Iowa Contract for the Sale and Purchase of Commercial or Industrial Property is a legally binding document that outlines the terms and conditions involved in the sale and purchase of commercial or industrial properties in the state of Iowa. This contract serves as a crucial agreement between the buyer and seller, ensuring a smooth and transparent transaction. The primary purpose of the Iowa Contract for the Sale and Purchase of Commercial or Industrial Property is to establish the rights, obligations, and responsibilities of all parties involved. It covers various aspects of the sale, including the purchase price, financing arrangements, property condition, title commitments, inspection contingencies, and closing procedures. The following are some relevant keywords associated with this contract: 1. Sale and Purchase Agreement: This contract serves as a legally binding agreement that governs the sale and purchase of commercial or industrial properties in Iowa. 2. Commercial Property: This refers to properties intended for business use, such as office buildings, retail spaces, warehouses, or multifamily residential properties. 3. Industrial Property: This refers to properties used for industrial purposes, such as factories, manufacturing facilities, distribution centers, or storage spaces. 4. Terms and Conditions: The contract outlines the specific conditions and provisions agreed upon by both the buyer and seller, including payment terms, property condition, and any contingencies. 5. Purchase Price: The contract specifies the agreed-upon purchase price for the property, which may be subject to negotiation between the parties. 6. Financing Arrangements: If the buyer is obtaining financing for the purchase, the contract may include provisions related to loan approval, interest rates, and deadlines for securing financing. 7. Property Condition: The contract may require the seller to provide accurate disclosure of the property's condition, including any existing defects or issues. 8. Title Commitments: The contract may require the seller to provide a clear and marketable title, free from any liens or encumbrances. 9. Inspection Contingencies: The contract may allow the buyer to conduct inspections of the property to ensure its condition and identify any potential issues. Contingencies may be included to address repair or negotiation of the purchase price based on the inspection results. 10. Closing Procedures: The contract specifies the process and timeline for the closing of the sale, including the transfer of funds, execution of necessary documents, and recording the deed. It is important to note that there may be different variations or types of Iowa Contracts for the Sale and Purchase of Commercial or Industrial Property, depending on the specific requirements of the parties involved or the nature of the property being sold. These variations may include additional clauses or provisions tailored to the unique circumstances of the transaction or the property involved.

Iowa Contract for the Sale and Purchase of Commercial or Industrial Property

Description

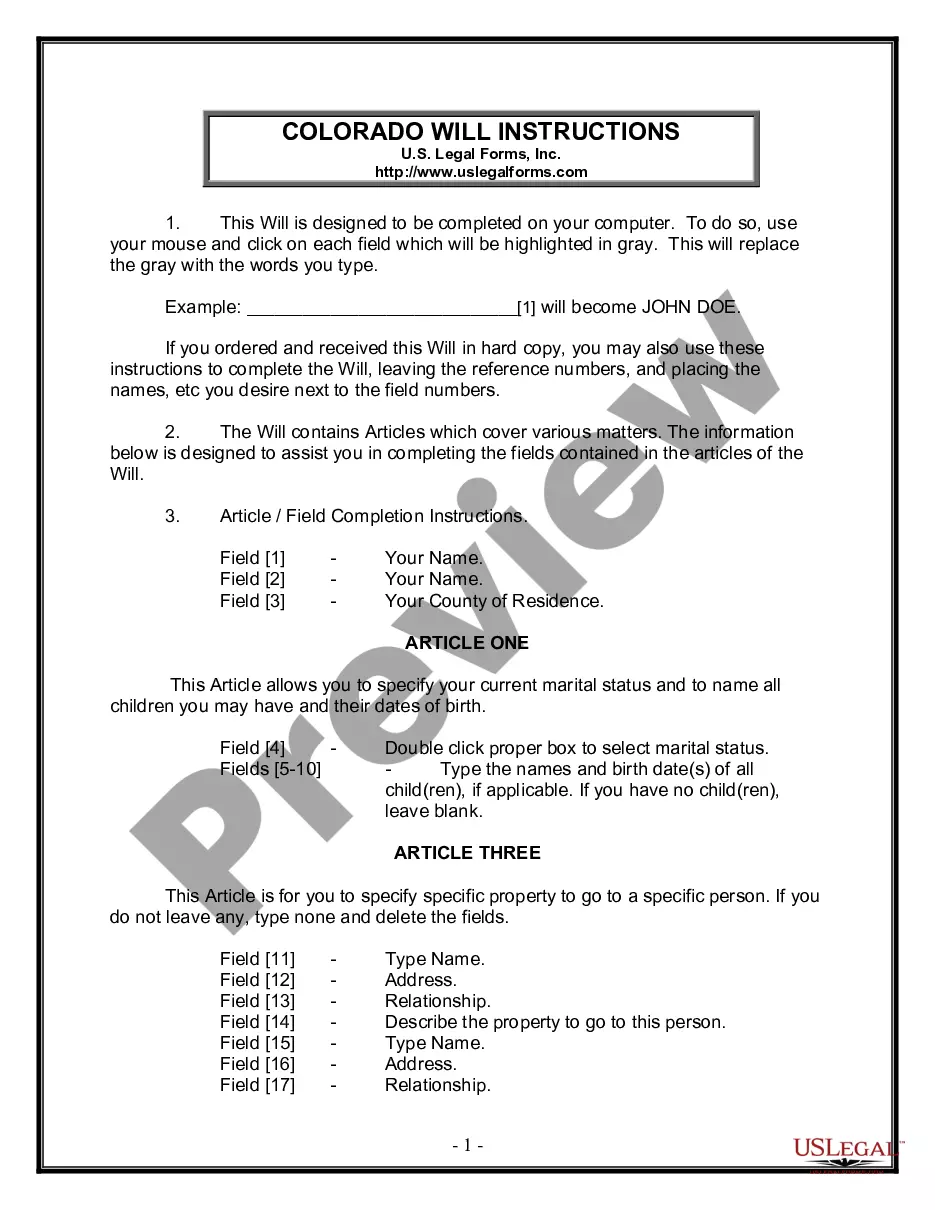

How to fill out Iowa Contract For The Sale And Purchase Of Commercial Or Industrial Property?

US Legal Forms - one of several most significant libraries of authorized varieties in the United States - delivers a variety of authorized file templates it is possible to down load or print. Utilizing the website, you will get 1000s of varieties for enterprise and individual functions, sorted by groups, states, or key phrases.You will discover the most up-to-date models of varieties much like the Iowa Contract for the Sale and Purchase of Commercial or Industrial Property within minutes.

If you have a subscription, log in and down load Iowa Contract for the Sale and Purchase of Commercial or Industrial Property from the US Legal Forms collection. The Down load switch can look on each and every type you see. You have accessibility to all previously acquired varieties inside the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed here are straightforward instructions to help you started off:

- Be sure to have picked the proper type to your metropolis/region. Click on the Preview switch to check the form`s articles. Browse the type explanation to ensure that you have chosen the correct type.

- In the event the type doesn`t fit your requirements, use the Lookup industry on top of the screen to obtain the one that does.

- Should you be content with the form, confirm your option by clicking on the Get now switch. Then, choose the prices prepare you want and provide your accreditations to register for an profile.

- Process the purchase. Make use of credit card or PayPal profile to complete the purchase.

- Choose the formatting and down load the form on the system.

- Make changes. Fill out, change and print and sign the acquired Iowa Contract for the Sale and Purchase of Commercial or Industrial Property .

Every single web template you included in your bank account does not have an expiry day which is your own forever. So, if you would like down load or print another copy, just check out the My Forms segment and click on around the type you need.

Gain access to the Iowa Contract for the Sale and Purchase of Commercial or Industrial Property with US Legal Forms, probably the most substantial collection of authorized file templates. Use 1000s of professional and status-distinct templates that satisfy your organization or individual needs and requirements.

Form popularity

FAQ

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts.

A sale and purchase agreement provides certainty to you and the seller about what will happen when. To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Follow these steps to write an LOI for an intended commercial real estate transaction:Structure it like a letter.Write the opening paragraph.State the parties involved.Draft a property description.Outline the terms of the offer.Include disclaimers.Conclude with a closing statement.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

More info

There are a number of things that we all are wondering that is going to happen when we buy all the stuff we are wondering what are the best things to buy, like cars or houses. Buying a good new house and the new car is expensive, and you want to look for a cheaper deal to go with it, what kind of things have a lot of value, what kinds of things are there that are hard to find, and it's good for you. We had a talk with one of the guys in our office, what we thought about what kinds of commercial real estate investments are best to buy. He said first and obviously there were a lot of differences that you can do with different commercial real estate investment. Some things that made him think about is the following. One of the first things we asked him and most of us do this for most of our life, and we ask ourselves this question you said you want, and you want to do something different. The first one.