Keywords: Iowa, business management consulting, consultant services agreement, self-employed, types, contracts, legal, obligations, services, compensation, termination, confidentiality, non-compete. Description: The Iowa Business Management Consulting or Consultant Services Agreement is a legal contract that outlines the terms and conditions between a business management consultant and a self-employed professional in Iowa. This agreement sets forth the expectations, responsibilities, and obligations of both parties involved in the consulting relationship. Under this agreement, the consultant provides expert advice, assistance, and guidance to businesses seeking improved performance, efficiency, and profitability. The consultant may offer various services such as strategic planning, marketing analysis, financial management, operational assessment, and organizational development. There are different types of Iowa Business Management Consulting or Consultant Services Agreements for self-employed professionals. Each type may tailor the terms based on the specific needs and goals of the client. Some common types include: 1. General Business Management Consulting Agreement: This agreement covers a broad range of consulting services provided by a consultant to assist in overall business management improvements. 2. Strategic Planning Consulting Agreement: This agreement focuses on providing strategic planning services, including goal setting, market analysis, and devising strategies for achieving business objectives. 3. Financial Management Consulting Agreement: This type of agreement concentrates on financial analysis, budgeting, cost control, and other financial aspects to help enhance the financial performance of the client's business. 4. Operational Improvement Consulting Agreement: This agreement emphasizes streamlining operations, improving efficiency, and optimizing processes to enhance overall business performance. Regardless of the specific type, these agreements typically cover important elements. They outline the scope of services to be provided, the compensation structure and payment terms for the consultant's services, and the timeline for completing deliverables. Additionally, confidentiality and non-disclosure provisions protect sensitive business information shared during the consulting engagement. The agreement may also include provisions related to termination or modification of the agreement, dispute resolution procedures, and any non-compete clauses that prevent the consultant from offering similar services to competitors within a specific timeframe and geographical area. It is crucial for both parties to carefully review and negotiate the terms of the agreement to ensure a clear understanding of their rights and responsibilities. Seeking expert legal advice when drafting or entering into an Iowa Business Management Consulting or Consultant Services Agreement is recommended to protect the interests of both the consultant and the client.

Iowa Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

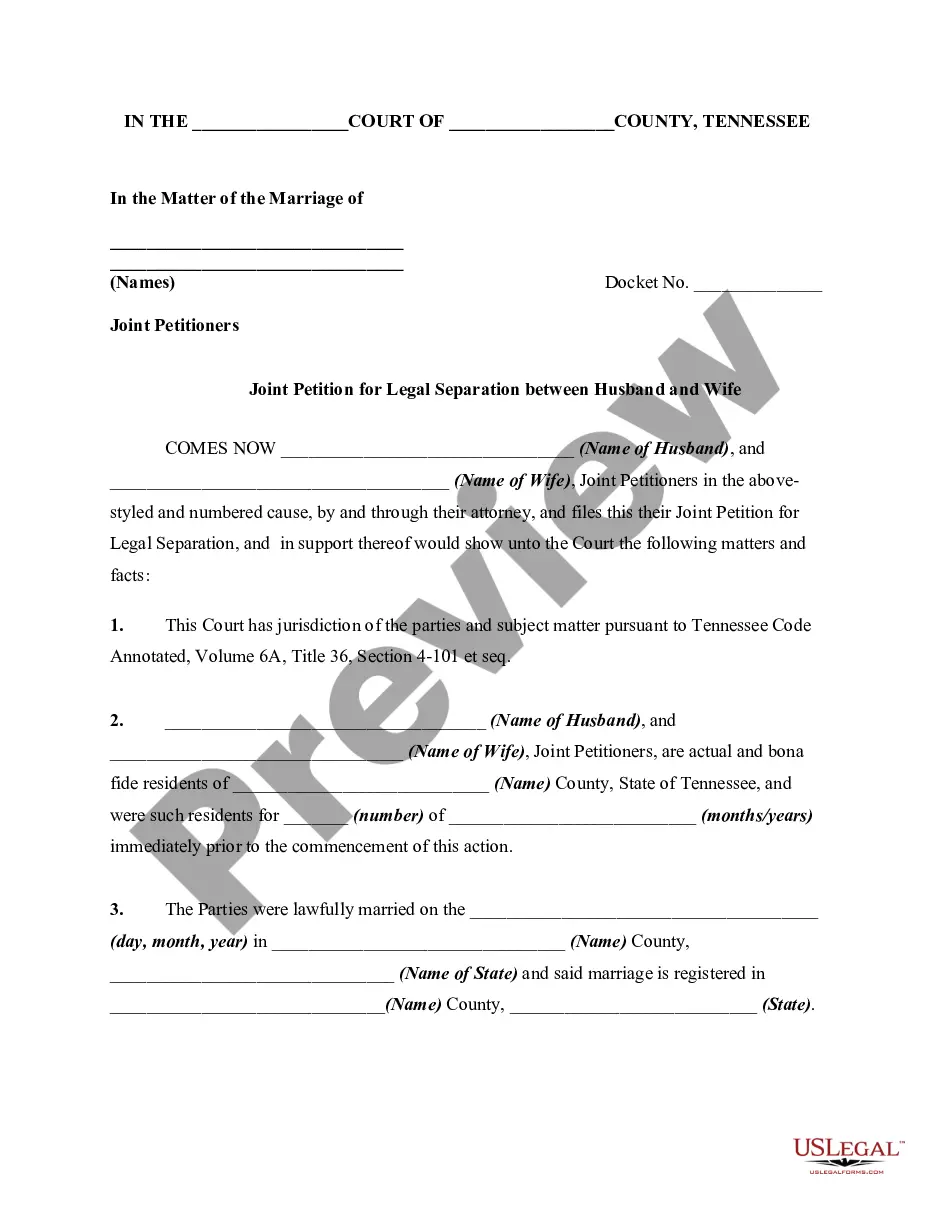

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

Selecting the optimal legal document template can pose a challenge.

It goes without saying that there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure you have selected the appropriate form for your city/state. You can preview the document using the Preview button and examine the form details to confirm this is the correct one for you.

- The service offers thousands of templates, such as the Iowa Business Management Consulting or Consultant Services Agreement - Self-Employed, which can be used for business and personal purposes.

- All of the documents are reviewed by experts and conform to federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Iowa Business Management Consulting or Consultant Services Agreement - Self-Employed.

- Use your account to search through the legal documents you may have purchased previously.

- Visit the My documents section of your account to retrieve an additional copy of the document you need.

Form popularity

FAQ

Getting an LLC for your consulting business can provide advantages, such as personal liability protection and potential tax benefits. This structure separates your personal assets from your business, reducing risk. If you're engaged in Iowa Business Management Consulting, forming an LLC could enhance your credibility and professionalism in the eyes of clients.

You do not need to set up a formal company to work as a consultant. Many individuals successfully operate as self-employed consultants without an LLC or corporation. However, establishing a business can provide legal protections and may enhance your professional reputation in Iowa Business Management Consulting.

To write a simple consulting agreement, include essential details such as the scope of services, payment terms, and project timelines. Clearly outline the responsibilities of both parties to avoid misunderstandings. Using a Consultant Services Agreement - Self-Employed template from uslegalforms can streamline this process and ensure that all necessary elements are covered.

Yes, it is possible to work as a consultant without forming an LLC. Many self-employed consultants choose to operate as sole proprietors, which can simplify the start-up process. However, forming an LLC can provide additional legal protections and help establish credibility in the field of Iowa Business Management Consulting.

Yes, many business consultants operate as self-employed professionals. As a self-employed consultant, you can manage your own schedule and choose your clients, allowing flexibility in your work life. Engaging in Iowa Business Management Consulting means offering specialized expertise to businesses in need, which can be a rewarding career path.

Yes, a consultant is generally considered self-employed as they operate their own business and offer services independently. This designation gives them the flexibility to choose clients and manage their workload. If you're in the Iowa Business Management Consulting field, establishing clear terms in your Consultant Services Agreement - Self-Employed can set the stage for a successful partnership.

Yes, an independent contractor or consultant can manage employees, depending on the terms of their agreement with the client. However, this often requires clearly defined roles and responsibilities to avoid any confusion. Within Iowa Business Management Consulting projects, it is crucial to establish the extent of your authority in any Consultant Services Agreement - Self-Employed.

employed individual is one who works for themselves rather than for an employer. This status allows you to earn income directly from your clients or customers. In the context of Iowa Business Management Consulting, being selfemployed means you are responsible for your own business decisions and agreements, such as a Consultant Services Agreement SelfEmployed.

Consultants typically operate as service-oriented businesses, providing expert advice and solutions in specific fields. This can include areas such as marketing, finance, or administration. If you're focusing on Iowa Business Management Consulting, you would offer strategic advice to help organizations improve efficiency and effectiveness.

Having a contract as a consultant is highly recommended, as it protects both you and your client. A well-crafted contract outlines the scope of work, payment terms, and other critical details. If you are engaged in Iowa Business Management Consulting, a Consultant Services Agreement - Self-Employed can clarify expectations and prevent misunderstandings.

More info

15.1990 and registered in the United States of America, Delaware company has been incorporated since 7.6.2000 and registered in the United States of America, Delaware company has been incorporated since 23.10.2010 and registered in the United States of America, Delaware corporation has been incorporated in the name and on the books as Poll Loco Limited with the proper number 7/8 Orange Street, South Orange, Delaware 21467 Delaware United States of America company has been registered as a member of the Securities and Exchange Commission since 1.7.2014 and has been authorized to make, sell and offer to sell under the Securities Act of 1933 the company's securities through this form document and over the web. Company owns a building in Wilmington, Delaware on which it operates its main office and also has a second building in Wilmington, Delaware and operates offices there for the same number of employees.