Ordinarily, the declaration must show that the claimant is the head of a family. In general, the claimant's right to select a homestead and to exempt it from forced sale must appear on the face of the declaration, and its omission cannot be supplied by extraneous evidence. Under some statutes, a declaration of homestead may be made by the owner or by his or her spouse.

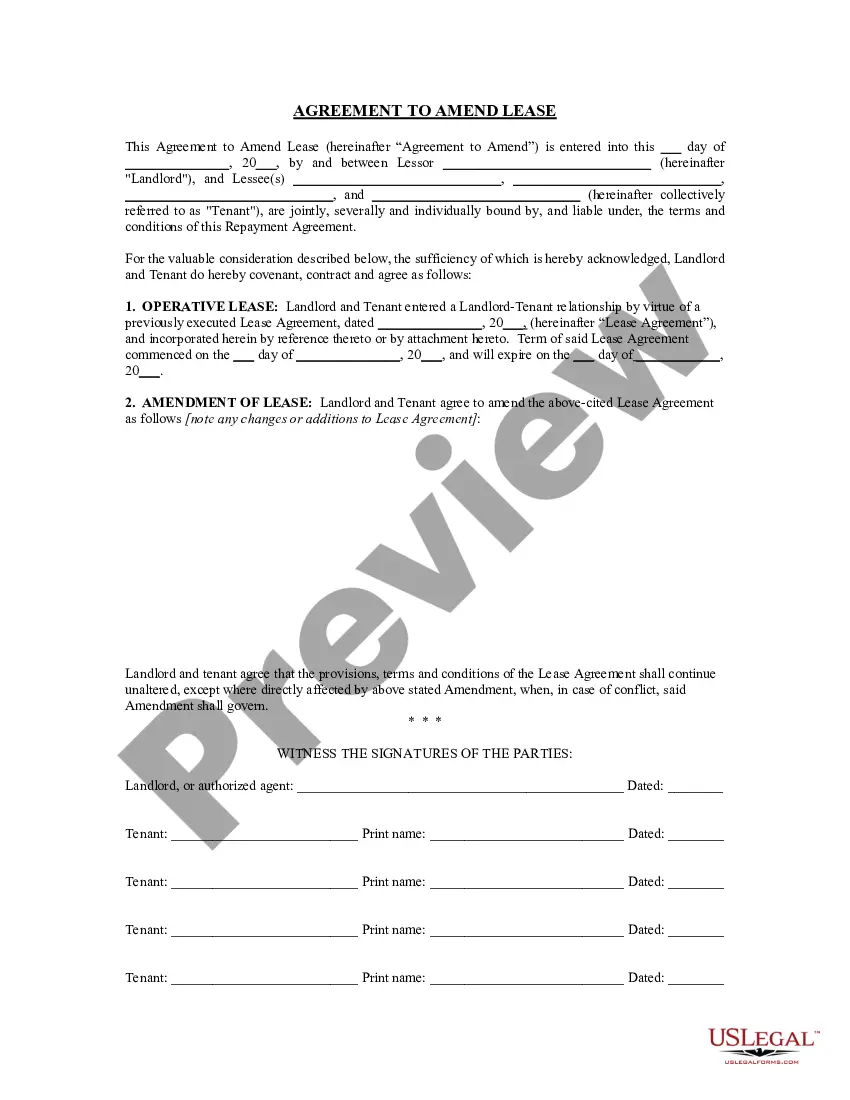

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Homestead Declaration following Decree of Legal Separation or Divorce: A Comprehensive Guide In Iowa, a Homestead Declaration is an important legal document that protects a divorced individual or those going through a legal separation from losing their primary residence. By filing a Homestead Declaration following a Decree of Legal Separation or Divorce, individuals can safeguard their home from creditors and ensure their right to reside in the property. This detailed description will delve into the complexities of Iowa's Homestead Declaration, shedding light on its significance, requirements, and potential variations. What is the Iowa Homestead Declaration? The Iowa Homestead Declaration is a statutory right that provides protection to homeowners during financial hardships, legal separations, or divorce. It allows individuals to retain their primary residence by designating it as their homestead, making it exempt from certain creditors seeking collection against personal debts. Importance of Homestead Declaration Following Decree of Legal Separation or Divorce: After going through a divorce or obtaining a legal separation, individuals often face various financial challenges and uncertainties. By filing a Homestead Declaration, one can secure their right to continue living in the marital home while ensuring it remains shielded from creditors involved in the divorce proceedings. This protection also extends to situations where one ex-spouse may attempt to mortgage or sell the property without the consent of the other party. Requirements for Iowa Homestead Declaration: To file a Homestead Declaration following a Decree of Legal Separation or Divorce in Iowa, several requirements must be met: 1. Ownership: The person filing the Homestead Declaration must be the legal owner of the property (titleholder or joint titleholder). 2. Principal Residence: The property must be the individual's primary residence, meaning it is where they reside most of the time. 3. Filing Period: The declaration must be filed within 90 days of the entry of the Decree of Legal Separation or Divorce. 4. Value Limit: The equity interest in the property should not exceed a specific value defined by Iowa law. Types of Iowa Homestead Declarations: While there are no different types of Homestead Declarations specifically following a Decree of Legal Separation or Divorce, it is essential to understand how the Homestead Declaration operates in Iowa overall. Iowa allows each individual to declare one homestead, whether they are married or divorced. However, if both spouses individually own separate residences, they can each declare their respective homesteads. Overall, the Homestead Declaration following a Decree of Legal Separation or Divorce in Iowa serves as a powerful tool to protect an individual's primary residence, regardless of whether they are the titled owner or their ex-spouse has been awarded the property. It ensures that one can have a secure place to call home despite the challenging financial circumstances that often accompany divorce or legal separation. By complying with the necessary requirements and filing the Homestead Declaration within the designated timeframe, individuals can gain peace of mind, knowing that their primary residence remains safeguarded against potential claims by creditors. Seeking legal advice from an experienced attorney specializing in divorce and property matters is highly recommended to fully understand the implications, process, and obligations associated with filing a Homestead Declaration in such situations.Iowa Homestead Declaration following Decree of Legal Separation or Divorce: A Comprehensive Guide In Iowa, a Homestead Declaration is an important legal document that protects a divorced individual or those going through a legal separation from losing their primary residence. By filing a Homestead Declaration following a Decree of Legal Separation or Divorce, individuals can safeguard their home from creditors and ensure their right to reside in the property. This detailed description will delve into the complexities of Iowa's Homestead Declaration, shedding light on its significance, requirements, and potential variations. What is the Iowa Homestead Declaration? The Iowa Homestead Declaration is a statutory right that provides protection to homeowners during financial hardships, legal separations, or divorce. It allows individuals to retain their primary residence by designating it as their homestead, making it exempt from certain creditors seeking collection against personal debts. Importance of Homestead Declaration Following Decree of Legal Separation or Divorce: After going through a divorce or obtaining a legal separation, individuals often face various financial challenges and uncertainties. By filing a Homestead Declaration, one can secure their right to continue living in the marital home while ensuring it remains shielded from creditors involved in the divorce proceedings. This protection also extends to situations where one ex-spouse may attempt to mortgage or sell the property without the consent of the other party. Requirements for Iowa Homestead Declaration: To file a Homestead Declaration following a Decree of Legal Separation or Divorce in Iowa, several requirements must be met: 1. Ownership: The person filing the Homestead Declaration must be the legal owner of the property (titleholder or joint titleholder). 2. Principal Residence: The property must be the individual's primary residence, meaning it is where they reside most of the time. 3. Filing Period: The declaration must be filed within 90 days of the entry of the Decree of Legal Separation or Divorce. 4. Value Limit: The equity interest in the property should not exceed a specific value defined by Iowa law. Types of Iowa Homestead Declarations: While there are no different types of Homestead Declarations specifically following a Decree of Legal Separation or Divorce, it is essential to understand how the Homestead Declaration operates in Iowa overall. Iowa allows each individual to declare one homestead, whether they are married or divorced. However, if both spouses individually own separate residences, they can each declare their respective homesteads. Overall, the Homestead Declaration following a Decree of Legal Separation or Divorce in Iowa serves as a powerful tool to protect an individual's primary residence, regardless of whether they are the titled owner or their ex-spouse has been awarded the property. It ensures that one can have a secure place to call home despite the challenging financial circumstances that often accompany divorce or legal separation. By complying with the necessary requirements and filing the Homestead Declaration within the designated timeframe, individuals can gain peace of mind, knowing that their primary residence remains safeguarded against potential claims by creditors. Seeking legal advice from an experienced attorney specializing in divorce and property matters is highly recommended to fully understand the implications, process, and obligations associated with filing a Homestead Declaration in such situations.