Iowa Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Non-Disclosure Agreement For Merger Or Acquisition?

Are you currently in the situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document formats available online, but finding reliable templates isn’t simple.

US Legal Forms offers a wide array of form templates, such as the Iowa Non-Disclosure Agreement for Merger or Acquisition, designed to comply with state and federal regulations.

Once you find the appropriate form, simply click Purchase now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Iowa Non-Disclosure Agreement for Merger or Acquisition template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you require and ensure it is for your correct city/state.

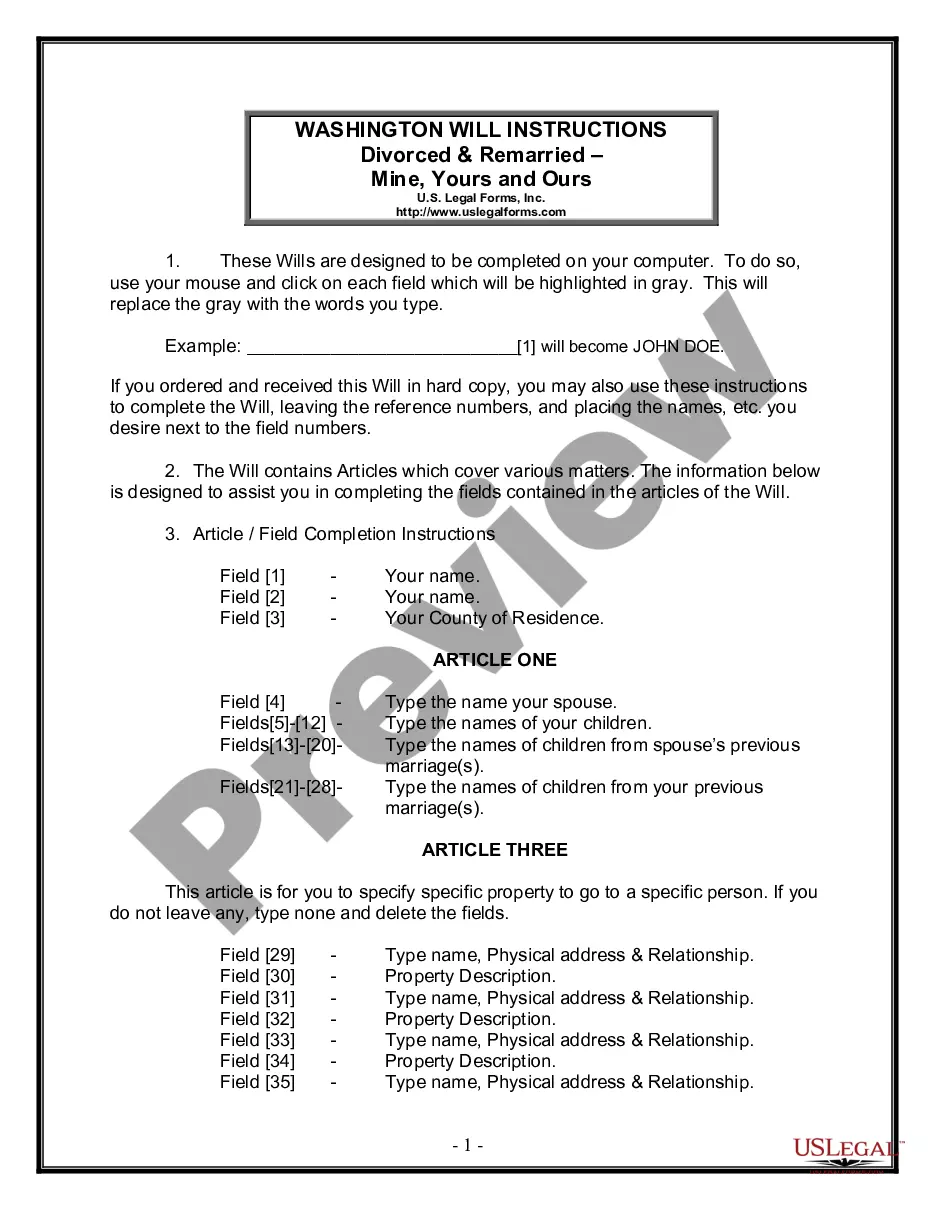

- Utilize the Review button to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you need, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Filling out an Iowa Non-Disclosure Agreement for Merger or Acquisition involves a few straightforward steps. First, identify the parties involved and clearly define the confidential information that needs protection. Next, specify the obligations each party has in maintaining confidentiality, along with the agreement's duration. Finally, review the document for accuracy, and consider using the US Legal Forms platform for templates and guidance to make the process easier.

When creating an Iowa Non-Disclosure Agreement for Merger or Acquisition, ensure it includes clear definitions of confidential information, obligations of both parties, a duration for the confidentiality obligations, exclusions from confidentiality, and remedies for breaches. Each element plays a crucial role in protecting sensitive information during the merger or acquisition process. By understanding these components, you can better safeguard your business interests. Consider using the US Legal Forms platform to streamline the creation of your agreement.

The confidentiality clause in mergers and acquisitions explicitly details the obligations of the parties regarding the handling of sensitive information. This clause specifies what information must be kept secret and outlines the consequences for breach of confidentiality. When establishing an Iowa Non-Disclosure Agreement for Merger or Acquisition, a well-defined confidentiality clause helps both parties feel secure and promotes a successful negotiation process.

The NDA process in mergers and acquisitions generally begins with drafting the agreement to cover all necessary terms. Once both parties review and agree upon the terms, they sign the document, thus making it legally binding. This step is crucial in the context of an Iowa Non-Disclosure Agreement for Merger or Acquisition, as it marks the transition into deeper discussions about the potential deal, allowing for a trust-based relationship to develop.

To create a legal non-disclosure agreement, you should clearly define the parties involved, specify the information to be kept confidential, and outline the obligations of both parties. It's essential to state the duration of confidentiality and any exclusions, such as information already in the public domain. You can simplify this process by using tools available on the UsLegalForms platform, where you can find templates tailored for an Iowa Non-Disclosure Agreement for Merger or Acquisition.

The main difference between an NDA and an MNDA, or Mutual Non-Disclosure Agreement, lies in the nature of confidentiality. An NDA typically protects the information of one party, while an MNDA binds both parties to maintain secrecy about shared information. In the context of an Iowa Non-Disclosure Agreement for Merger or Acquisition, choosing between the two depends on whether both parties are exchanging sensitive data that they want to protect.

The primary purpose of an NDA in an acquisition is to safeguard confidential information that may be exchanged during the negotiation process. By establishing clear boundaries around what information can be shared, the NDA helps to prevent leaks that could harm either party's competitive advantage. Utilizing an Iowa Non-Disclosure Agreement for Merger or Acquisition generates a secure environment where discussions can occur freely without the fear of information misuse.

An NDA, or Non-Disclosure Agreement, in mergers and acquisitions (M&A) is a legal contract that ensures confidentiality between parties involved in a transaction. This agreement protects sensitive information from being disclosed to third parties. When entering into an Iowa Non-Disclosure Agreement for Merger or Acquisition, parties agree to keep each other's proprietary information private, fostering trust and open communication during negotiations.

The main distinction between an NDA and an MNDA lies in the nature of the information exchange. An NDA typically involves one party protecting its sensitive information from another party, whereas an MNDA entails both parties sharing confidential information. Using an Iowa Non-Disclosure Agreement for Merger or Acquisition can effectively outline the expectations and responsibilities in either case, promoting a secure environment for discussions.

The three primary types of Non-Disclosure Agreements include unilateral, mutual, and multilateral NDAs. A unilateral NDA involves one party disclosing information, while a mutual NDA involves both parties sharing information under obligations of confidentiality. Businesses engaging in mergers or acquisitions often benefit from the Iowa Non-Disclosure Agreement for Merger or Acquisition, tailoring the agreement to meet their specific needs.