impact your eligibility. It's essential to plan carefully and consult with an expert to ensure your structure protects your home and meets your needs.

You would consider placing your house in an Iowa Revocable Trust for House to simplify estate management and protect your home from probate. This trust structure also allows for flexibility, enabling you to alter the terms or dissolve the trust at any time while you are alive. By taking this step, you can ensure a smoother transition for your beneficiaries, making it an appealing option for effective estate planning.

Holding property in an Iowa Revocable Trust for House provides several advantages, such as avoiding probate and ensuring a smoother transfer of assets upon death. However, it also comes with potential downsides, like limited control over the property during your lifetime since the trust controls the asset. You must consider both sides carefully to determine what aligns best with your estate planning goals.

The best trust for your house often is an Iowa Revocable Trust for House, which offers flexibility and control over your property. This type of trust allows you to manage your assets during your lifetime and make changes as your situation evolves. It also simplifies the transfer of your home to your heirs, avoiding probate. Using a reliable service like USLegalForms can help you create your trust efficiently, ensuring your wishes are honored.

Yes, you can place your house in an Iowa Revocable Trust for House even if you have a mortgage. The mortgage does not prevent you from transferring ownership to a trust. However, it's essential to inform your mortgage lender about the change, as some loans may have specific requirements. Consulting with a legal expert can help ensure that you comply with all terms while maximizing the benefits of your trust.

To place your house in an Iowa Revocable Trust for House, you must first create the trust document, outlining its terms and beneficiaries. Next, you will need to execute a deed transferring ownership of the house to the trust. Finally, file the deed with the county recorder's office to complete the process. Utilizing resources from uslegalforms can help simplify this process and ensure all legal requirements are met.

While an Iowa Revocable Trust for House offers several benefits, there are potential disadvantages to consider. The trust does not provide asset protection from creditors, and you may incur costs when setting it up. Additionally, you may lose some control over the property, as the trust becomes the legal owner. It is essential to weigh these factors and consult a professional if necessary.

One of the biggest mistakes parents make is not clearly defining their wishes when setting up a trust fund. Without explicit instructions, the trust may not serve your intentions effectively. This is where an Iowa Revocable Trust for House can be beneficial, as it allows you to articulate your desires regarding your home and other assets. Clear communication can help avoid family disputes and ensure smooth transitions.

Interesting Questions

More info

S. Department of the Treasury. FDIC is officially mandated by the U.S. Department of the Treasury. FDIC is one of the six insured depository institutions that are part of the Federal Deposit Insurance Corporation and are under the supervision of the FDIC's Office of the Inspector General. The FDIC is authorized to enforce financial and accounting laws and to issue rules and regulations defining the terms under which banks and banks holding companies will operate. The FDIC has a long history of providing for and supervising the operation of banks and is also mandated by federal law to conduct certain functions, including the conduct of an annual comprehensive examination of large bank holding companies pursuant to section 7(a) of the Federal Deposit Insurance Act.