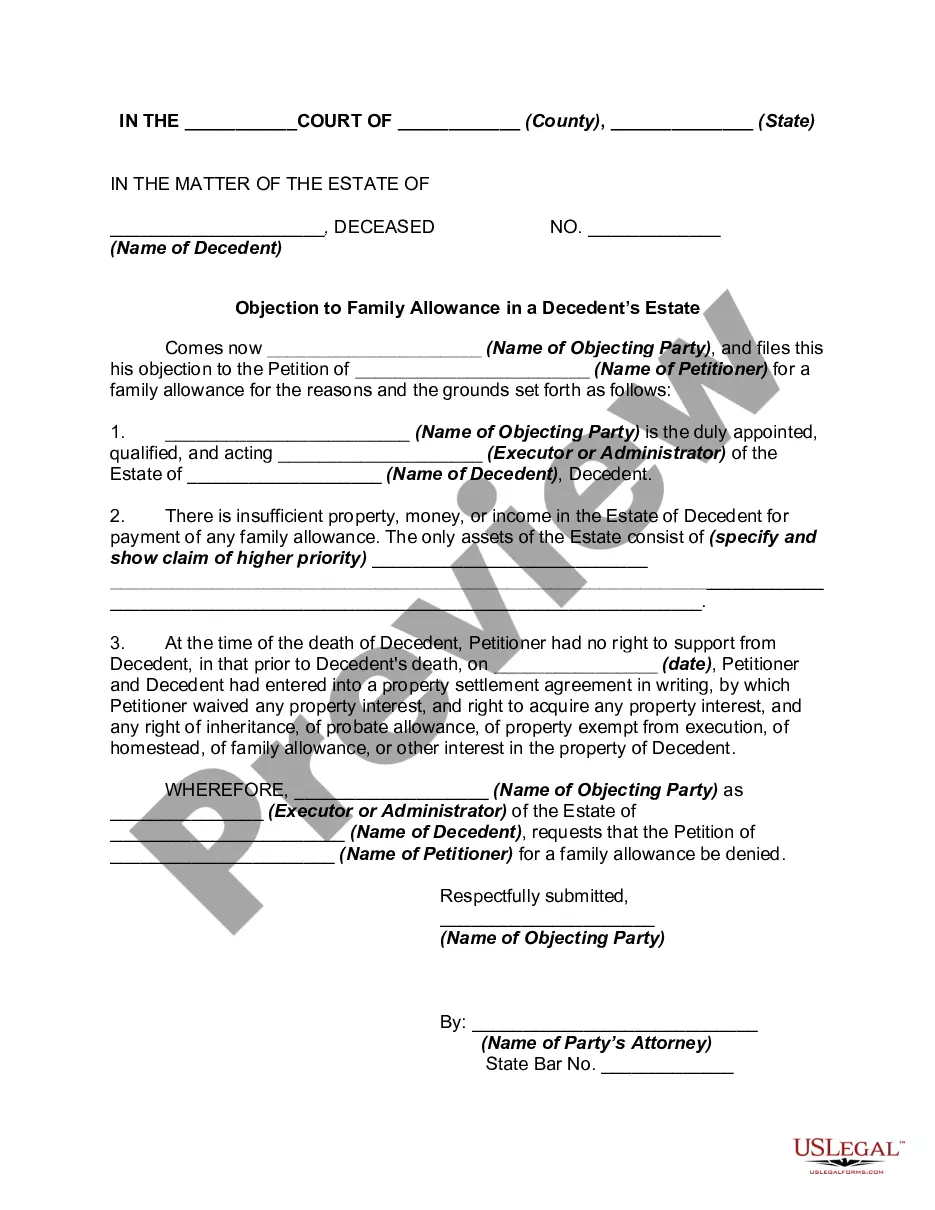

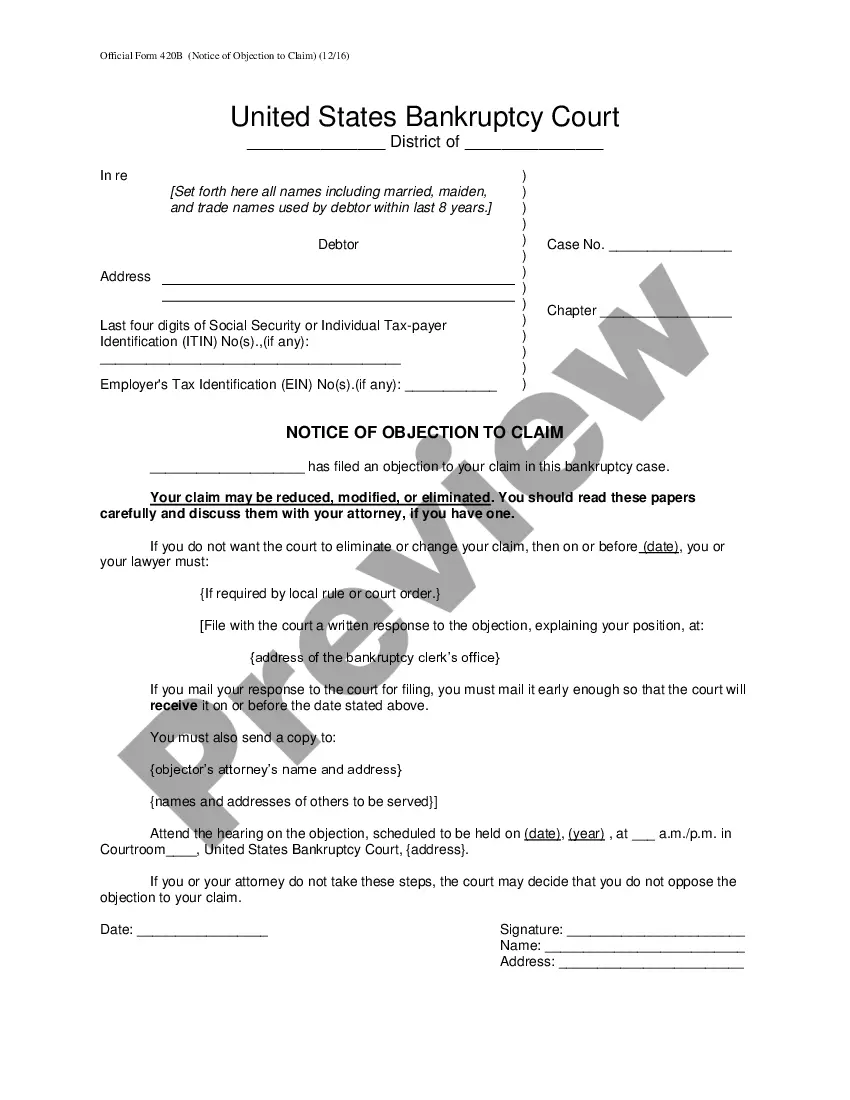

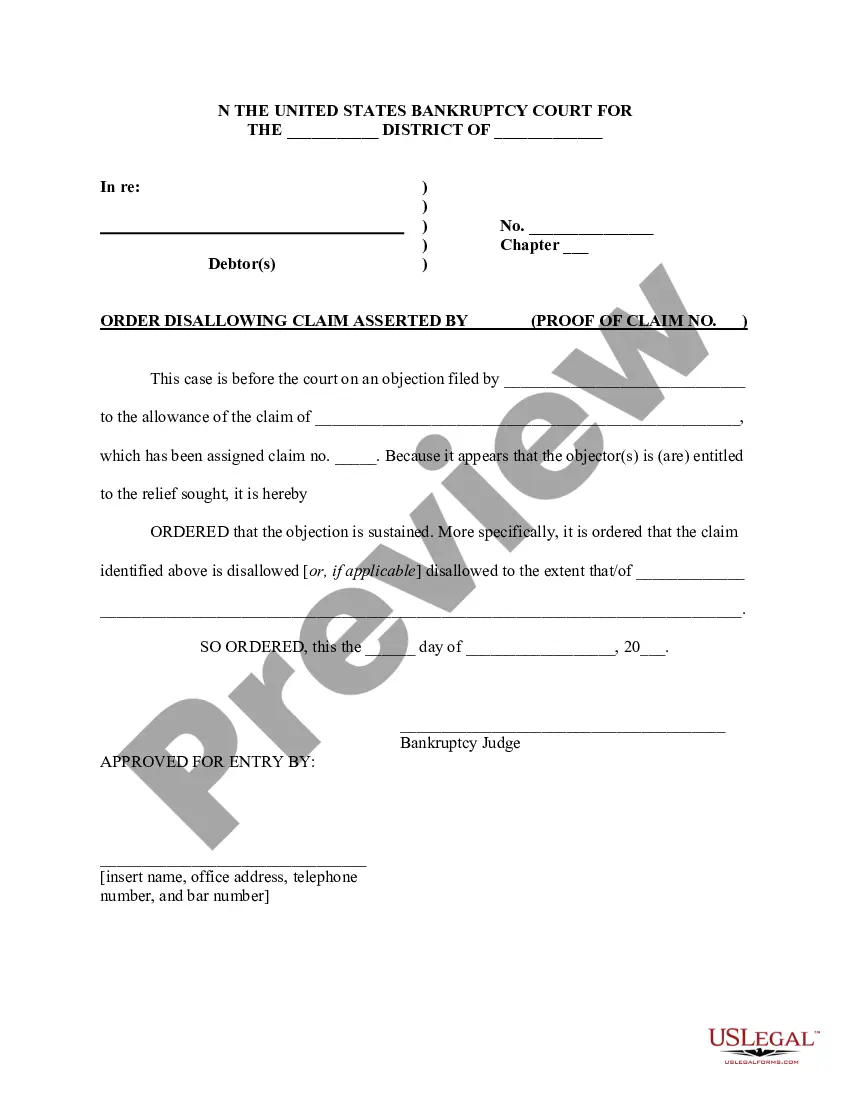

Any interested party in an estate of a decedent generally has the right to make objections to the accounting of the executor, the compensation paid or

proposed to be paid, or the proposed distribution of assets. Such objections must be filed within within a certain period of time from the date of service of the Petition for approval of the accounting.

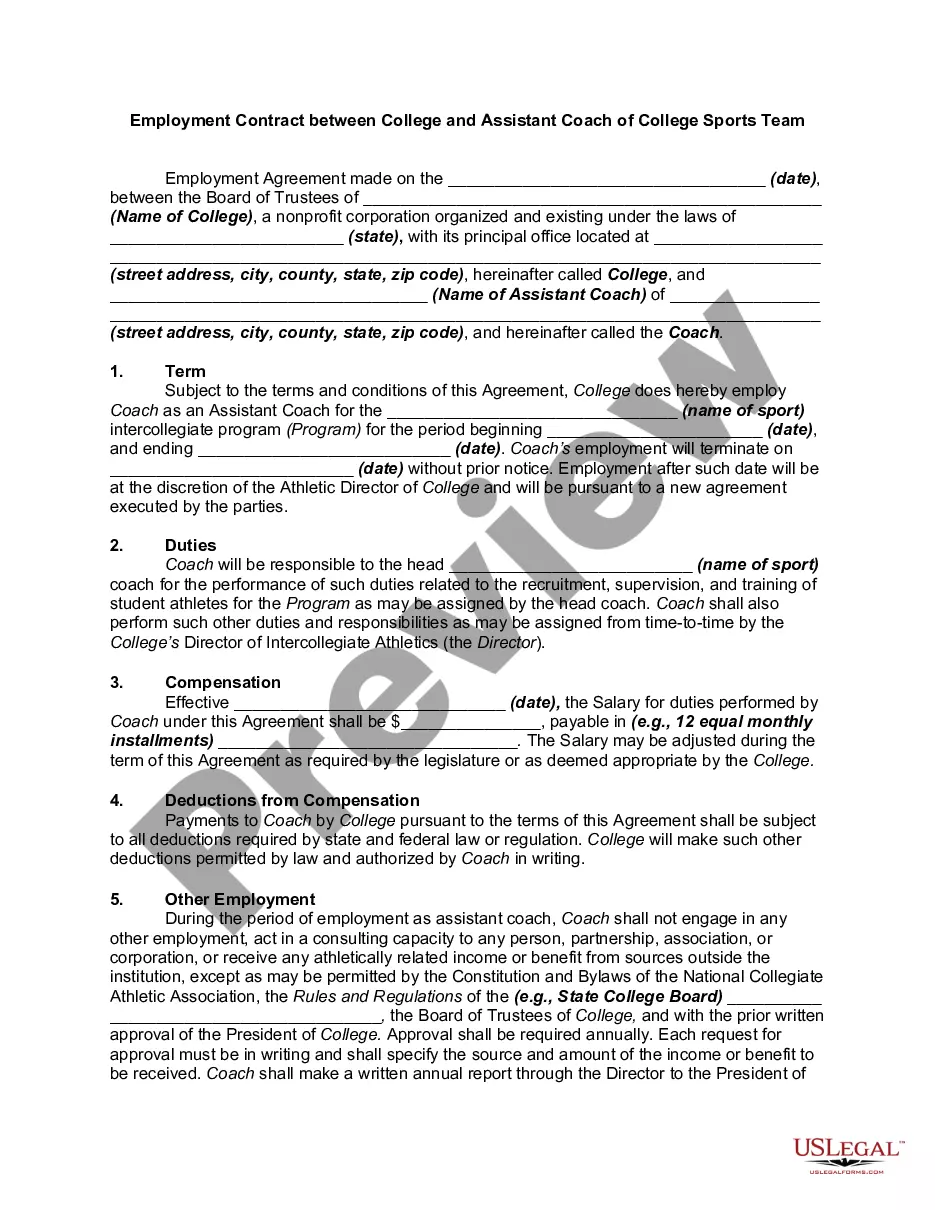

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.