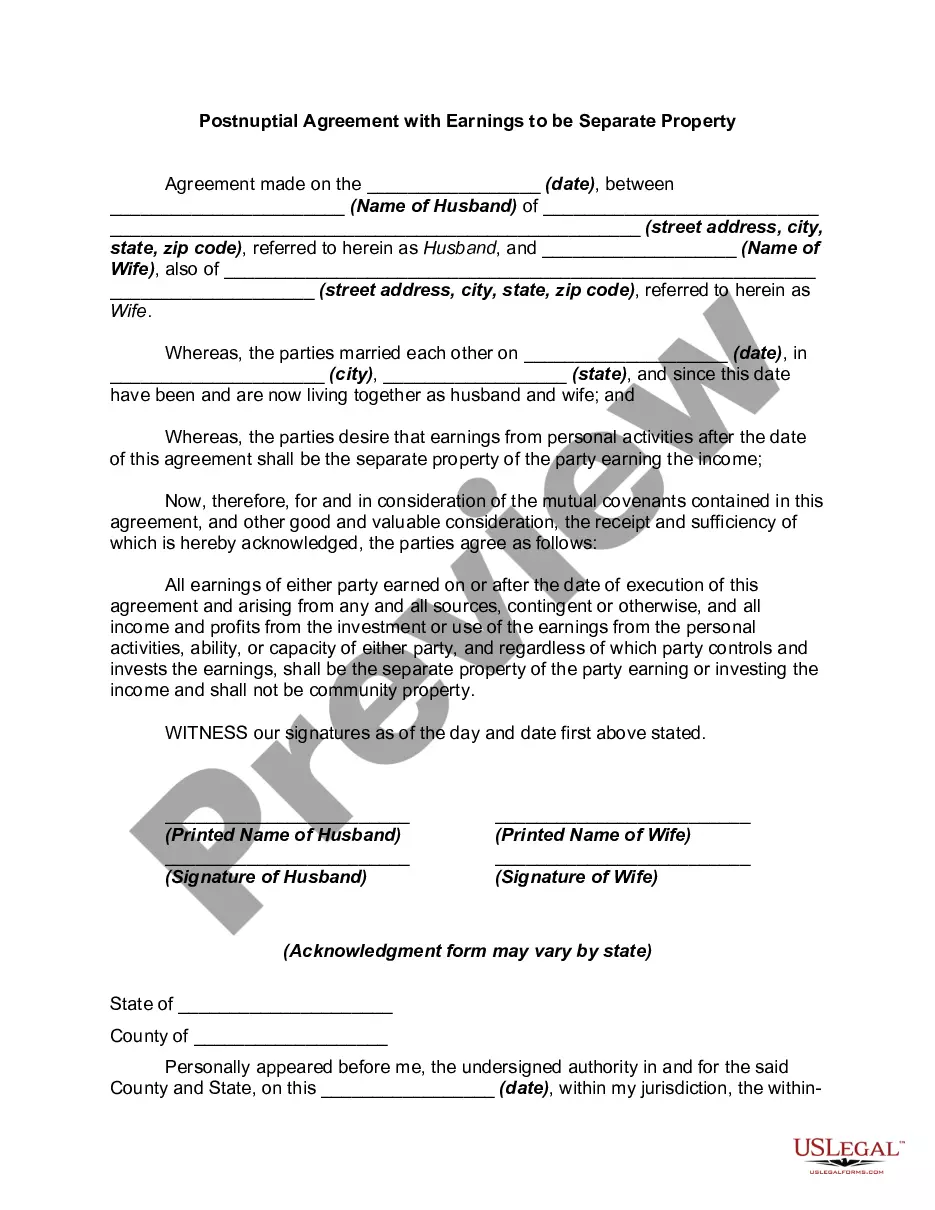

A postnuptial agreement is a written contract executed after a couple gets married to settle the couple's affairs and assets in the event of a separation or divorce.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A postnuptial agreement with earnings to be separate property in Iowa is a legal document that allows married couples to define and establish ownership rights over their individual incomes and assets during the course of their marriage. It serves as a safeguard in cases where both parties wish to maintain separate financial standings, potentially preventing future disputes and potential complications during a divorce or separation. In Iowa, there are different types of postnuptial agreements that can specify the terms concerning earnings being considered separate property. These agreements can include: 1. Iowa Separate Property Agreement: This type of postnuptial agreement explicitly outlines the intention of both spouses to keep their individual earnings, income, and assets separate during the marriage. It establishes that any income earned by each spouse belongs to them individually and should not be subject to division or distribution in the event of a divorce. 2. Iowa Modified Community Property Agreement: This postnuptial agreement permits couples to alter the default community property laws in Iowa. It specifies that certain earnings or assets acquired during the marriage will be treated as separate property by agreement, rather than being subject to the default rule of community property. 3. Iowa Income Segregation Agreement: This type of postnuptial agreement focuses specifically on segregating and separating the income earned by each spouse. It may include provisions that outline the division or allocation of expenses, tax liabilities, and other financial matters during the marriage to maintain the separation of earnings as separate property. 4. Iowa Earnings Allocation Agreement: This postnuptial agreement distributes the earnings acquired by each spouse during the marriage into separate accounts. It may define the percentage or specific amounts of income that will be allocated to each spouse's separate property fund, ensuring that assets and income remain separate during the marriage. Iowa postnuptial agreements with separate property clauses can provide spouses with peace of mind and clarity regarding their financial rights and responsibilities. It is advisable to consult with a qualified attorney who specializes in family law to ensure that the agreement meets all legal requirements and accurately reflects the intentions and desires of both parties involved.A postnuptial agreement with earnings to be separate property in Iowa is a legal document that allows married couples to define and establish ownership rights over their individual incomes and assets during the course of their marriage. It serves as a safeguard in cases where both parties wish to maintain separate financial standings, potentially preventing future disputes and potential complications during a divorce or separation. In Iowa, there are different types of postnuptial agreements that can specify the terms concerning earnings being considered separate property. These agreements can include: 1. Iowa Separate Property Agreement: This type of postnuptial agreement explicitly outlines the intention of both spouses to keep their individual earnings, income, and assets separate during the marriage. It establishes that any income earned by each spouse belongs to them individually and should not be subject to division or distribution in the event of a divorce. 2. Iowa Modified Community Property Agreement: This postnuptial agreement permits couples to alter the default community property laws in Iowa. It specifies that certain earnings or assets acquired during the marriage will be treated as separate property by agreement, rather than being subject to the default rule of community property. 3. Iowa Income Segregation Agreement: This type of postnuptial agreement focuses specifically on segregating and separating the income earned by each spouse. It may include provisions that outline the division or allocation of expenses, tax liabilities, and other financial matters during the marriage to maintain the separation of earnings as separate property. 4. Iowa Earnings Allocation Agreement: This postnuptial agreement distributes the earnings acquired by each spouse during the marriage into separate accounts. It may define the percentage or specific amounts of income that will be allocated to each spouse's separate property fund, ensuring that assets and income remain separate during the marriage. Iowa postnuptial agreements with separate property clauses can provide spouses with peace of mind and clarity regarding their financial rights and responsibilities. It is advisable to consult with a qualified attorney who specializes in family law to ensure that the agreement meets all legal requirements and accurately reflects the intentions and desires of both parties involved.