Iowa Non-Disclosure Agreement for Potential Investors: Explained and Types to consider Introduction: A Non-Disclosure Agreement (NDA) is a legally binding contract that protects sensitive and confidential information shared between parties. In the realm of potential investments, an Iowa Non-Disclosure Agreement for Potential Investors serves the crucial purpose of safeguarding trade secrets, business strategies, financial data, and other proprietary information. Let's delve into the details of this agreement and explore its different types available in Iowa. What is an Iowa Non-Disclosure Agreement for Potential Investors? An Iowa Non-Disclosure Agreement for Potential Investors, also known as a Confidentiality Agreement, is a legal document designed to establish confidentiality and restrict the disclosure of confidential information shared during the investment evaluation process. This agreement ensures that investors interested in exploring potential investment opportunities within Iowa adhere to strict confidentiality guidelines, thereby protecting the interests of both parties involved. Key Elements of an Iowa Non-Disclosure Agreement for Potential Investors: 1. Identification of Parties: The agreement should clearly identify the parties involved, i.e., the disclosing party (typically the business seeking investment) and the receiving party (potential investor). 2. Definition of Confidential Information: It is essential to specifically outline what constitutes confidential information to be covered under the agreement. This may include financial records, client lists, patentable ideas, marketing strategies, and other proprietary data. 3. Purpose and Use of Confidential Information: The NDA should state that the disclosed information should strictly be used for evaluating potential investment opportunities and not for any other unauthorized purposes. 4. Non-Disclosure Obligations: The agreement spells out the obligations of the receiving party not to disclose confidential information to any third parties or use it for personal gain. It also highlights the importance of implementing reasonable safeguards to protect the disclosed information. 5. Exclusions from Confidentiality: Certain information may be excluded from the scope of confidentiality, such as publicly available data, information rightfully obtained from another source, or information independently developed by the receiving party. Different Types of Iowa Non-Disclosure Agreements for Potential Investors: 1. Mutual Non-Disclosure Agreement (MNA): This type of agreement is typically used when both parties plan to share confidential information with each other. With an MNA, both the potential investor and the business seeking investment agree to keep each other's trade secrets and proprietary data confidential. 2. Unilateral Non-Disclosure Agreement (USDA): In cases where only one party has sensitive information to disclose, an UNDA is employed. Here, the party disclosing the information (usually the business seeking investment) requires the potential investor to maintain utmost confidentiality. Conclusion: An Iowa Non-Disclosure Agreement for Potential Investors is an indispensable legal tool to maintain confidentiality and protect proprietary information during the investment evaluation process. Whether opting for a Mutual or Unilateral Non-Disclosure Agreement, businesses and potential investors must carefully consider the specific terms and clauses tailored to their unique circumstances before entering into such agreements to safeguard their interests.

Iowa Non-Disclosure Agreement for Potential Investors

Description

How to fill out Iowa Non-Disclosure Agreement For Potential Investors?

If you need to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Take advantage of the site’s simple and convenient search to find the documents you require. Numerous templates for business and personal use are classified by categories and states, or keywords.

Use US Legal Forms to obtain the Iowa Non-Disclosure Agreement for Potential Investors with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to each form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Compete and obtain, then print the Iowa Non-Disclosure Agreement for Potential Investors using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms customer, Log Into your account and click on the Download option to access the Iowa Non-Disclosure Agreement for Potential Investors.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct region/state.

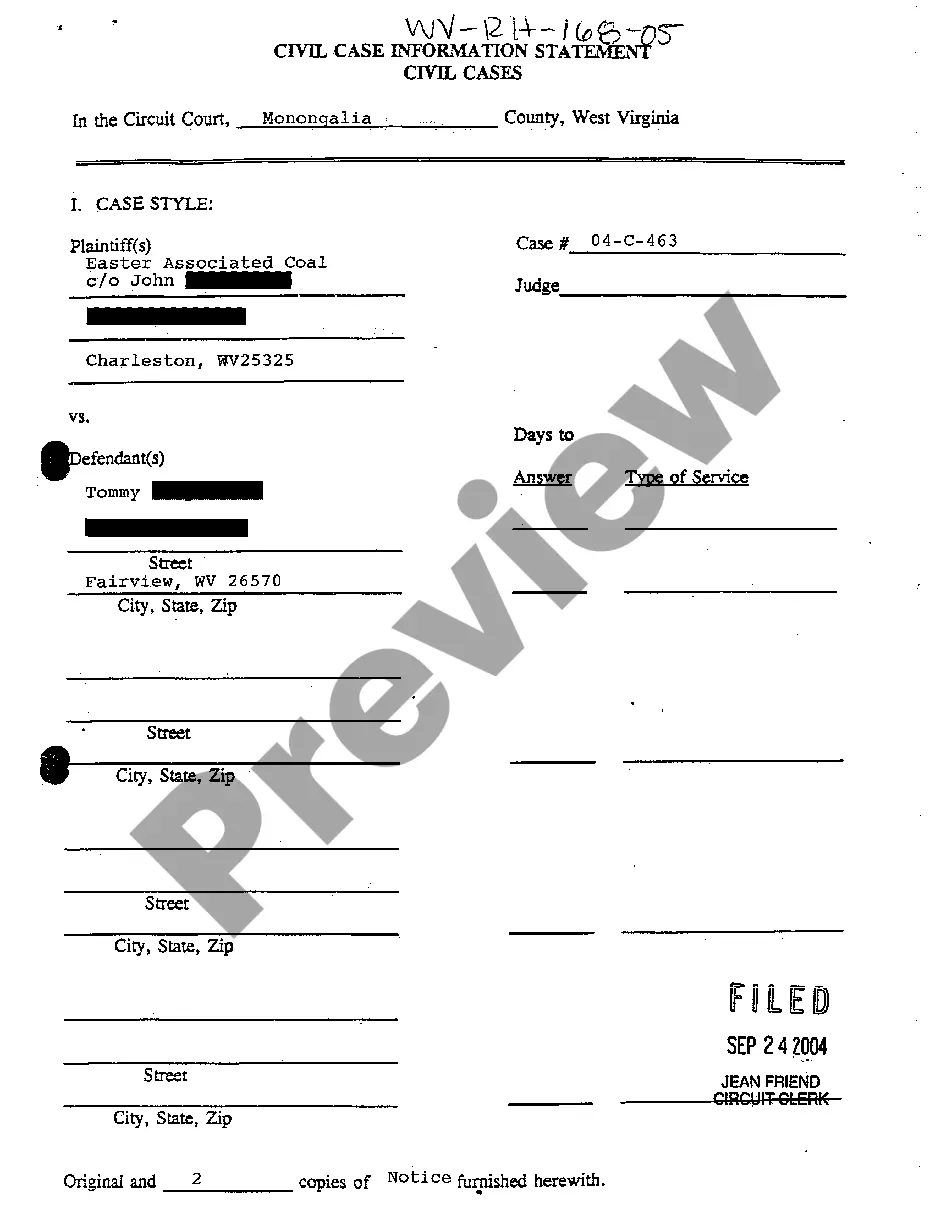

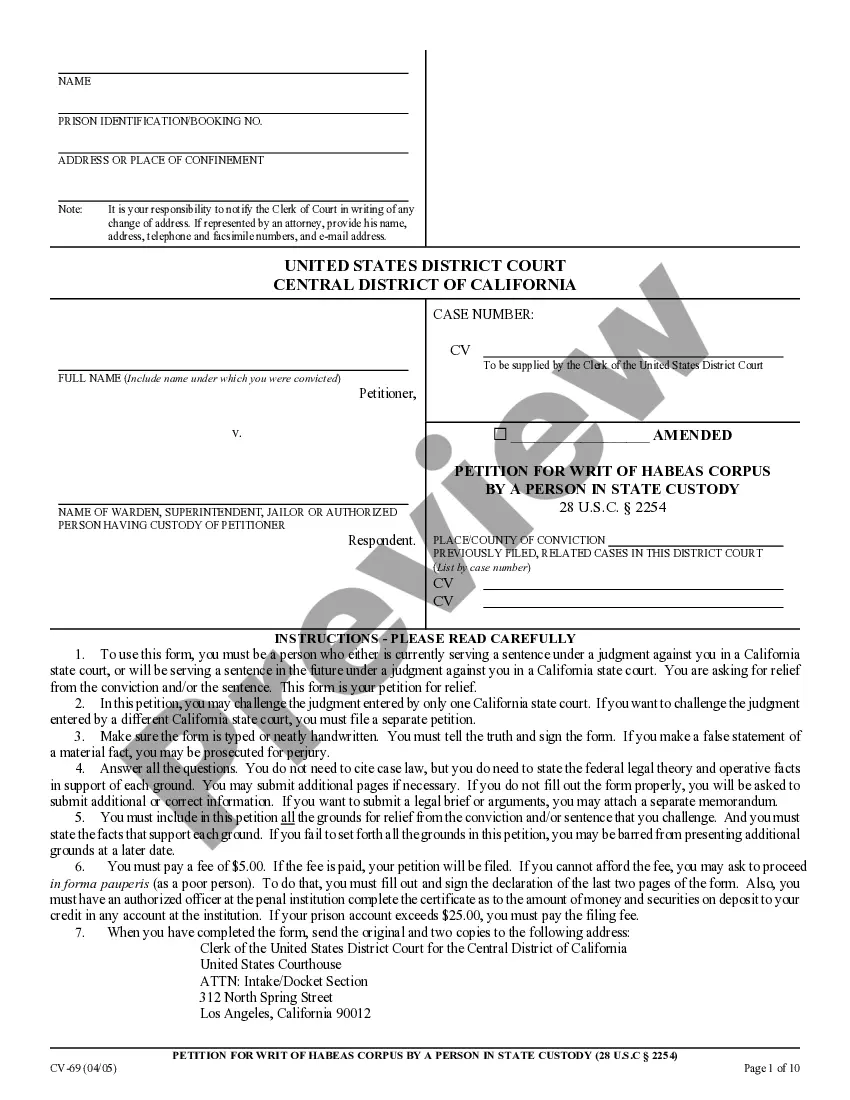

- Step 2. Utilize the Review option to verify the form’s details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have located the form you want, click the Buy now option. Choose your preferred payment plan and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Iowa Non-Disclosure Agreement for Potential Investors.

Form popularity

FAQ

In practice, when somebody breaks a non-disclosure agreement, they face the threat of being sued and could be required to pay financial damages and related costs. But legal experts say there's limited case law on whether contracts like NDAs to settle sexual harassment claims can be enforced.

Violating an NDA leaves you open to lawsuits from your employer, and you could be required to pay financial damages and possibly associated legal costs. It's illegal to reveal trade secrets or sensitive company information to a competitor.

An NDA is a contract specifically dealing with how parties will handle the others' confidential information. A confidentiality clause is a section in a larger agreement essentially covering the same things as an NDA, only usually with less detail than in an NDA.

Having a signed NDA helps deter such idea theft. Without one, it can be difficult to prove that an idea has been stolen. A company hiring outside consultants may also require those individuals, who will be handling sensitive data, to sign an NDA so that they do not disclose those details at any point.

The Key Elements of Non-Disclosure AgreementsIdentification of the parties.Definition of what is deemed to be confidential.The scope of the confidentiality obligation by the receiving party.The exclusions from confidential treatment.The term of the agreement.

A confidentiality agreement is a legal document that binds one or more parties to keep secret or proprietary information confidential or proprietary. An NDA is a kind of a contract that upholds secrecy; it does so by defining a confidential partnership and legally binding any parties who sign the NDA to that

To avoid confusion, I've drafted a short standard reply on why I don't sign NDAs and what I'm willing to do instead: the Professional Academic Alternative to Non-Disclosure Agreements (PAANDA). If you're offered an NDA, you're welcome to offer the PAANDA.

Pursuing a Lawsuit After Filing an NDA If an employee has been the victim of discrimination or harrassment, they should be able to file a lawsuit to seek financial compensation for resulting damages, even if they previously signed an NDA.

An NDA should be reasonable and specific about what's considered confidential and non-confidential. Language that is too broad, unreasonable or onerous can void an agreement. Courts will also challenge or invalidate agreements that are overly expansive, oppressive or try to cover non-confidential information.

Violating an NDA can have serious consequences NDAs are legally binding contracts. If an employee has violated an NDA, then the company may take legal action. The most common claims in NDA lawsuits include: Breach of the contract (such as the breach of NDA)

Interesting Questions

More info

The Privacy Center has offices in Washington, D. C. and New York, New York.