Iowa Promissory Note in Connection with Sale of Motor Vehicle

Description

A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

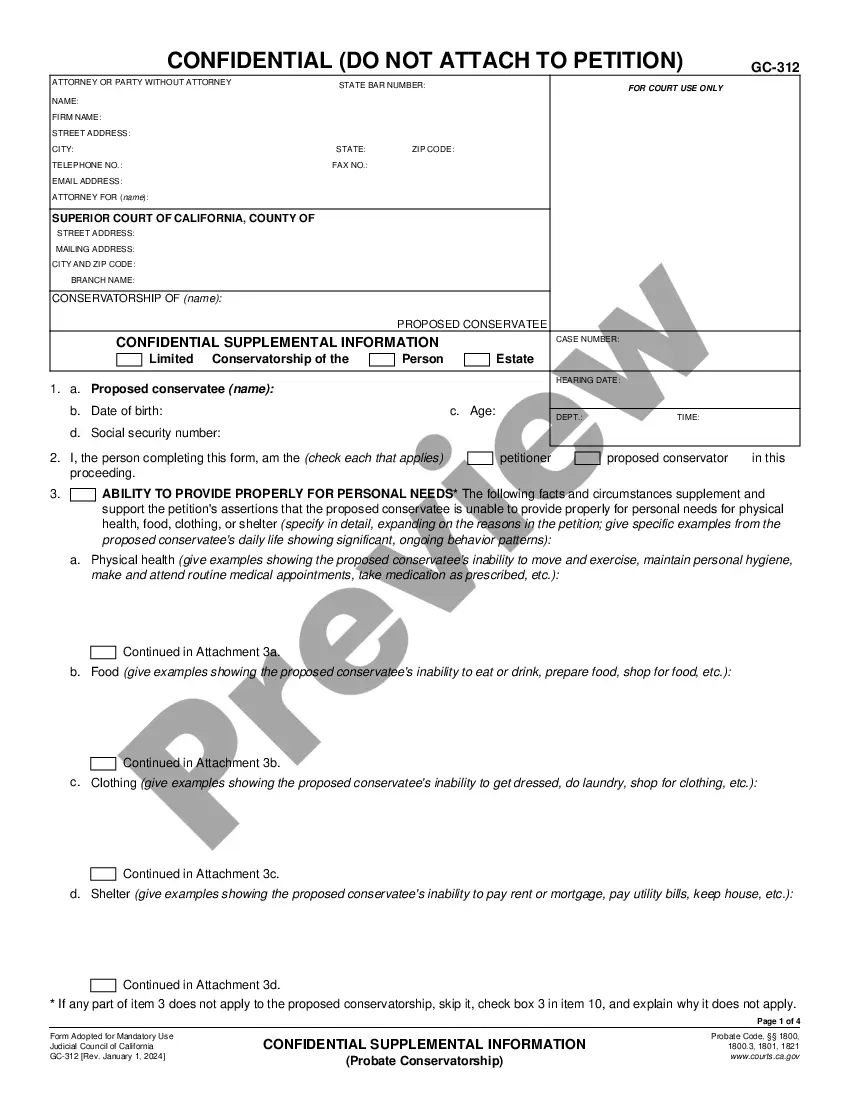

How to fill out Promissory Note In Connection With Sale Of Motor Vehicle?

US Legal Forms - one of the most notable collections of legal templates in the USA - offers a range of legal document templates available for download or printing.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents like the Iowa Promissory Note in Relation to the Sale of a Motor Vehicle in just seconds.

Read the form details to confirm that you have chosen the correct form.

If the form does not suit your requirements, use the Search bar at the top of the page to locate one that does.

- If you already have a monthly subscription, Log In and download the Iowa Promissory Note in Relation to the Sale of a Motor Vehicle from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for the city/state.

- Click the Preview option to review the form’s content.

Form popularity

FAQ

Several entities can provide you with an Iowa Promissory Note in Connection with Sale of Motor Vehicle. You can create one through legal form platforms like US Legal Forms, which offers customizable options. Alternatively, you can seek assistance from lawyers or financial institutions that specialize in vehicle sales.

To obtain a copy of your Iowa Promissory Note in Connection with Sale of Motor Vehicle, you should check with the party who holds the original note. If you created the document through a service like US Legal Forms, you might be able to retrieve it from your account. Keep all records organized for easy access and verification.

To get your Iowa Promissory Note in Connection with Sale of Motor Vehicle, you first need to complete the necessary forms. You can usually find templates online, or you can consult a legal expert. Once you fill out the form with accurate details, you can notarize it to ensure its legality.

You can obtain an Iowa Promissory Note in Connection with Sale of Motor Vehicle from various sources. Many legal websites, such as US Legal Forms, offer customizable templates. Additionally, some financial institutions or legal professionals can help you draft or obtain a valid promissory note tailored to your needs.

The promissory note of sale is a vital document that outlines the agreement between the buyer and seller during a vehicle transaction. It specifies the amount financed, repayment schedule, and consequences for missed payments. This note facilitates a clear understanding of financial obligations and protects the interests of both parties. When drafting a promissory note in connection with the sale of a vehicle in Iowa, using templates from USLegalForms can help ensure comprehensiveness and legal compliance.

Promissory notes typically hold up in court if they meet legal requirements, such as being in writing and signed by the parties involved. In Iowa, a well-drafted promissory note in connection with the sale of a motor vehicle can be a strong piece of evidence if disputes arise. Courts usually enforce these notes as binding contracts, ensuring that both parties adhere to the agreed-upon terms. To ensure your note is compliant, consider using resources from USLegalForms.

Filling out a promissory note sample requires entering specific information such as the borrower’s name, the amount owed, the interest rate, and repayment terms. Make sure to adhere to the format for an Iowa promissory note in connection with sale of motor vehicle for clarity. Following a reliable template can also expedite the process.

Selling a car with a promissory note involves drafting the note to outline payment terms clearly. Ensure both parties understand the obligations under the Iowa promissory note in connection with sale of motor vehicle. After completing the sale, provide the buyer a copy of the note and keep one for your records.

To make a promissory note legally binding in Iowa, ensure it includes all required elements such as the amount, interest rate, and signatures. Additionally, consider witnessing or notarizing the document. Proper formulation of an Iowa promissory note in connection with sale of motor vehicle enhances its legal validity.

Writing a promissory note involves outlining the essential details, such as the amount borrowed, interest rate, and repayment schedule. Start by clearly stating who is borrowing, who is lending, and the terms of repayment. For an Iowa promissory note in connection with sale of motor vehicle, it is useful to reference the vehicle's identification number.