Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

Closed-end transactions involve a fixed amount to be paid back over a period of time such as a note or a retail installment contract.

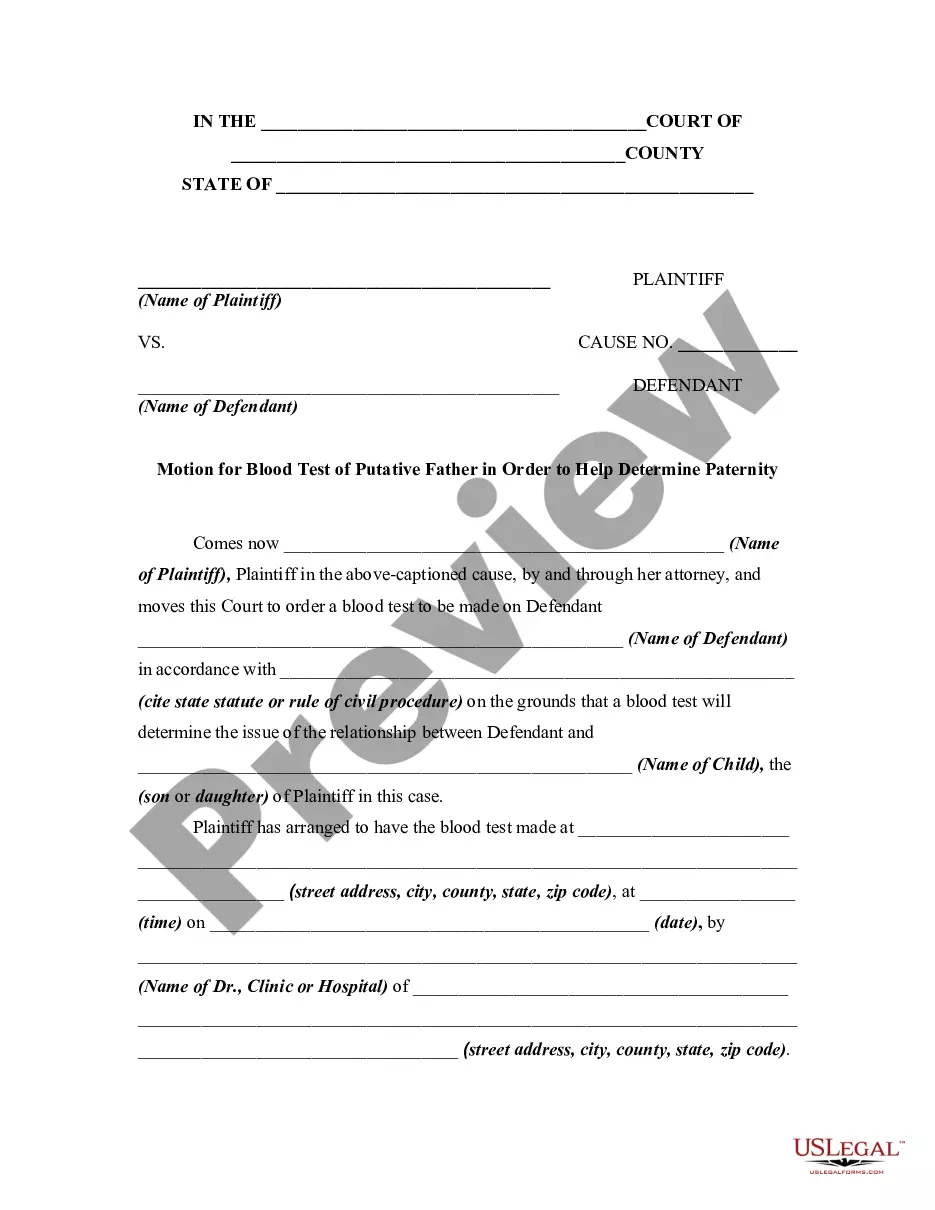

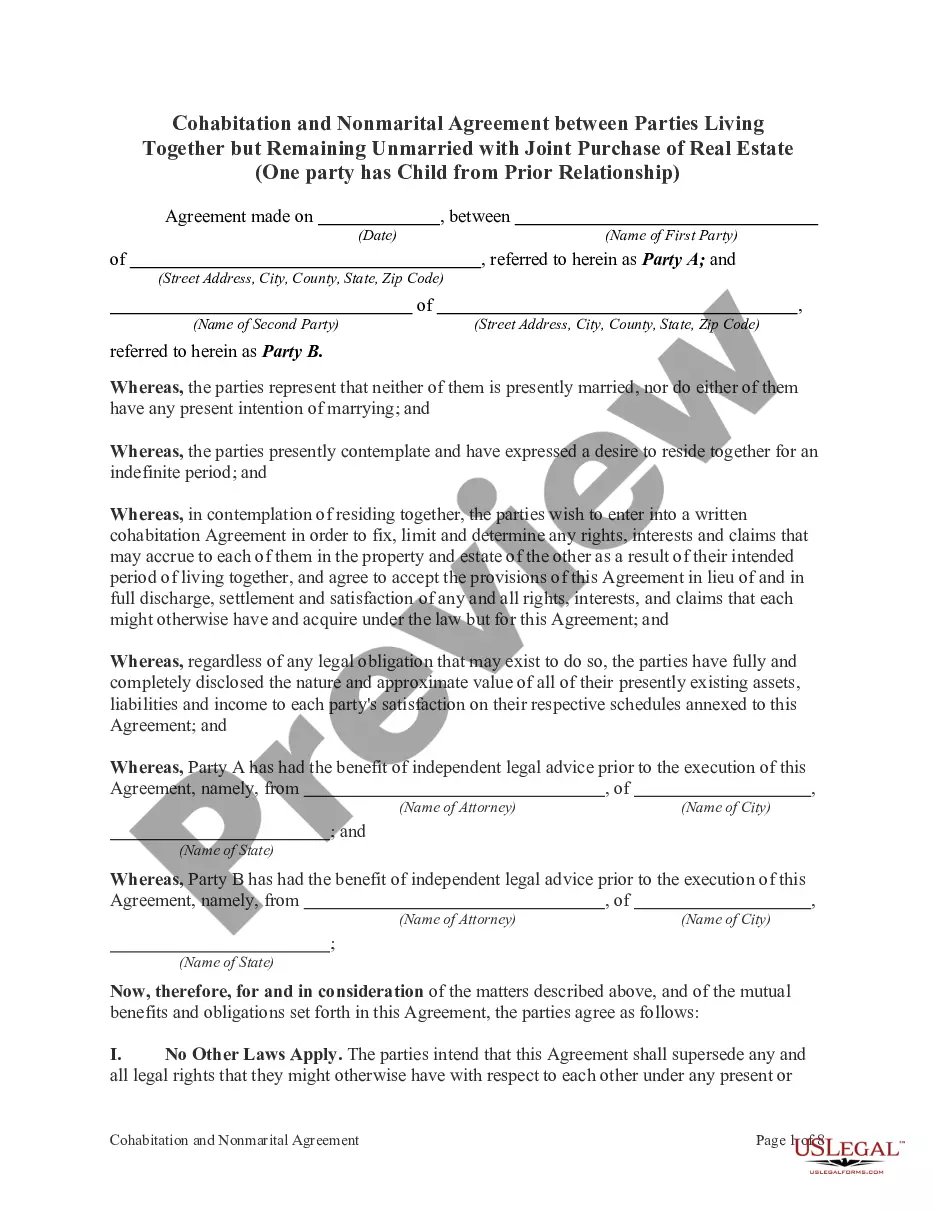

How to fill out General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

Are you in a situation where you require documents for both commercial and specific intents almost every time.

There are numerous authentic document templates accessible online, but locating ones you can depend on isn’t easy.

US Legal Forms provides thousands of form templates, like the Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, which are designed to satisfy federal and state requirements.

When you find the appropriate form, simply click Buy now.

Select the pricing plan you want, fill in the necessary information to process your payment, and finalize the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Use the Review button to examine the form.

- Check the summary to ensure you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Lookup field to find the form that fits your requirements.

Form popularity

FAQ

The Truth in Lending Act requires retail businesses to disclose essential information about credit terms. This includes details like interest rates, payment schedules, and total costs of credit. These disclosures are part of the Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, designed to protect consumers from deceptive practices. Retailers can ensure compliance and avoid legal pitfalls by utilizing tools offered by uslegalforms.

Section 535.3 in the Iowa Code addresses the requirements for lender compliance with interest rate limitations. This section is crucial for understanding the standards under the Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. By adhering to this section, lenders can provide clear and transparent information about their rates. This transparency promotes trust between lenders and consumers.

The highest interest rate allowed by law in Iowa depends on various factors, including the type of retail installment contract. Typically, it is regulated to prevent excessive charges and ensure fairness for consumers. The Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures plays a role in informing retailers and consumers of their rights and obligations regarding interest rates. To navigate these regulations effectively, consider leaning on resources like uslegalforms.

Code 537.7102 in Iowa outlines specific regulations regarding closed-end credit transactions. This section is part of the Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. Understanding these regulations ensures compliance for businesses offering retail installment contracts. It is crucial to be aware of these details to avoid legal issues.

Regulation Z requires a range of specific disclosures on installment loans, including total finance charges, the APR, and the total amount financed. Borrowers must be informed of their payment schedule, including the timing and amounts. Knowing these Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures empowers consumers to make sound financial choices.

The Truth in Lending Act requires lenders to provide clear disclosures about the terms of credit. These include the Annual Percentage Rate (APR), finance charges, total payments, and payment schedule. Understanding these Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures helps consumers make informed decisions about borrowing.

Disclosures in the Truth in Lending Act include detailed information about credit terms and conditions to protect consumers. These disclosures cover aspects such as interest rates, fees, and payment schedules, ensuring borrowers are aware of their obligations. Understanding Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures can empower you to make informed borrowing choices.

According to Regulation Z, all closed-end credit disclosures must be presented clearly and understandably. They must highlight key information prominently to help consumers fully understand their credit obligations. By reviewing Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, borrowers can better grasp their financial commitments.

A Truth in Lending disclosure statement must include key elements like the annual percentage rate (APR), total finance charges, and the total amount financed. Additionally, it should detail the payment schedule and any late fees that may apply. Familiarizing yourself with Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures ensures you receive all necessary information transparently.

The Truth in Lending Act (TILA) mandates clear disclosure of credit terms to consumers. This includes essential details such as interest rates, payment schedules, and total costs associated with borrowing. Understanding Iowa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures helps ensure consumers make informed choices.