If you have to complete, download, or print out legal file layouts, use US Legal Forms, the most important selection of legal forms, that can be found on the Internet. Take advantage of the site`s easy and convenient lookup to obtain the files you want. A variety of layouts for business and personal reasons are categorized by groups and says, or keywords. Use US Legal Forms to obtain the Iowa Security Agreement in Accounts and Contract Rights with a number of clicks.

In case you are currently a US Legal Forms consumer, log in in your profile and click on the Obtain key to find the Iowa Security Agreement in Accounts and Contract Rights. You may also access forms you formerly downloaded in the My Forms tab of your respective profile.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the proper town/country.

- Step 2. Make use of the Preview choice to check out the form`s content. Do not overlook to read through the description.

- Step 3. In case you are not happy together with the form, use the Look for discipline on top of the display to discover other types of your legal form template.

- Step 4. After you have discovered the shape you want, click the Get now key. Choose the costs prepare you favor and include your qualifications to sign up on an profile.

- Step 5. Method the deal. You should use your charge card or PayPal profile to perform the deal.

- Step 6. Pick the formatting of your legal form and download it on your gadget.

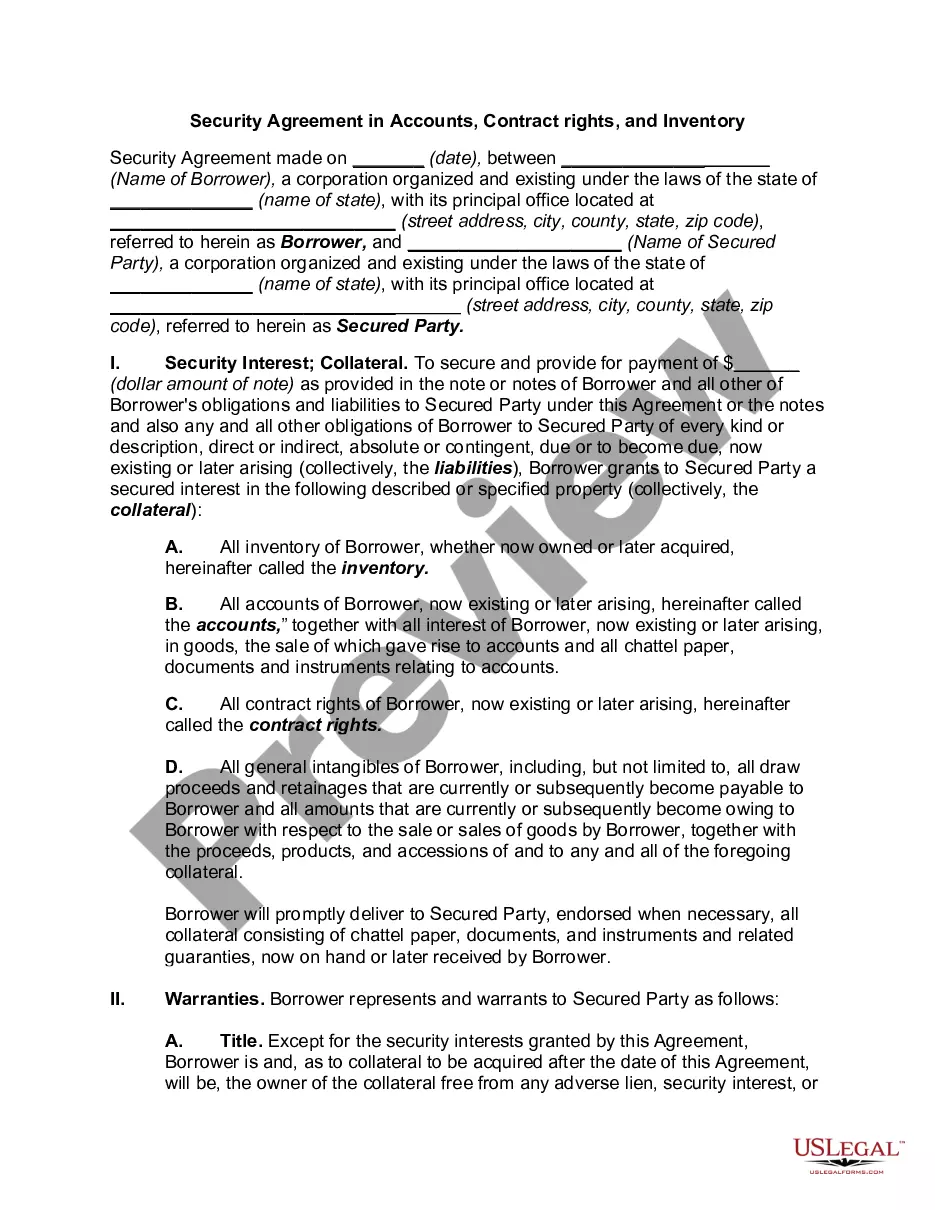

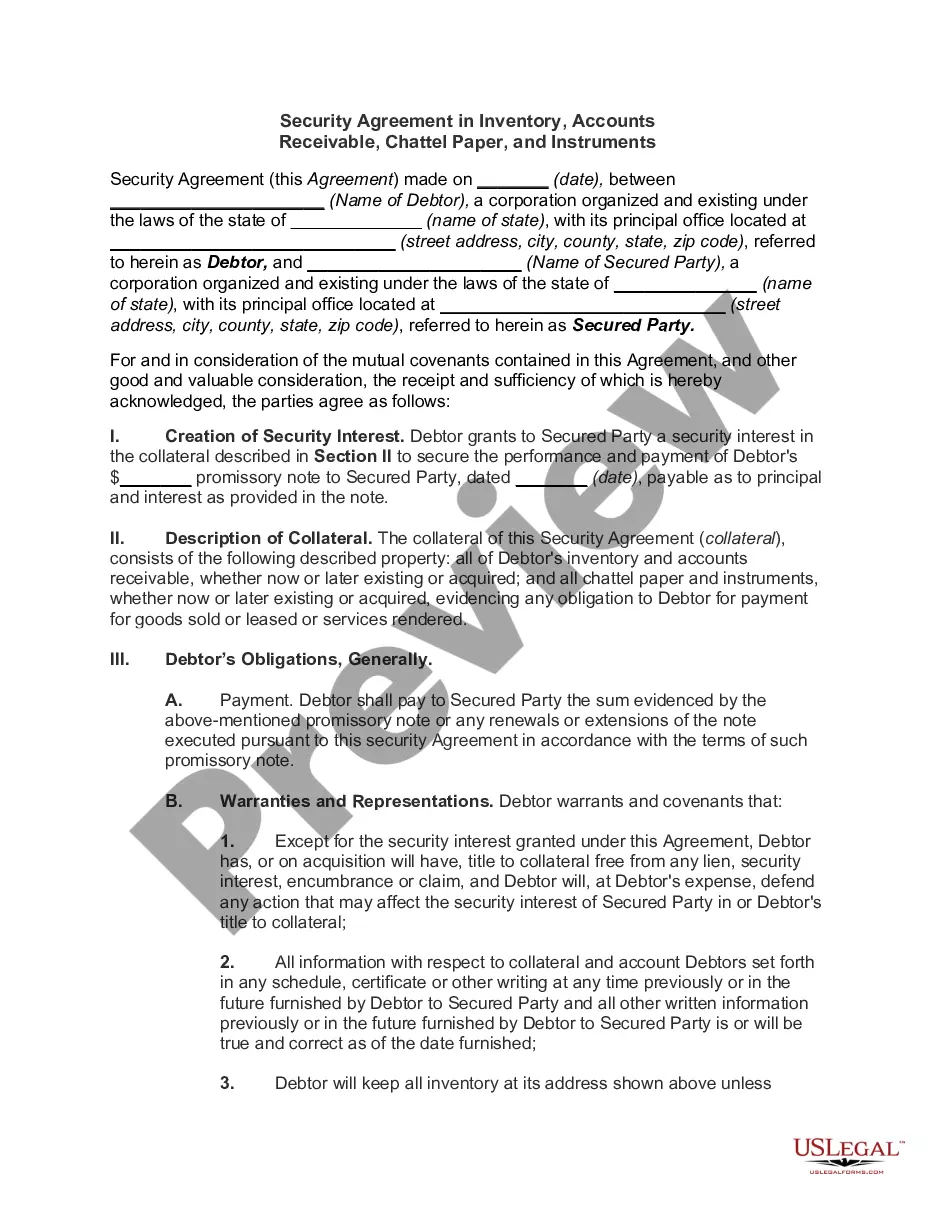

- Step 7. Full, revise and print out or indicator the Iowa Security Agreement in Accounts and Contract Rights.

Each and every legal file template you buy is the one you have forever. You may have acces to every form you downloaded with your acccount. Go through the My Forms section and pick a form to print out or download again.

Compete and download, and print out the Iowa Security Agreement in Accounts and Contract Rights with US Legal Forms. There are thousands of specialist and status-certain forms you can utilize for the business or personal needs.