Iowa Debt Agreement

Description

How to fill out Debt Agreement?

Selecting the correct authorized document format can be a challenge.

Certainly, there are numerous templates accessible online, but how can you acquire the legal version you require? Make use of the US Legal Forms website.

The service offers thousands of templates, such as the Iowa Debt Agreement, which can be utilized for business and personal needs. All of the forms are verified by experts and meet state and national standards.

If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Get now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the obtained Iowa Debt Agreement. US Legal Forms is the largest library of legal forms where you can find various document templates. Use the service to download properly crafted paperwork that comply with state regulations.

- If you are currently registered, Log In to your account and click on the Download button to get the Iowa Debt Agreement.

- Use your account to search through the legal forms you have obtained previously.

- Visit the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/region.

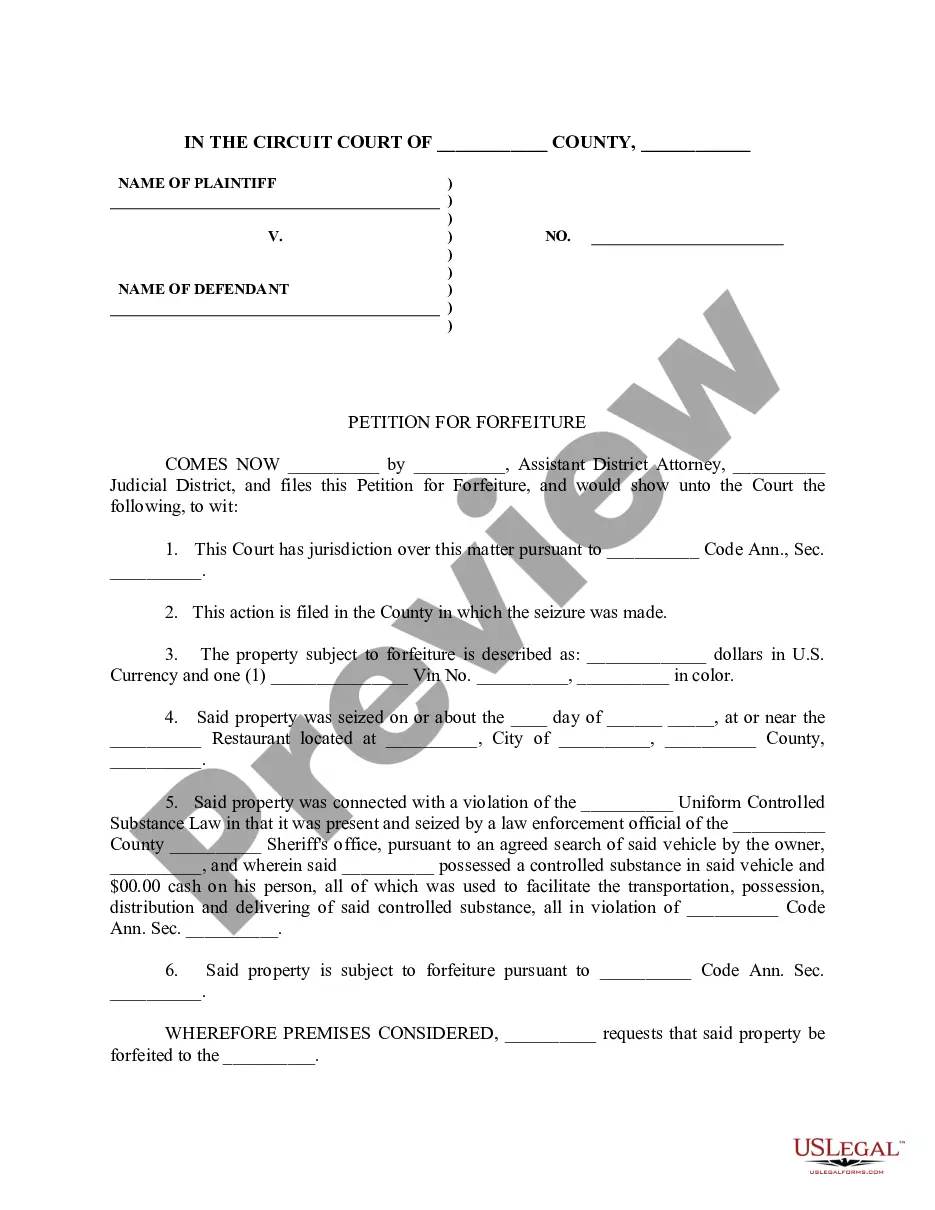

- You can browse the form using the Preview button and review the form description to ensure this is the right one for you.

Form popularity

FAQ

In Iowa, the statute of limitations generally makes a debt uncollectible after ten years. This period starts from the date the debt became due. If you're facing unmanageable debts, considering an Iowa Debt Agreement can provide you with solutions before you reach this threshold.

An offer in compromise with the Iowa Department of Revenue allows taxpayers to settle their tax debts for less than the total owed. This process requires submission of specific financial information to determine eligibility. Utilizing an Iowa Debt Agreement can help clarify your position and aid you in presenting a compelling case.

Iowa's debt varies and includes both state and local obligations. It is essential for residents to stay informed about their personal finances in relation to the state's financial health. Engaging in an Iowa Debt Agreement can provide valuable support in managing your own debts effectively.

One downside for the IRS is the potential loss of revenue if an offer in compromise is accepted. They may also face increased administrative costs during the review process. Understanding an Iowa Debt Agreement can help you navigate these complexities and make informed choices about your tax obligations.

The approval process for an offer in compromise can take several months. Generally, the IRS reviews the offer thoroughly to ensure all criteria are met. By considering an Iowa Debt Agreement, you may expedite your path to resolution, as it provides clarity regarding your financial responsibilities.

Yes, you can set up a payment plan for Iowa taxes. The Iowa Department of Revenue allows taxpayers to establish a payment agreement based on their financial situation. This arrangement is often referred to as an Iowa Debt Agreement. By doing this, you can manage your tax obligations while avoiding unnecessary penalties.

Setoff debt collection refers to the practice of using amounts owed to you to cover an outstanding debt. Within the framework of an Iowa Debt Agreement, creditors may initiate this process to recover what they are owed effectively. Knowing how setoff collections work enables you to prepare better and possibly negotiate your debt terms.

A Debt Arrangement Scheme can be suitable if you're struggling to keep up with payments. It provides a legal solution to manage debt and avoid bankruptcy. Before enrolling, it’s wise to consult various resources, like USLegalForms, to guide you through the process.

Typically, an Iowa Debt Agreement will remain on your credit file for seven years. This timeframe allows potential lenders to see your past financial behaviors and learn about your debt management efforts. While it may affect your credit, successfully completing the agreement can demonstrate responsibility.

A debt agreement, such as an Iowa Debt Agreement, can be a good idea if you're trying to manage large amounts of debt. This option allows you to consolidate your payments into a more manageable plan. Always consider your financial circumstances and consult with professionals before proceeding.