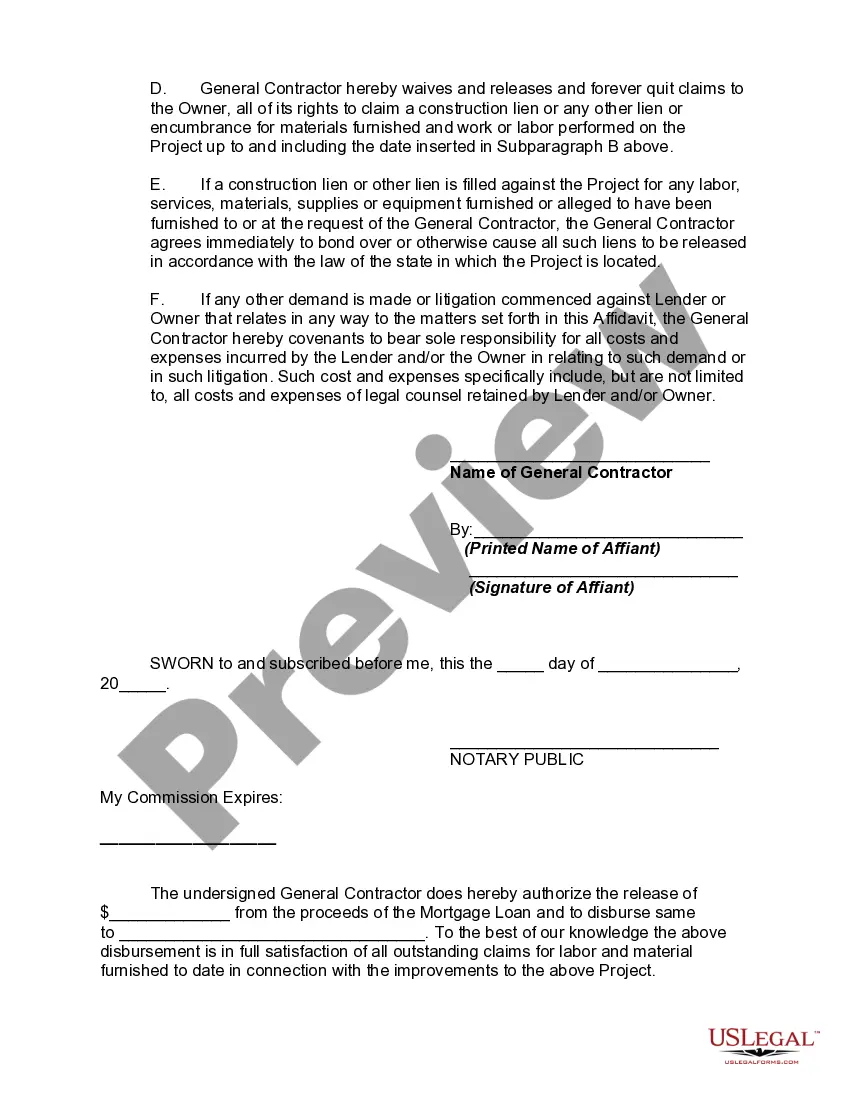

When the contractor requests final payment, a Final Contractor's Affidavit must be submitted to the lender. The Final Contractor's Affidavit lists all money due to potential lienors that have not been paid. The lender will typically require affidavits from each potential lienor assuring that they have been paid before releasing the final draw amount to the contractor.

Iowa Contractor's Affidavit to Induce Lender to Release Funds — Final Payment is a legal document commonly used in the construction industry in Iowa. It serves as a formal declaration made by a contractor to induce a lender to release the final payment for a construction project. This affidavit ensures that all parties involved, including the lender, are made aware of the contractor's compliance with the terms and conditions of the contract. It is crucial to provide an accurate and detailed description of the work performed, materials used, and any outstanding payments or change orders. Keywords: Iowa, Contractor's Affidavit, Induce Lender, Release Funds, Final Payment, Construction Industry, Legal Document, Compliance, Terms and Conditions, Outperformed, Materials Used, Outstanding Payments, Change Orders. Different types of Iowa Contractor's Affidavit to Induce Lender to Release Funds — Final Payment: 1. Standard Affidavit: This is the most common type of contractor's affidavit used in Iowa construction projects. It outlines the contractor's completion of the work as per the contract, ensuring payment release from the lender. 2. Notarized Affidavit: Some contractors may opt to notarize their affidavit, adding an extra layer of authenticity and legal validity to the document. Notarization requires the presence of a notary public who will verify the contractor's identity and witness their signature. 3. Subcontractor Affidavit: In cases where subcontractors are involved in the project, they may also need to submit an affidavit to the lender. This affidavit confirms that the subcontractor has been paid by the contractor and releases any potential claims or liens against the project. 4. Affidavit with Change Orders: If there are any change orders or modifications to the original contract, the contractor must include them in their affidavit. This ensures that the lender is informed of any additional costs or adjustments made during the construction process. 5. Affidavit with Outstanding Payments: In situations where the contractor still has outstanding payments from the owner or other parties involved, this type of affidavit highlights those outstanding amounts. It ensures transparency and notifies the lender that the contractor still has financial obligations to fulfill. Remember, the content and specific requirements of the Iowa Contractor's Affidavit to Induce Lender to Release Funds — Final Payment may vary depending on the project, contract terms, and individual circumstances. It is crucial to consult with a legal professional or seek guidance from relevant industry experts to ensure the accuracy and effectiveness of the affidavit.