Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

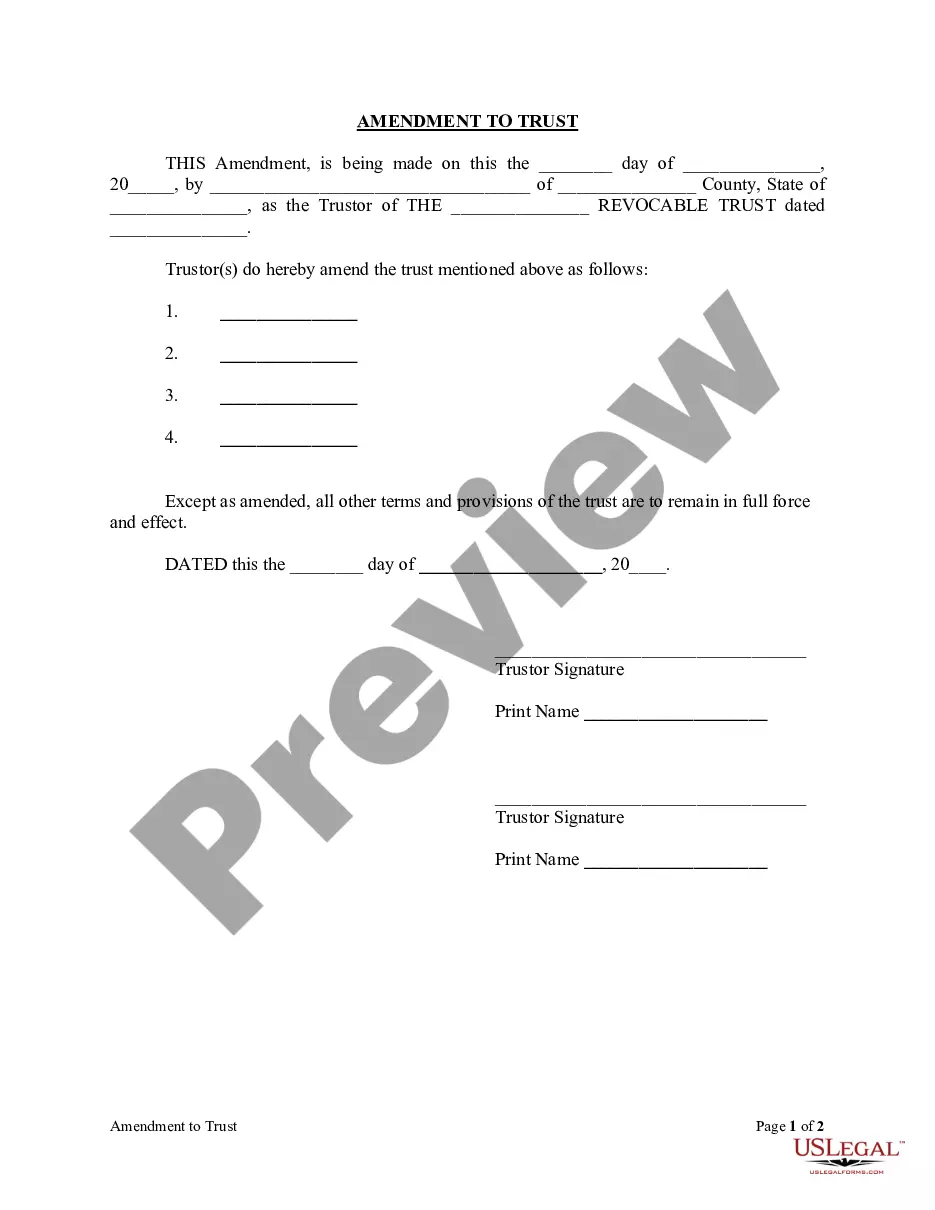

How to fill out Contract For The Sale Of Motor Vehicle - Owner Financed With Provisions For Note And Security Agreement?

If you want to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the top choice of legal forms that are accessible online.

Make use of the site’s straightforward and user-friendly search to find the documents you need.

Many templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement in just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Acquire button to download the Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A legal contract known as an Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement permits the vehicle owner, often a dealer, to provide temporary use of the vehicle to a buyer in exchange for regular payments. This contract establishes the terms for ownership transfer, payment details, and security interests. It ensures both parties understand their obligations, which can help prevent future disputes. By offering this type of financing, it allows customers to own a vehicle while making manageable payments.

Yes, a bill of sale can still be valid even if it is not notarized in Iowa. The key is to ensure that the document properly reflects the agreement between both parties, especially in an Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. However, notarization may add an extra layer of protection for both the buyer and seller.

Whether to notarize a bill of sale is a personal choice. Though Iowa does not require notarization, doing so can increase the document's security and trustworthiness. If you are considering an Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, notarization may help alleviate uncertainties for both parties.

Iowa Code 321.30 relates to the requirements for a certificate of title for vehicles. This code outlines the necessary procedures for transferring ownership, which is essential when drafting an Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. Understanding this code can help ensure the transaction complies with state law.

Similar to a vehicle bill of sale, a bill of sale for a car in Iowa is not required by law to be notarized. That said, including notarization may enhance the document's credibility, which is beneficial when dealing with the Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. We recommend considering notarization to protect all parties involved.

In Iowa, a vehicle bill of sale does not necessarily need to be notarized. However, having it notarized can add an extra layer of authenticity, especially for an Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. This step may simplify the ownership transfer process and reduce potential disputes later.

If you don’t have a bill of sale, you can still complete a sale, but it may complicate ownership proof later. An Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement can help fill this gap by clearly outlining the terms of the sale. However, obtaining a simple bill of sale ideally protects your interests as both the buyer and seller.

To write a contract to sell your car, start by including both parties' information, vehicle details, and sale terms. It is wise to use a structured format, like the Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, which provides a comprehensive outline. Finally, ensure both parties review and sign the contract; this safeguards against future disputes.

Iowa does not legally require a bill of sale to transfer vehicle ownership, but it is strongly recommended. An Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement often benefits from having a bill of sale, as it helps document the transaction. This additional paperwork proves useful should any questions arise regarding the sale in the future.

In Iowa, a bill of sale is not a strict requirement for vehicle registration, but it serves as a valuable record of the transaction. When you complete an Iowa Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, including a bill of sale can clarify the terms agreed upon by both parties. This document helps prevent disputes in the future and protects both the buyer and the seller.