The Iowa General Form of Agreement to Incorporate is a legally binding document used in the state of Iowa to establish a corporation. This agreement outlines the terms and conditions under which the corporation will be formed, operated, and regulated. It serves as a blueprint for the corporation's structure, management, and governance. Keywords: Iowa, General Form of Agreement to Incorporate, corporation, legally binding, terms and conditions, formed, operated, regulated, structure, management, governance. There are various types of Iowa General Form of Agreement to Incorporate, including: 1. Standard Iowa General Form of Agreement to Incorporate: This is the most commonly used type of agreement, providing a general framework for incorporating a business in Iowa. It covers essential aspects, such as the corporation's name, purpose, registered agent, and initial directors. 2. Nonprofit Iowa General Form of Agreement to Incorporate: Designed specifically for nonprofit organizations, this agreement incorporates a corporation for nonprofit activities in Iowa. It includes provisions related to the corporation's charitable mission, tax-exempt status, and governance specific to nonprofit organizations. 3. Professional Service Iowa General Form of Agreement to Incorporate: This agreement is tailored for professional service corporations, such as law firms, medical practices, or engineering companies. It addresses specific regulations and limitations imposed on such corporations, including state licensing requirements, professional liability, and the composition of shareholders and directors. 4. Close Corporation Iowa General Form of Agreement to Incorporate: This agreement caters to close corporations, which are typically small companies with a limited number of shareholders. It includes provisions that allow for more flexibility in decision-making authority and shareholder rights, as close corporations often operate more informally than larger public corporations. 5. S Corporation Iowa General Form of Agreement to Incorporate: This type of agreement is specifically designed for corporations seeking S Corporation tax status. It includes provisions related to the IRS requirements for S Corporation eligibility, such as limitations on the number of shareholders, types of stock, and the distribution of profits and losses. These different types of Iowa General Form of Agreement to Incorporate cater to specific business needs, ensuring that corporations adhere to the applicable legal requirements and regulations based on their unique characteristics and activities.

Iowa General Form of Agreement to Incorporate

Description

How to fill out Iowa General Form Of Agreement To Incorporate?

You can commit hrs online looking for the lawful file format that fits the federal and state requirements you will need. US Legal Forms supplies 1000s of lawful kinds that happen to be analyzed by pros. You can actually obtain or produce the Iowa General Form of Agreement to Incorporate from my assistance.

If you already have a US Legal Forms account, you can log in and click on the Download switch. After that, you can full, revise, produce, or sign the Iowa General Form of Agreement to Incorporate. Every lawful file format you buy is the one you have for a long time. To get yet another version of any bought develop, check out the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms internet site the very first time, adhere to the easy recommendations listed below:

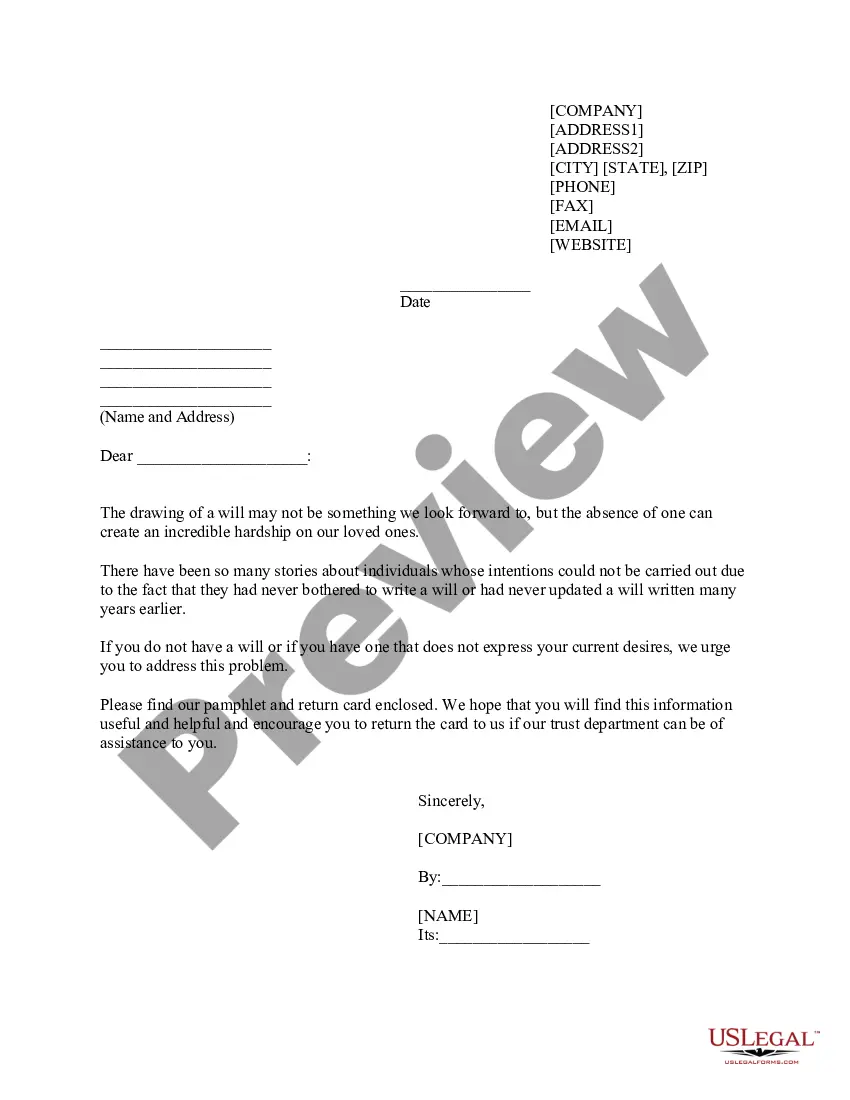

- Very first, make sure that you have chosen the best file format to the region/metropolis that you pick. Browse the develop explanation to make sure you have picked the right develop. If readily available, make use of the Preview switch to look through the file format at the same time.

- If you want to find yet another edition from the develop, make use of the Look for field to find the format that fits your needs and requirements.

- Once you have located the format you need, click Acquire now to move forward.

- Pick the prices strategy you need, key in your qualifications, and register for an account on US Legal Forms.

- Complete the deal. You should use your Visa or Mastercard or PayPal account to purchase the lawful develop.

- Pick the structure from the file and obtain it to your gadget.

- Make adjustments to your file if necessary. You can full, revise and sign and produce Iowa General Form of Agreement to Incorporate.

Download and produce 1000s of file web templates while using US Legal Forms website, which provides the biggest selection of lawful kinds. Use expert and condition-specific web templates to take on your small business or person needs.