A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

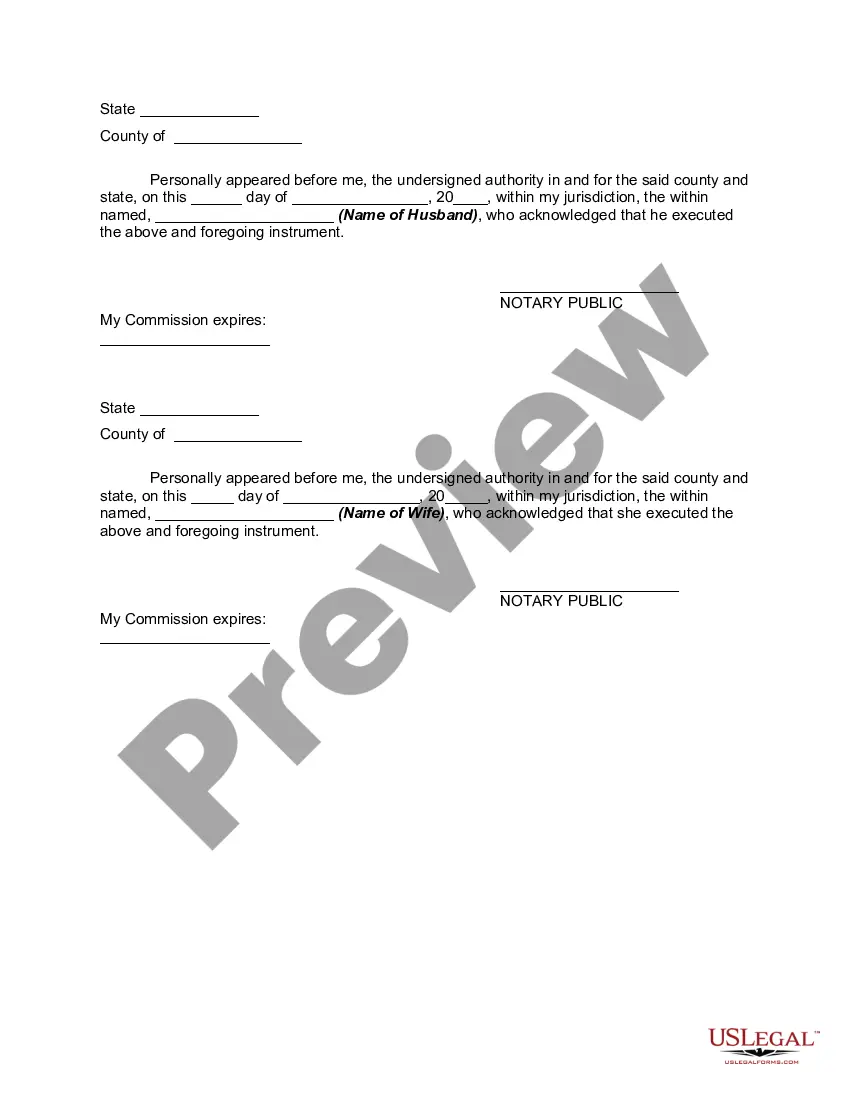

Iowa Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property refers to a legal document that allows married couples in Iowa to change the status of their property from community property, which is owned jointly, to separate property, which is owned individually. This agreement is often entered into after the couple has gotten married and wishes to reclassify certain assets. One common type of Iowa Transmutation or Postnuptial Agreement is the conversion of real estate or real property into separate property. This could involve changing the ownership of a house, land, or other real estate assets from jointly owned to individually owned. By doing so, it ensures that if the couple was to get divorced or one of them passes away, the property will be categorized as separate property and subject to different rules and distribution. Another type of Iowa Transmutation or Postnuptial Agreement is the conversion of financial accounts into separate property. This can include bank accounts, investments, retirement funds, stocks, or any other financial asset that the couple wishes to reclassify. By converting such assets into separate property, each spouse can maintain ownership and control over specific financial resources, even in the event of a divorce or legal separation. It's important to note that Iowa law requires certain criteria to be met for these agreements to be valid. The agreement must be in writing, signed by both spouses, and notarized. Both parties should fully disclose all assets and liabilities, and the agreement should be fair and reasonable at the time it is executed. It's highly recommended consulting with a professional family law attorney to ensure compliance with the legal requirements and to tailor the agreement to individual needs and circumstances. In summary, an Iowa Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property allows married couples in Iowa to change their jointly owned assets into individually owned assets. These agreements can include the conversion of real estate, financial accounts, or other types of property. It's essential to consult with an attorney to draft a legally binding and fair agreement that protects the interests of both spouses.Iowa Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property refers to a legal document that allows married couples in Iowa to change the status of their property from community property, which is owned jointly, to separate property, which is owned individually. This agreement is often entered into after the couple has gotten married and wishes to reclassify certain assets. One common type of Iowa Transmutation or Postnuptial Agreement is the conversion of real estate or real property into separate property. This could involve changing the ownership of a house, land, or other real estate assets from jointly owned to individually owned. By doing so, it ensures that if the couple was to get divorced or one of them passes away, the property will be categorized as separate property and subject to different rules and distribution. Another type of Iowa Transmutation or Postnuptial Agreement is the conversion of financial accounts into separate property. This can include bank accounts, investments, retirement funds, stocks, or any other financial asset that the couple wishes to reclassify. By converting such assets into separate property, each spouse can maintain ownership and control over specific financial resources, even in the event of a divorce or legal separation. It's important to note that Iowa law requires certain criteria to be met for these agreements to be valid. The agreement must be in writing, signed by both spouses, and notarized. Both parties should fully disclose all assets and liabilities, and the agreement should be fair and reasonable at the time it is executed. It's highly recommended consulting with a professional family law attorney to ensure compliance with the legal requirements and to tailor the agreement to individual needs and circumstances. In summary, an Iowa Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property allows married couples in Iowa to change their jointly owned assets into individually owned assets. These agreements can include the conversion of real estate, financial accounts, or other types of property. It's essential to consult with an attorney to draft a legally binding and fair agreement that protects the interests of both spouses.