Iowa Building Loan Agreement between Lender and Borrower

Description

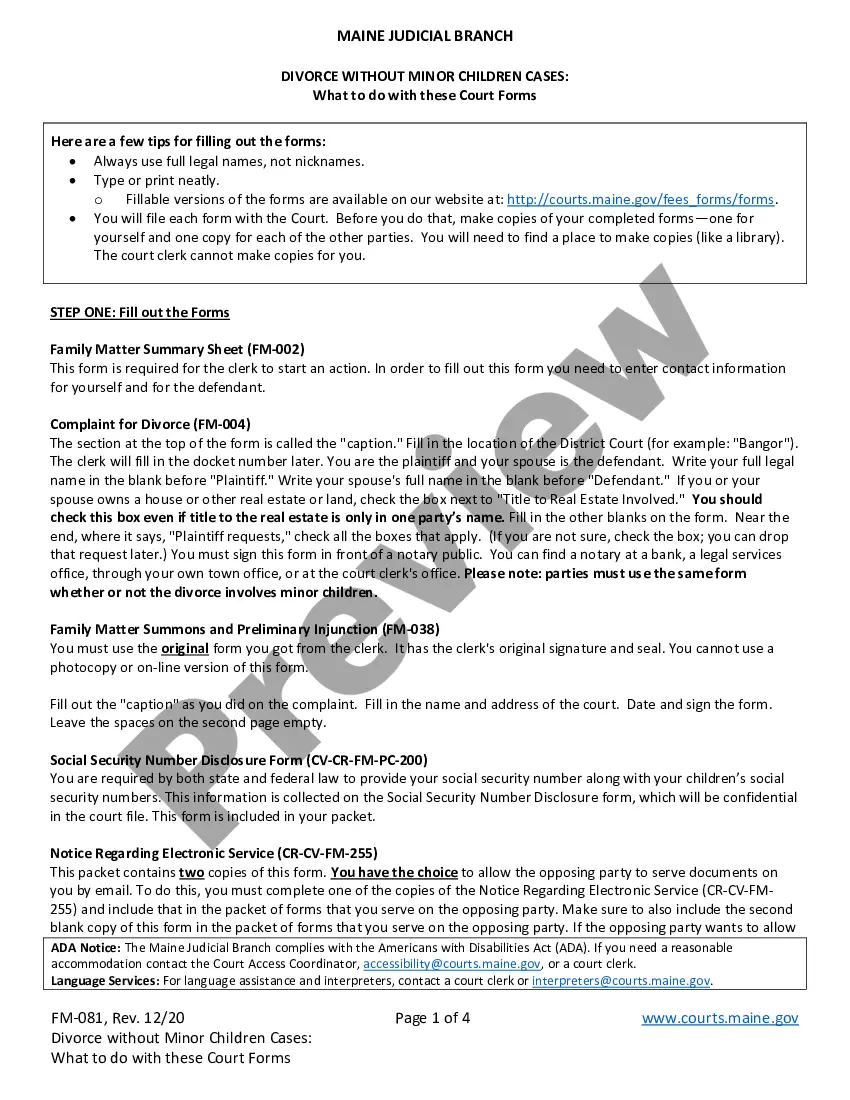

How to fill out Iowa Building Loan Agreement Between Lender And Borrower?

If you want to complete, download, or printing lawful record layouts, use US Legal Forms, the biggest selection of lawful forms, which can be found on the Internet. Make use of the site`s simple and easy convenient research to find the documents you want. Various layouts for business and individual functions are sorted by groups and suggests, or keywords. Use US Legal Forms to find the Iowa Building Loan Agreement between Lender and Borrower in a number of mouse clicks.

When you are presently a US Legal Forms consumer, log in for your accounts and click on the Acquire option to obtain the Iowa Building Loan Agreement between Lender and Borrower. You may also accessibility forms you earlier downloaded in the My Forms tab of the accounts.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that appropriate area/nation.

- Step 2. Make use of the Preview option to look through the form`s content material. Do not overlook to learn the outline.

- Step 3. When you are not satisfied with all the develop, utilize the Look for field at the top of the screen to get other variations of your lawful develop format.

- Step 4. Upon having found the shape you want, go through the Get now option. Pick the pricing program you choose and add your references to register on an accounts.

- Step 5. Process the deal. You can use your bank card or PayPal accounts to accomplish the deal.

- Step 6. Select the file format of your lawful develop and download it in your gadget.

- Step 7. Full, revise and printing or sign the Iowa Building Loan Agreement between Lender and Borrower.

Every lawful record format you buy is the one you have eternally. You may have acces to each and every develop you downloaded within your acccount. Select the My Forms portion and decide on a develop to printing or download yet again.

Contend and download, and printing the Iowa Building Loan Agreement between Lender and Borrower with US Legal Forms. There are millions of professional and condition-certain forms you can utilize for your personal business or individual requirements.

Form popularity

FAQ

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lenderat a later date. It allows you to buy now with the promise of paying later. By understanding how each type of credit works, you will learn to manage credit successfully.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

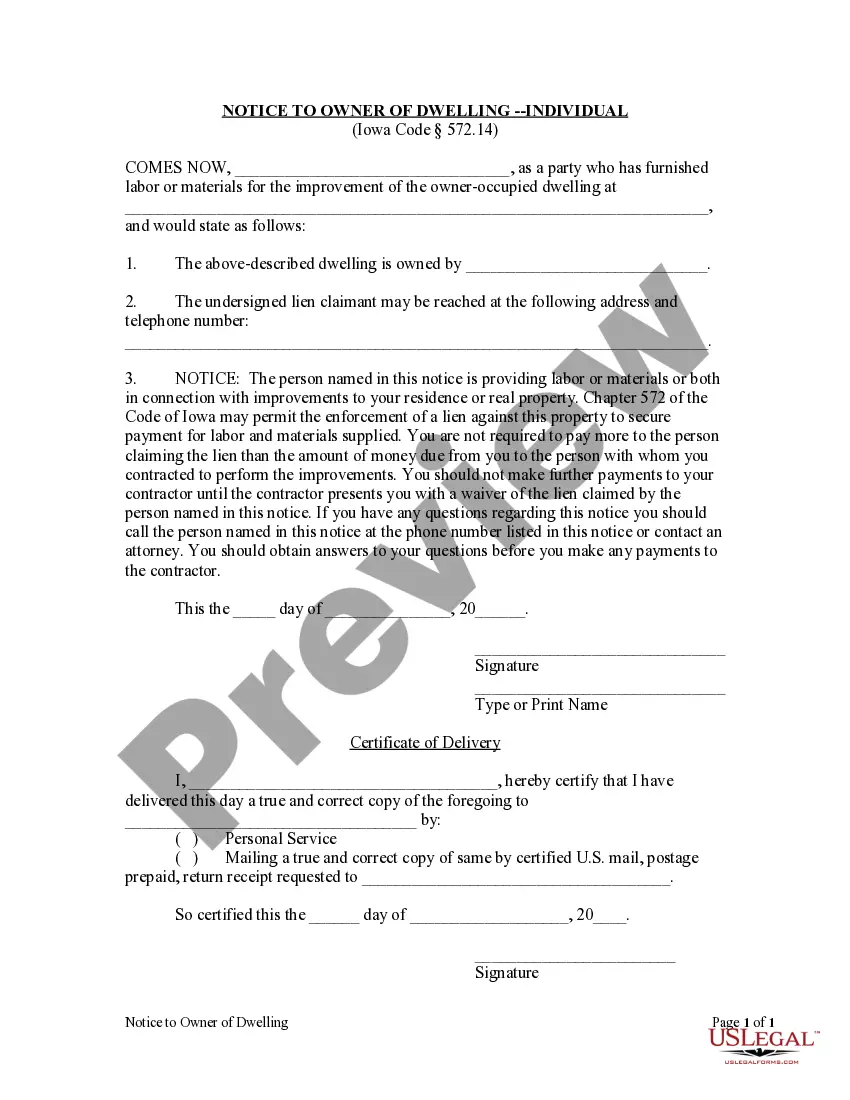

Loan agreement - Typically refers to a written agreement between a lender and borrower stipulating the terms and conditions associated with a financing transaction and in addition to those included to accompanying note, security agreement and other loan documents.