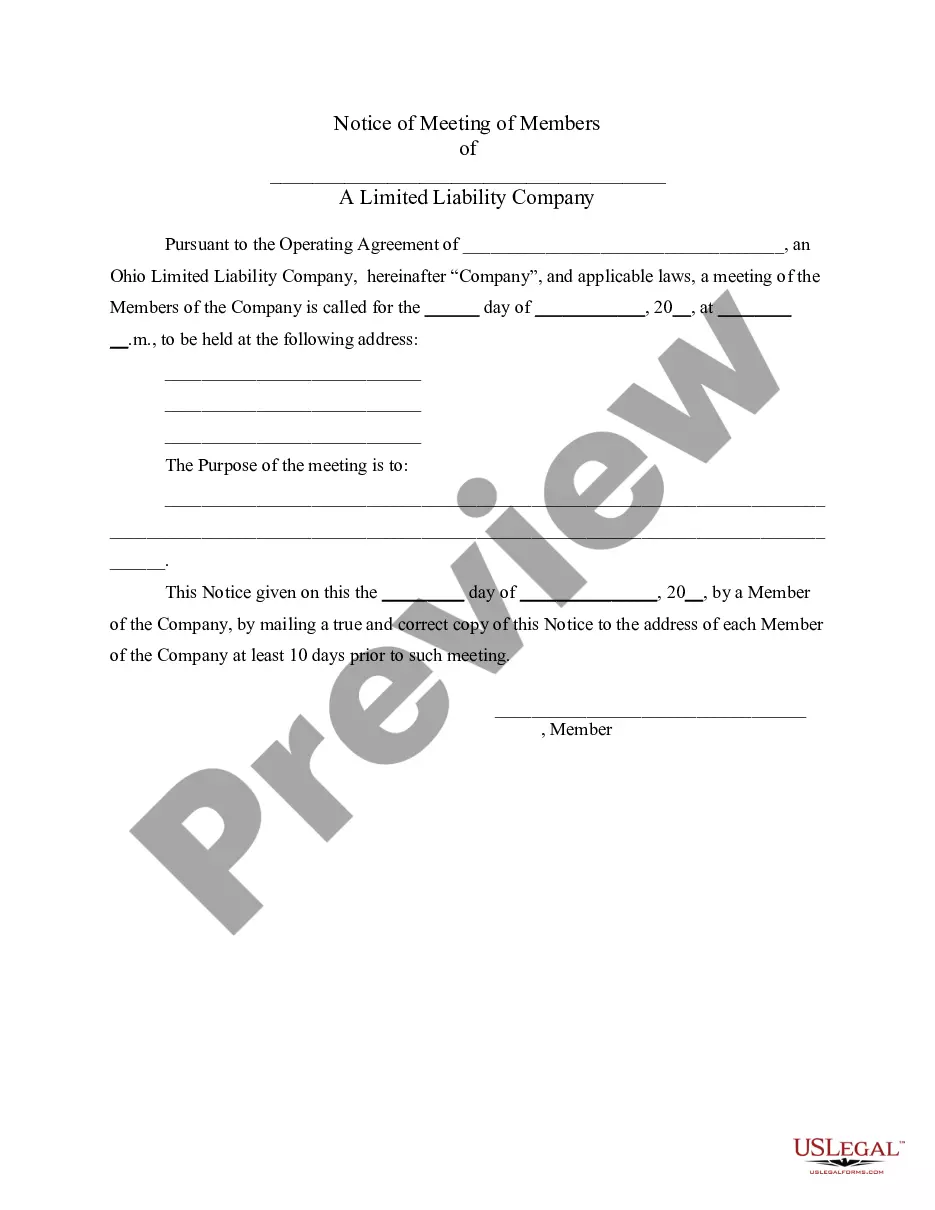

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Gift of Entire Interest in Literary Property

Description

How to fill out Gift Of Entire Interest In Literary Property?

It is feasible to spend hours online trying to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms provides numerous legal forms that are reviewed by experts.

You can easily download or print the Iowa Gift of Complete Interest in Literary Property from our service.

If you wish to find another version of the form, utilize the Search field to locate the template that fits your needs and requirements. When you have found the template you want, click on Purchase now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the Iowa Gift of Complete Interest in Literary Property. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Iowa Gift of Complete Interest in Literary Property.

- Each legal document template you purchase is yours forever.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have chosen the correct document template for the region/city of your choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

Not all gifts require reporting on Form 709. You only need to report gifts that surpass the annual exclusion limit, which includes any significant gifts like an Iowa Gift of Entire Interest in Literary Property. Keeping tabs on your contributions ensures you meet IRS requirements without unnecessary complications.

A completed gift occurs when the donor has relinquished all control over the property, and the recipient has accepted it. For instance, giving an Iowa Gift of Entire Interest in Literary Property qualifies as a completed gift once you transfer ownership without conditions. Documentation of this transfer will solidify the status of the gift.

The exclusion amount for Form 709 can change each year, but for 2023, it generally allows individuals to gift up to $17,000 without triggering gift tax. This applies to various types of gifts, including an Iowa Gift of Entire Interest in Literary Property. It's always prudent to verify the current exclusions as they are indexed for inflation.

If the gift is exactly $15,000, it typically does not need to be reported on your gift tax return as it falls within the annual exclusion limit. This is true even if the gift is an Iowa Gift of Entire Interest in Literary Property. However, gifts exceeding this amount must be reported, so it is essential to keep accurate records for tax purposes.

You do not have to report all gifts on a gift tax return. If a gift falls below the annual exclusion limit, which is adjusted annually, it does not need to be reported. However, an Iowa Gift of Entire Interest in Literary Property that exceeds this limit must be disclosed to ensure compliance with IRS regulations.

A gift tax audit can be triggered by various factors, including the amount of the gift or discrepancies in reported values on Form 709. High-value gifts, like an Iowa Gift of Entire Interest in Literary Property, often raise red flags if not documented properly. Additionally, certain patterns in your gift-giving history may prompt an audit from the IRS.

The IRS becomes aware of gifts primarily through the requirement to file a gift tax return, known as Form 709. If your gift exceeds the annual exclusion limit, or involves an Iowa Gift of Entire Interest in Literary Property, you must report it. Additionally, any financial institutions and certain transactions may notify the IRS as part of their reporting requirements.

Documenting a gift for tax purposes involves gathering crucial information about the gift, such as its value and the date of transfer. For an Iowa Gift of Entire Interest in Literary Property, you should create a written record that includes the specifics of the item and the intent to transfer ownership. This documentation helps in case you need to prove the gift during a tax audit.

To document a gift of equity, you should create a written gift letter that outlines the details, including the property description and the value of the gift. This letter should clearly state that the giver does not expect repayment. When dealing with an Iowa Gift of Entire Interest in Literary Property, it’s also wise to include any pertinent legal documents to support the transaction. Utilizing resources from uslegalforms can further simplify the documentation process.

On a closing disclosure, the gift of equity typically appears in the section that details the seller's concessions or credits. This section may be labeled as 'Seller Contributions' or similar. If you are handling an Iowa Gift of Entire Interest in Literary Property, it's crucial to ensure the amount is correctly documented. Using platforms like uslegalforms can help guide you through the process and ensure all paperwork is accurately completed.