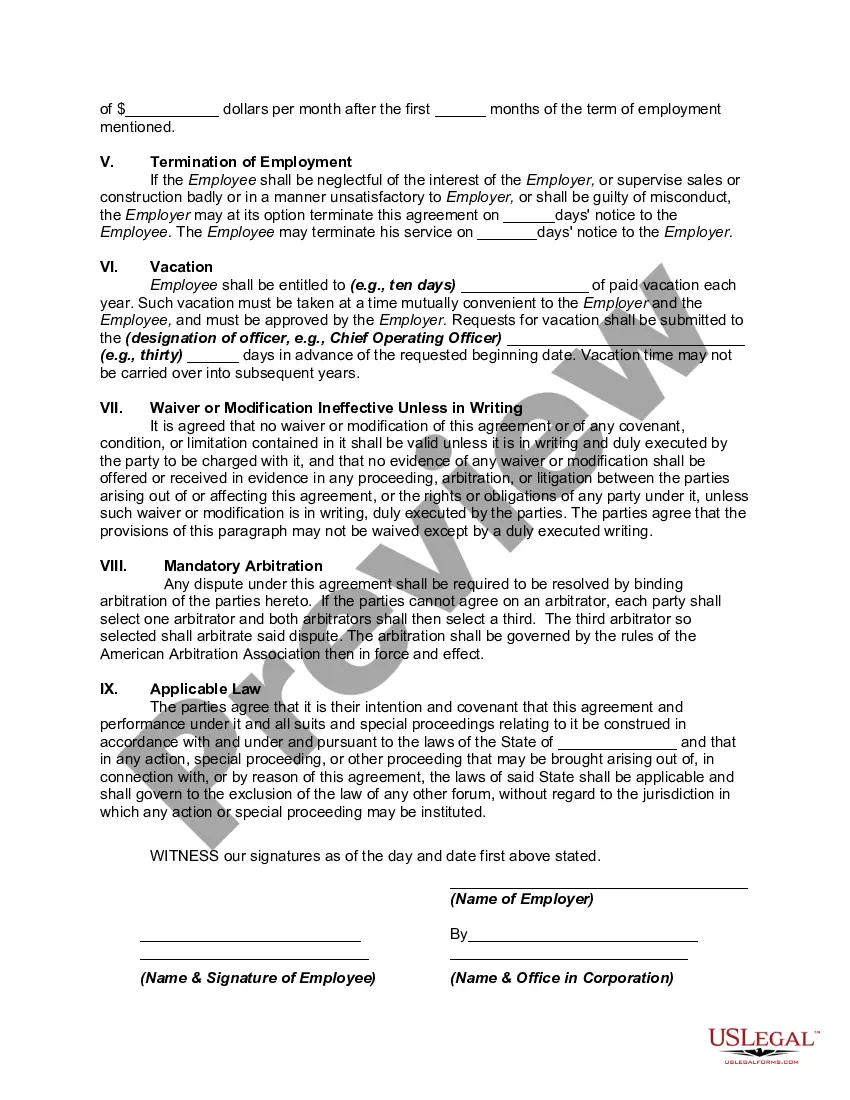

This agreement is an example of an employment agreement with a Sales and Construction Manager of a Land Development and Residential Home Construction Company. The employee is a regular employee and is not an independent contractor.

Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company

Description

How to fill out Employment Agreement With A Sales And Construction Manager Of Land Development And Residential Home Construction Company?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company in just seconds.

If you already have an account, Log In and retrieve the Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company from your US Legal Forms repository. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your system. Edit. Fill in, modify, and print your downloaded Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company. Each template you add to your account has no expiration date, making it yours indefinitely. So, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you need. Access the Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company through US Legal Forms, one of the largest repositories of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some easy steps to help you get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the contents of the form.

- Check the form summary to confirm you have chosen the right template.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Get Now button.

- Next, select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

Yes, construction labor is generally considered taxable in Iowa. However, certain exemptions may apply based on the nature of the work performed. When entering into an Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company, it's wise to consult tax guidelines to ensure compliance with state regulations and avoid unexpected liabilities.

To protect yourself in a construction contract, ensure all terms are explicitly stated and understood by both parties. Utilize written agreements that outline deliverables and timelines to avoid ambiguity. By establishing an effective Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company, you can create a solid foundation for a successful partnership.

To create a contract agreement for construction, first identify the key terms such as scope, timeline, and payment. Then, draft the agreement with clear, concise language to prevent misunderstandings. Tools like uslegalforms can simplify the process, helping you produce an Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company that meets legal standards.

A construction management agreement outlines the relationship between the client and the construction manager. This agreement typically includes scope, responsibilities, and payment methods. When creating an Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company, it's important to ensure that the management agreement complements the overall contract to avoid conflicts later on.

The five essential elements of a construction contract include offer, acceptance, consideration, capacity, and legality. Each element plays a vital role in ensuring the contract is enforceable in Iowa. A well-crafted Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company will incorporate these elements to protect both parties involved.

A construction contract may be invalid if it lacks essential elements such as offer, acceptance, consideration, and lawful purpose. Additionally, if one party is found to be mentally incapable or under duress at the time of signing, the contract can be deemed void. Be cautious when drafting an Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company to ensure all these factors are properly addressed.

The rules of contract construction guide how to interpret the terms of a contract. These rules emphasize the intent of the parties and the must-have elements such as mutual assent, consideration, and legality. In relation to an Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company, understanding these rules helps avoid misunderstandings during project execution.

When drafting construction contracts, avoid vague language and unclear terms. It's crucial to remain precise in defining responsibilities and timelines. Ambiguity can lead to disputes, making it difficult to uphold the Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company. Always ensure both parties understand the commitments outlined in the contract.

An employment agreement for an independent contractor outlines the conditions under which the contractor will provide services. It typically covers work expectations, payment details, and other important legal stipulations. Implementing an Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company ensures clarity and protects both parties in this contractual relationship.

An independent contractor agreement establishes a working relationship in which the contractor operates independently, while an employment agreement creates an employer-employee relationship with specific rights and obligations. The independent contractor is responsible for their own taxes and benefits, whereas the employee typically receives such benefits from the employer. Understanding this distinction is crucial when drafting an Iowa Employment Agreement with a Sales and Construction Manager of Land Development and Residential Home Construction Company.