Iowa Financing Statement

Description

How to fill out Financing Statement?

Have you ever been in a situation where you require documents for either professional or personal purposes almost every working day.

There are numerous legitimate document templates accessible online, yet finding forms you can trust is not easy.

US Legal Forms offers thousands of template documents, such as the Iowa Financing Statement, that are designed to comply with federal and state requirements.

Once you obtain the correct form, click Purchase now.

Select the payment plan you want, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Iowa Financing Statement template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct state/region.

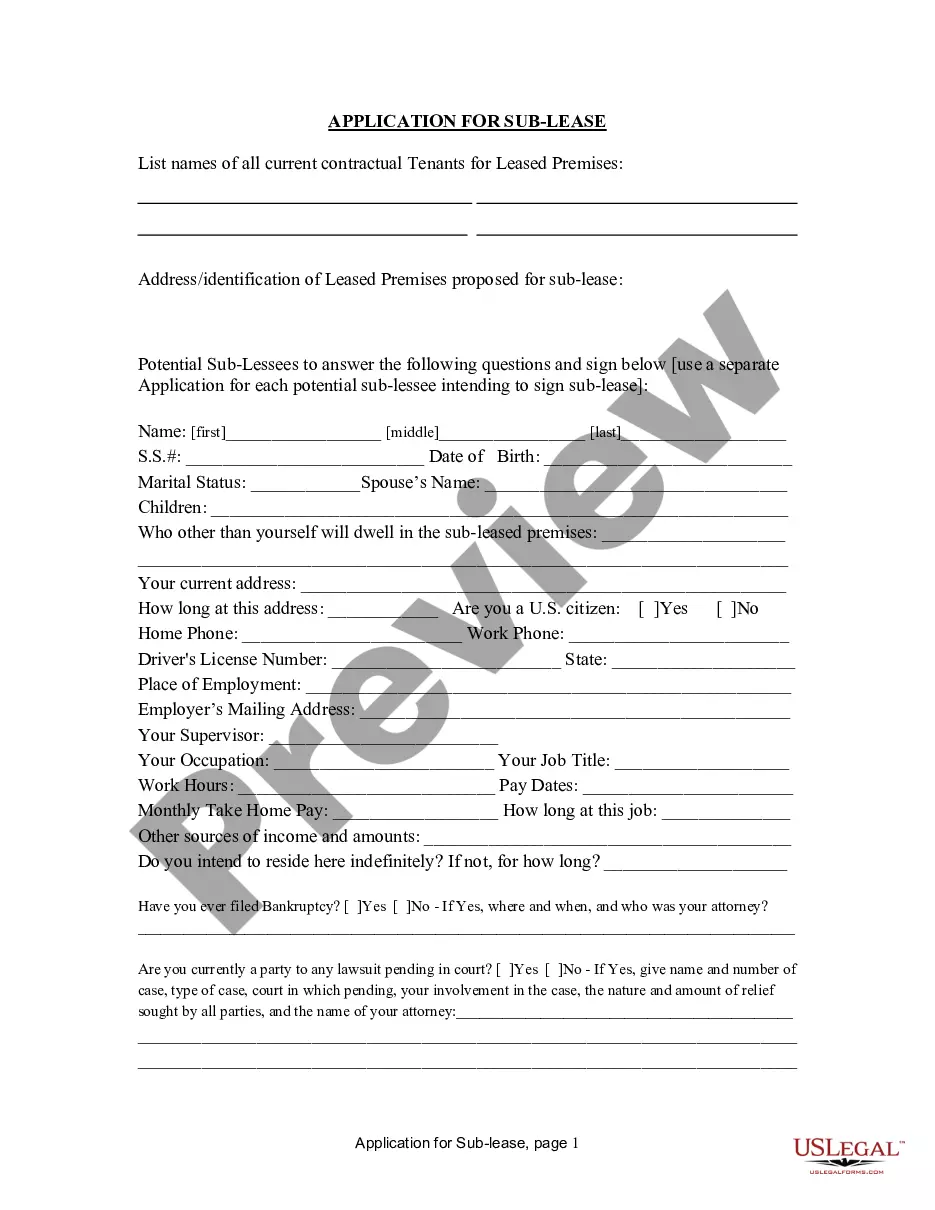

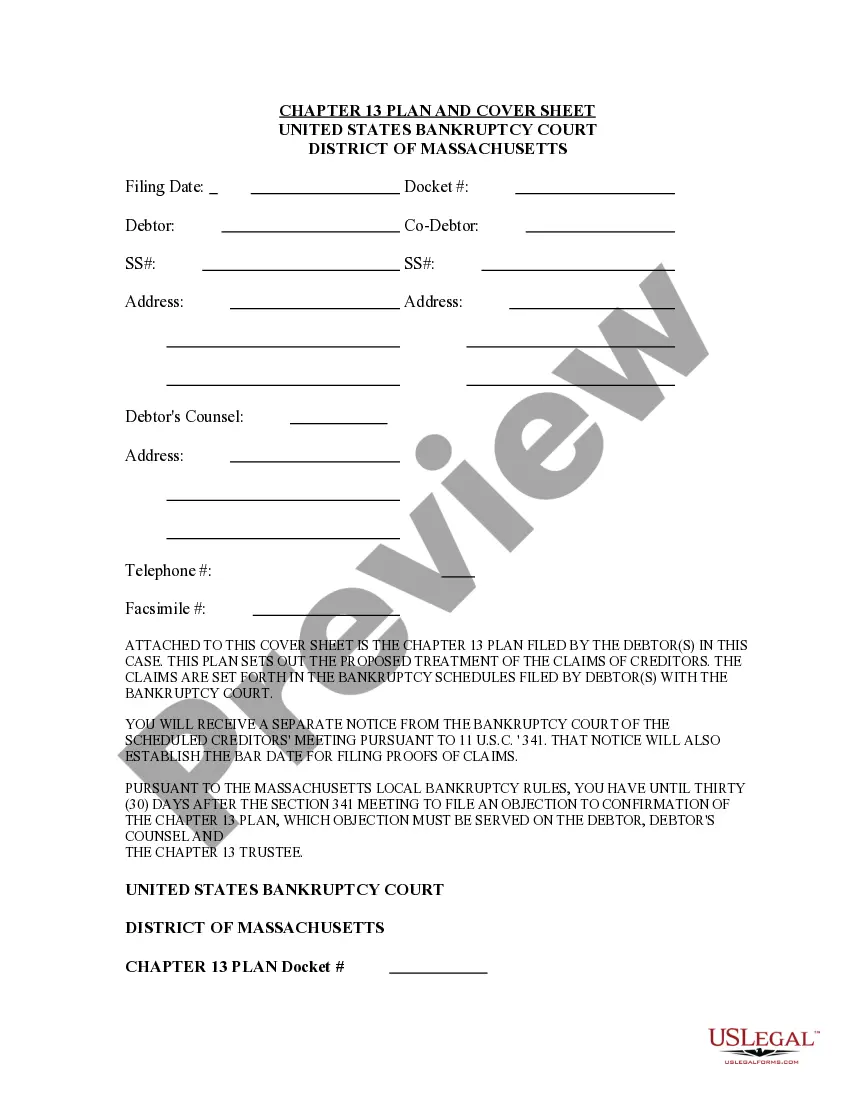

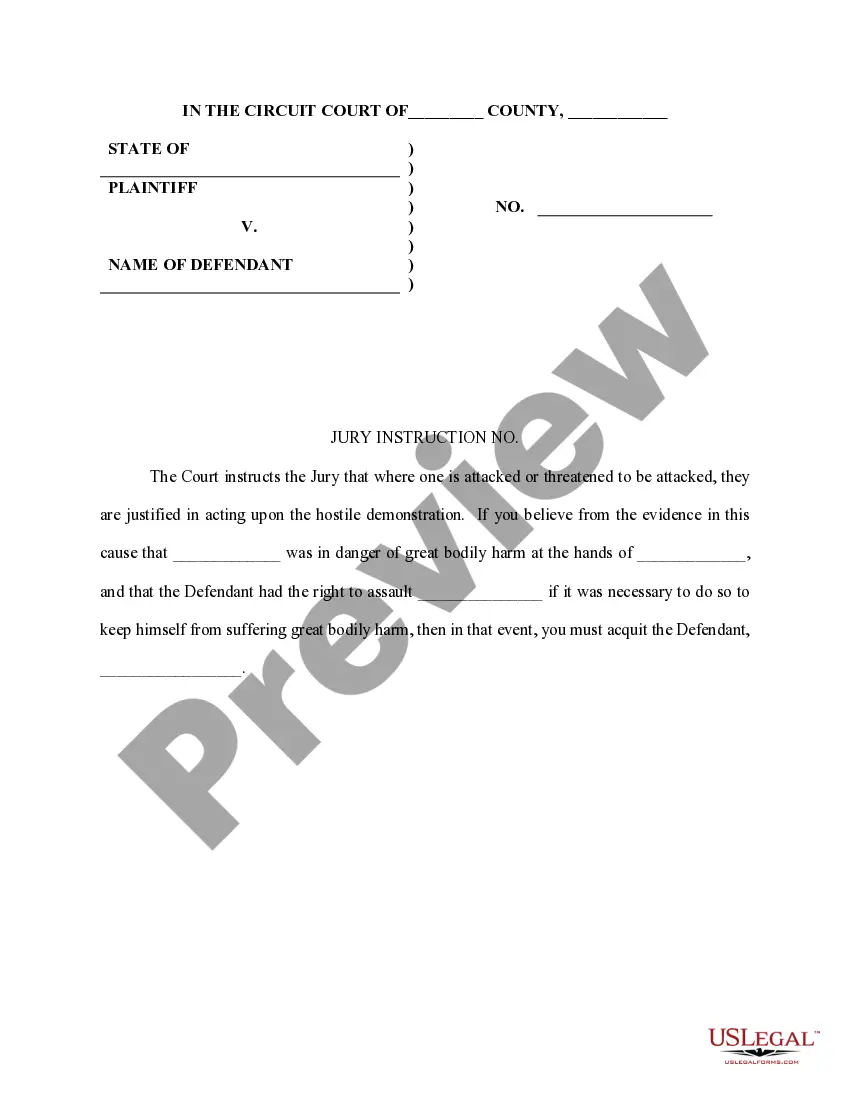

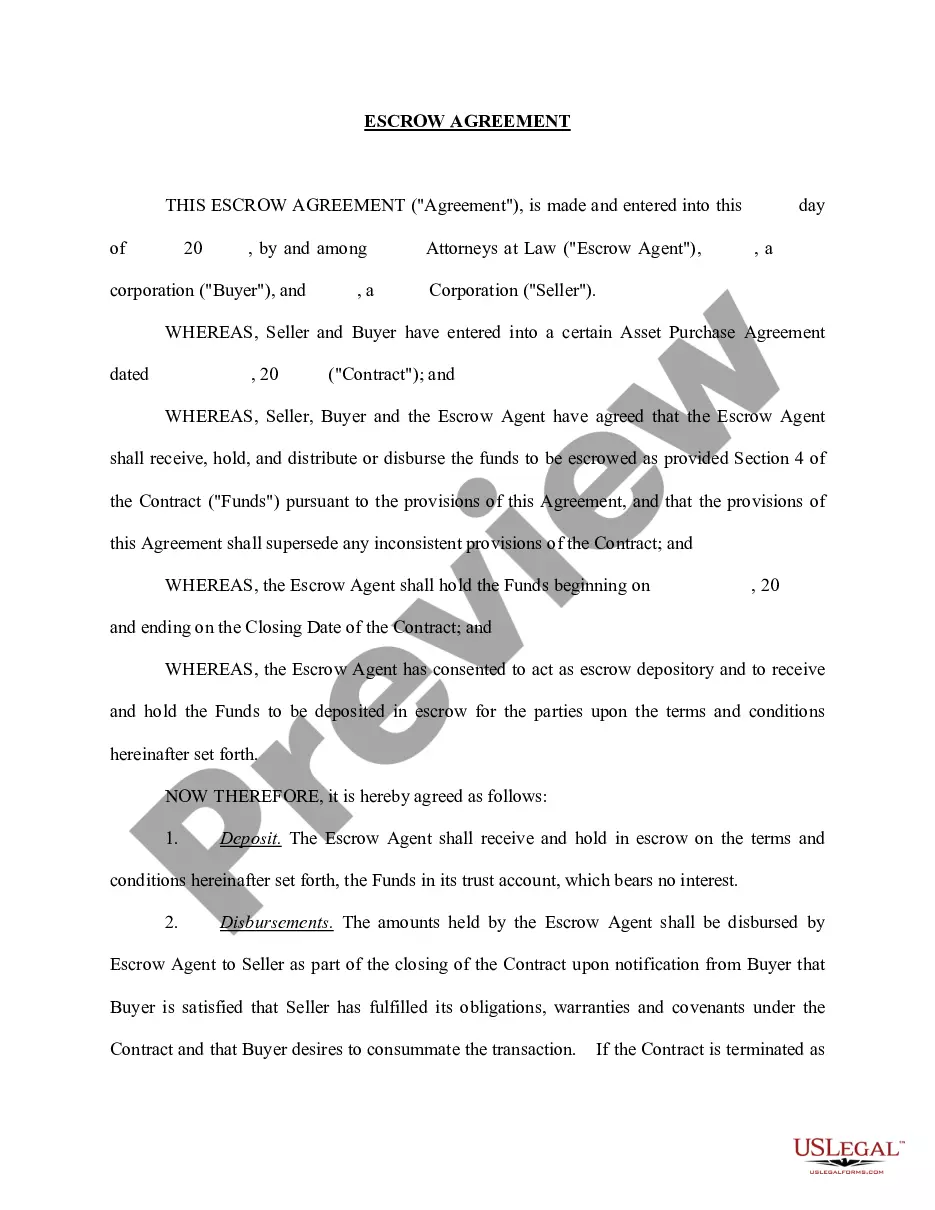

- Use the Preview button to review the document.

- Examine the details to confirm that you have selected the accurate template.

- If the template is not what you are seeking, utilize the Search field to locate the form that meets your needs and criteria.

Form popularity

FAQ

Filing a UCC in Iowa involves completing a financing statement and submitting it to the Iowa Secretary of State. You can file your Iowa Financing Statement online for convenience, or you can choose to mail it in if you prefer. Be sure to include all required information accurately to avoid delays. Using uslegalforms can help ensure that your filing meets all legal requirements and is done correctly.

To place a lien on someone's property in Iowa, you typically need to file a financing statement with the Iowa Secretary of State. This document must detail the debt and the specific property involved. Proper documentation is vital to ensure the lien is enforceable. For comprehensive instructions and a smooth filing experience, consider uslegalforms, which offers detailed guidance tailored to your needs.

To file a UCC fixture filing, you should submit it to the Iowa Secretary of State. This filing must be done in the same manner as a standard Iowa Financing Statement, ensuring that you correctly identify the fixture being attached to the real estate. By filing in the right location, you establish a public record of your interest. Using uslegalforms can simplify this process, providing templates to help you navigate the filing.

Yes, a financing statement must be signed to be valid. The signature can come from the debtor or their authorized representative, ensuring the transaction is legitimate. The signed Iowa Financing Statement is critical for perfecting a security interest, as it reflects the consent of the debtor. If you need assistance with the signing requirements, uslegalforms offers useful resources and templates.

Typically, a financing statement is filed by creditors who want to secure their interests in a debtor's property. This filing can be done by individuals or businesses who have extended credit. It's essential to ensure that the Iowa Financing Statement is filed correctly to establish your rights effectively. If you are unsure about how to proceed, uslegalforms can provide guidance and necessary templates.

To file an Iowa Financing Statement, you need to submit your document to the Iowa Secretary of State's office. This can be done online or through traditional mail, depending on your preference. Online filing is often quicker and more efficient, allowing you to receive confirmation faster. Make sure to check the Iowa Secretary of State's website for detailed instructions on the filing process.

A financing statement is a legal document that establishes a secured party's interest in a debtor's collateral. In the context of an Iowa Financing Statement, it plays a crucial role in securing loans or credit by publicly declaring the lender's claim. Understanding the significance of this document can help you protect your investments and relationships effectively.

Filling out a UCC-1 form involves providing accurate and complete information about the debtor, secured party, and collateral. It's essential to ensure that all sections are filled out correctly to avoid any issues with the Iowa Financing Statement. Many find it helpful to utilize services like UsLegalForms to guide them through the process, ensuring compliance with state regulations.

An Iowa Financing Statement includes several key elements, such as the names and addresses of the debtor and the secured party, a description of the collateral, and the filing office where the statement is recorded. This document serves as a public record and protects the interests of the secured party in case of default. Accurately detailing this information is crucial to maintain your legal rights.

To clear a UCC-1 financing statement, you need to file a UCC-3 amendment form with the appropriate state office. This form notifies relevant parties that you are terminating or amending the existing financing statement. In Iowa, ensuring all necessary details are accurate is crucial for a smooth process. Using a reliable platform like UsLegalForms can help you complete this step efficiently.