Iowa Sample Letter for Expense Account Statement

Description

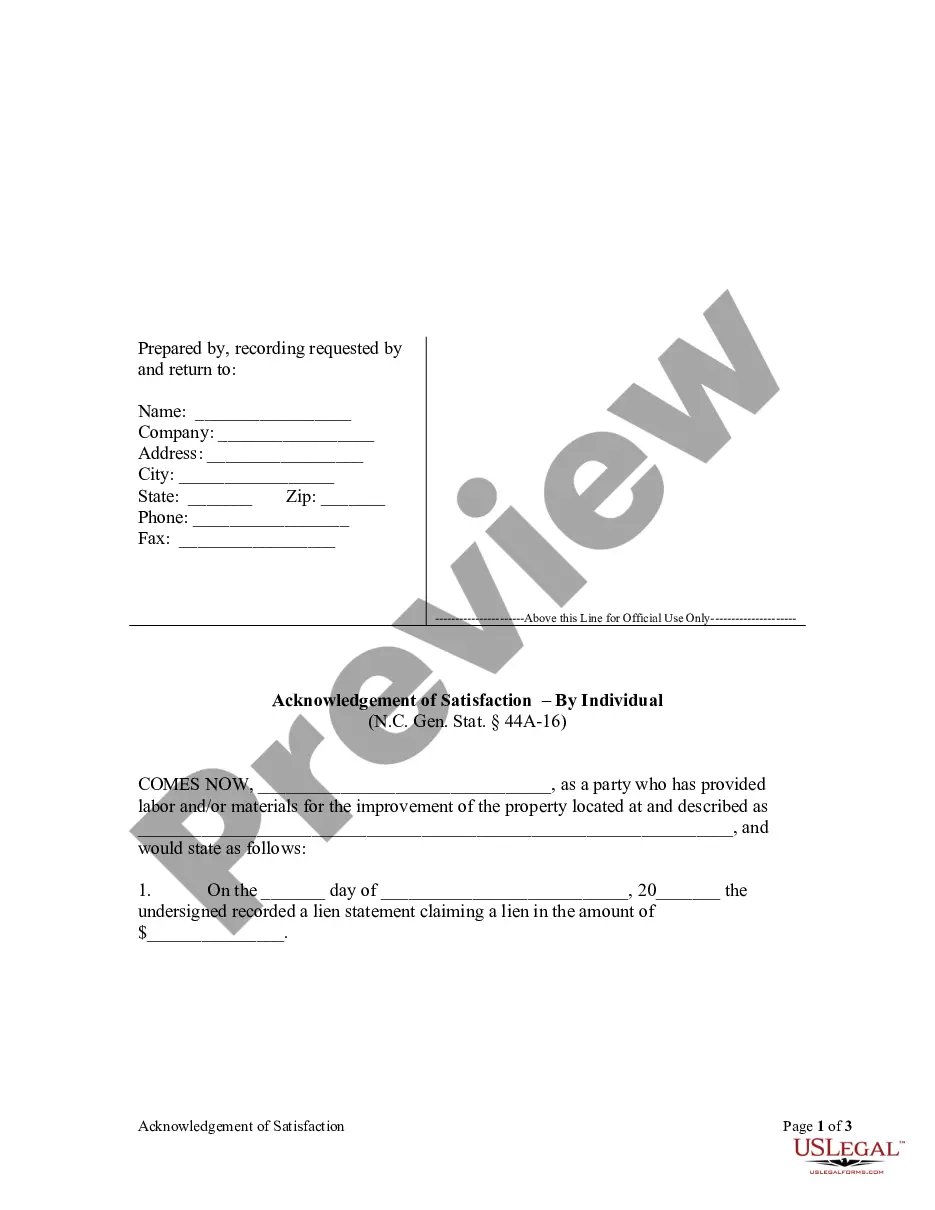

How to fill out Sample Letter For Expense Account Statement?

Selecting the appropriate valid document format can present a challenge. It goes without saying that there are numerous templates available online, but how do you find the correct type you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Iowa Sample Letter for Expense Account Statement, which can be utilized for business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Iowa Sample Letter for Expense Account Statement. Use your account to browse through the legal forms you have previously obtained. Go to the My documents section of your account and download another copy of the document you need.

Complete, edit, print, and sign the acquired Iowa Sample Letter for Expense Account Statement. US Legal Forms is the largest repository of legal documents where you can find various file formats. Take advantage of the service to obtain professionally crafted paperwork that meets state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct form for your specific city/state. You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- When you are confident that the form is right, click the Buy now button to purchase the form.

- Choose the payment plan you wish to follow and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Select the file format and download the legal document for your use.

Form popularity

FAQ

The formula for preparing the income statement is straightforward: Total Revenues minus Total Expenses equals Net Income. Utilize this formula to analyze financial performance over a specific timeframe. By determining revenues and deducting expenses, you can arrive at the net income. For clear examples, refer to the Iowa Sample Letter for Expense Account Statement to help solidify your understanding.

To write a letter requesting financial statements, clearly state your request in a polite manner and provide necessary details. Include your name, contact information, and a brief explanation of why you need these statements. Emphasizing the reason for your request can enhance its effectiveness, and leveraging formats like the Iowa Sample Letter for Expense Account Statement can guide you in crafting a clear and concise letter.

Preparing an income statement account involves organizing financial data in a structured manner. Collect all income and expense data for the period you’re analyzing, then categorize these figures appropriately. Present this information clearly in a formal format, and always double-check your calculations. By using templates like the Iowa Sample Letter for Expense Account Statement, you can ensure your presentation meets professional standards.

Creating an income statement requires understanding revenues, categorizing expenses, calculating totals, drafting the statement, and reviewing the document for accuracy. Begin with identifying total revenue figures from sales or services. Then, itemize your expenses to get a clear view of costs. Next, sum these figures and draft your statement while referring to examples, such as the Iowa Sample Letter for Expense Account Statement, for structured guidance.

Preparing an income statement involves gathering data, organizing revenues and expenses, calculating net income, and reviewing the overall statement. First, collect all relevant financial information, including sales and operating costs. Next, categorize your revenues and expenses neatly. Finally, compute the net income and ensure that the document reflects accurate financial health, considering tools like the Iowa Sample Letter for Expense Account Statement for clear communication.

Tax filing forms can generally be picked up at the local office of the Iowa Department of Revenue or downloaded from their website. For convenience, you can also explore online platforms such as uslegalforms, which offer easy access to all forms you might need, including essential documents like the Iowa Sample Letter for Expense Account Statement.

You can access Iowa state tax forms on the Iowa Department of Revenue's official website, which provides a comprehensive list of all necessary tax documents. Alternatively, you might consider using uslegalforms, where you can obtain customized forms, including the Iowa Sample Letter for Expense Account Statement, to fit your specific needs.

A Notice of Assessment from the Iowa Department of Revenue informs you of adjustments to your tax return or any discrepancies they have identified. This notice provides details on how the assessment affects your tax liability and informs you if there are additional steps you need to take. Understanding this notice is crucial, especially if it references any prior statements, like the Iowa Sample Letter for Expense Account Statement.

A letter from the Iowa Department of Revenue Compliance Services usually indicates that they need clarification regarding your tax filings or accounts. This may stem from unresolved issues, missing information, or concerns with your previous submissions. If the letter includes an Iowa Sample Letter for Expense Account Statement, it may relate to your business expenses and their official review process.

The post office generally does not carry state tax forms, including those for Iowa. Most state forms, including the Iowa Sample Letter for Expense Account Statement, are primarily distributed through the respective state revenue department or online platforms like uslegalforms. It's best to use these reliable sources for the most current forms.