This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

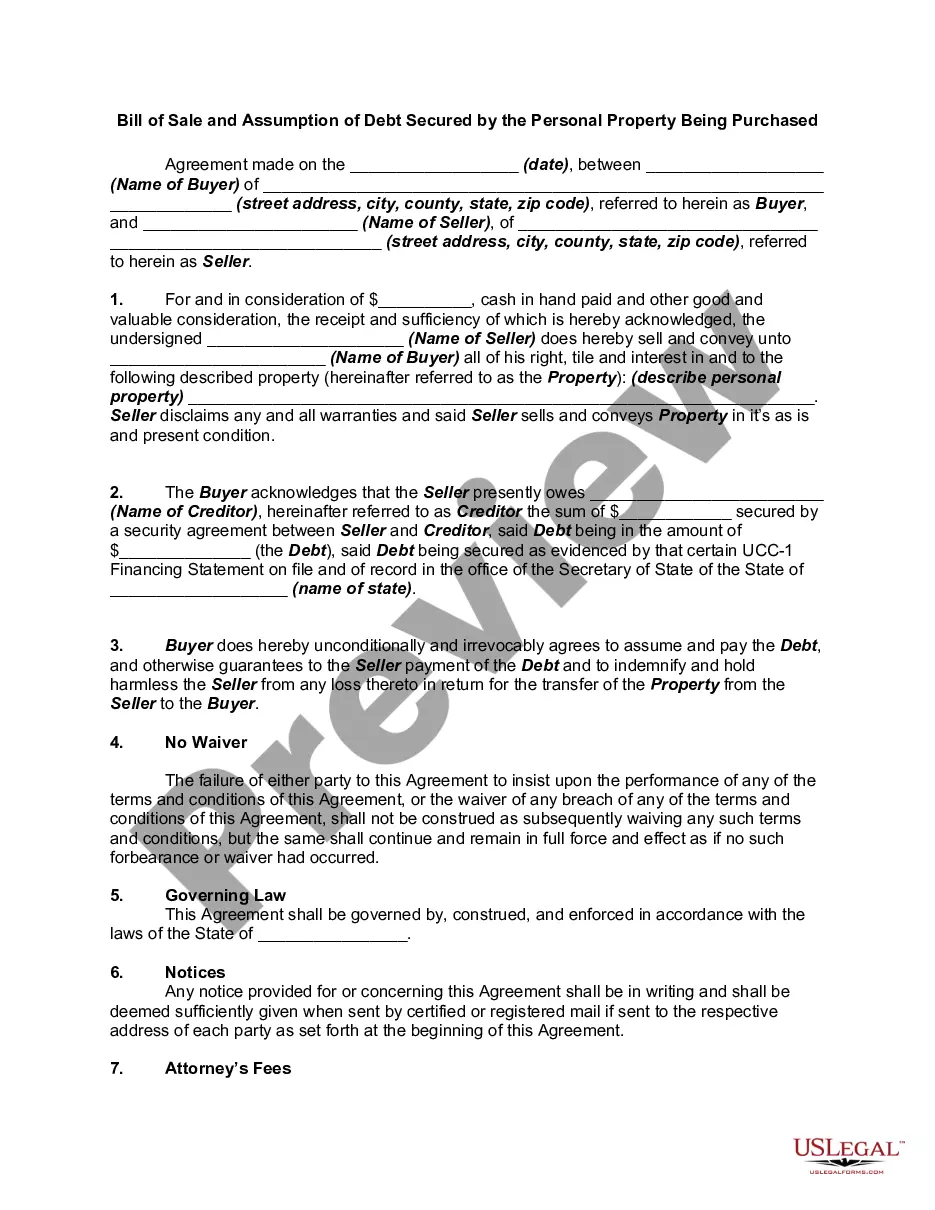

Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased

Description

How to fill out Bill Of Sale And Assumption Of Debt Secured By The Personal Property Being Purchased?

If you wish to be thorough, download, or print sanctioned document templates, use US Legal Forms, the largest selection of legal forms, that can be accessed online.

Utilize the site's straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are categorized by groups and titles, or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Acquired in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Acquired.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review function to examine the form’s contents. Do not forget to read the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Writing a bill of sale for a vehicle without a title requires careful documentation. Clearly state the make, model, year, and VIN of the vehicle, along with the buyer's and seller's details. Additionally, note the reasons for the lack of a title, and include any agreements regarding the assumption of debt. Using uslegalforms can help you craft an effective document to comply with Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased guidelines.

Yes, a handwritten bill of sale can be notarized in Iowa. However, it must still meet all legal requirements and include all pertinent information related to the transaction. Make sure that it clearly states the essence of the deal, reflecting the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

Yes, including the seller's address in a bill of sale is important. This information helps establish identity and provides a point of contact should any questions arise after the transaction. When preparing an Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, make sure to document the seller's complete address.

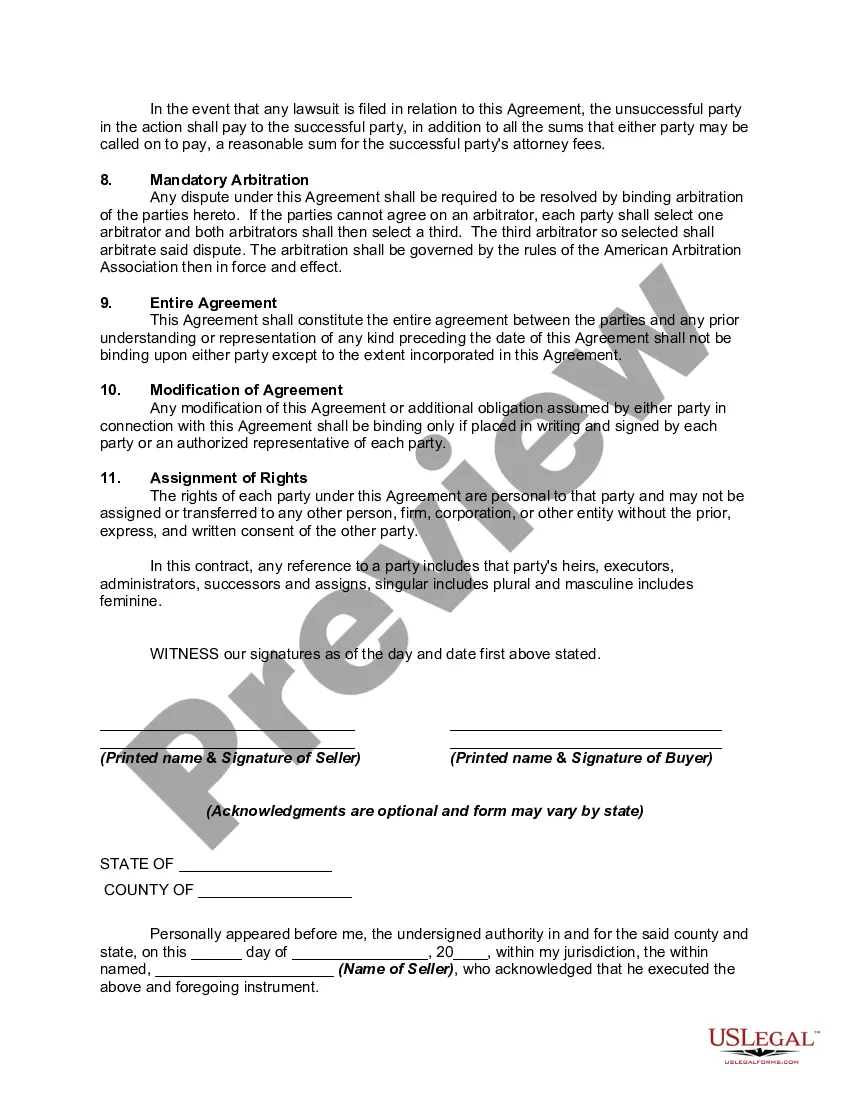

Filling out a notarized bill of sale involves providing essential information such as the buyer's and seller's full names, addresses, a detailed description of the property, and the sale amount. Include any conditions or agreements related to the assumption of debt. Utilize templates available through uslegalforms to ensure that you cover all required elements for the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

Yes, both parties generally need to be present when notarizing a bill of sale. This ensures that the notary can confirm each individual's identity and that both agree to the terms of the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. If one party cannot be present, they may need to sign the document in the presence of a separate notary.

While a notarized bill of sale serves as an official record of the transaction, it does not replace a title. In Iowa, the title is the legal document that proves ownership of personal property. However, a notarized bill of sale can support your claim of ownership, particularly when considering the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

Code 321.277 concerns the regulations for vehicle registration and ownership confirmation in Iowa. This code sets forth the specifics of how ownership must be established, and a bill of sale plays a vital role in this context. Utilizing an Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased will streamline the registration process and ensure compliance with Iowa law.

Iowa Code 321.18 pertains to the transfer of ownership for vehicles and the recording requirements associated with it. To ensure a smooth transfer, a bill of sale is typically required. This code emphasizes the importance of the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased for lawful ownership transition.

In Iowa, a bill of sale does not necessarily need to be notarized to be valid. However, having it notarized can add an extra layer of security and authenticity to the transaction. It is advisable to consider notarization when using an Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, particularly for high-value items.

Code 321.97 in Iowa states that the state has the authority to suspend vehicle registrations under certain conditions. If ownership is not properly documented, including through an Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, it can lead to complications. Understanding this code can help vehicle owners take necessary actions to maintain their registration status.