The Iowa Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document that outlines the transfer of ownership of assets from a corporation to another party. This type of bill of sale is commonly used in business transactions, mergers, acquisitions, or when a corporation decides to liquidate its assets. When executing an Iowa Bill of Sale by Corporation of all or Substantially all of its Assets, it is crucial to include specific keywords to ensure clarity and compliance. Some relevant keywords include: 1. Iowa Corporation: Refers to a legal entity registered under Iowa state law, engaged in business activities and subject to specific regulations. 2. Bill of Sale: A written document that serves as evidence of the transfer of ownership of assets from one party to another. It includes detailed information about the assets being sold and terms of the transaction. 3. Substantially all: Indicates that the majority or a significant portion of the corporation's assets are being transferred. This keyword helps define the scope of the transaction. 4. Assets: Refers to any property, real estate, equipment, intellectual property, contracts, or any other tangible or intangible items owned by the corporation. Different types of Iowa Bill of Sale by Corporation of all or Substantially all of its Assets include: 1. General Bill of Sale: A document that transfers all assets owned by the corporation to the buyer, excluding any specific exclusions or limitations mentioned in the agreement. 2. Limited Bill of Sale: A document that transfers only specific assets or a defined subset of the corporation's assets, rather than transferring all of them. 3. Conditional Bill of Sale: A document that stipulates specific conditions or requirements that must be met by the buyer or both parties for the asset transfer to take place. These conditions may include secure financing, regulatory approvals, or other agreed-upon terms. 4. Asset Purchase Agreement: A comprehensive legal contract that outlines the terms and conditions for the transfer of assets, detailing items such as purchase price, payment terms, representations, warranties, indemnifications, and any post-closing obligations. It is essential to consult legal professionals specializing in business law or corporate transactions to ensure compliance with Iowa state laws and regulations when drafting or executing an Iowa Bill of Sale by Corporation of all or Substantially all of its Assets.

Iowa Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out Iowa Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Choosing the right legitimate papers web template can be quite a have difficulties. Needless to say, there are tons of themes available online, but how will you find the legitimate form you will need? Make use of the US Legal Forms site. The support offers a huge number of themes, including the Iowa Bill of Sale by Corporation of all or Substantially all of its Assets, which can be used for business and private demands. Each of the forms are inspected by experts and meet up with federal and state specifications.

If you are presently authorized, log in to the accounts and then click the Acquire key to obtain the Iowa Bill of Sale by Corporation of all or Substantially all of its Assets. Make use of accounts to look throughout the legitimate forms you have bought formerly. Visit the My Forms tab of your accounts and acquire another copy in the papers you will need.

If you are a whole new customer of US Legal Forms, here are simple instructions that you can stick to:

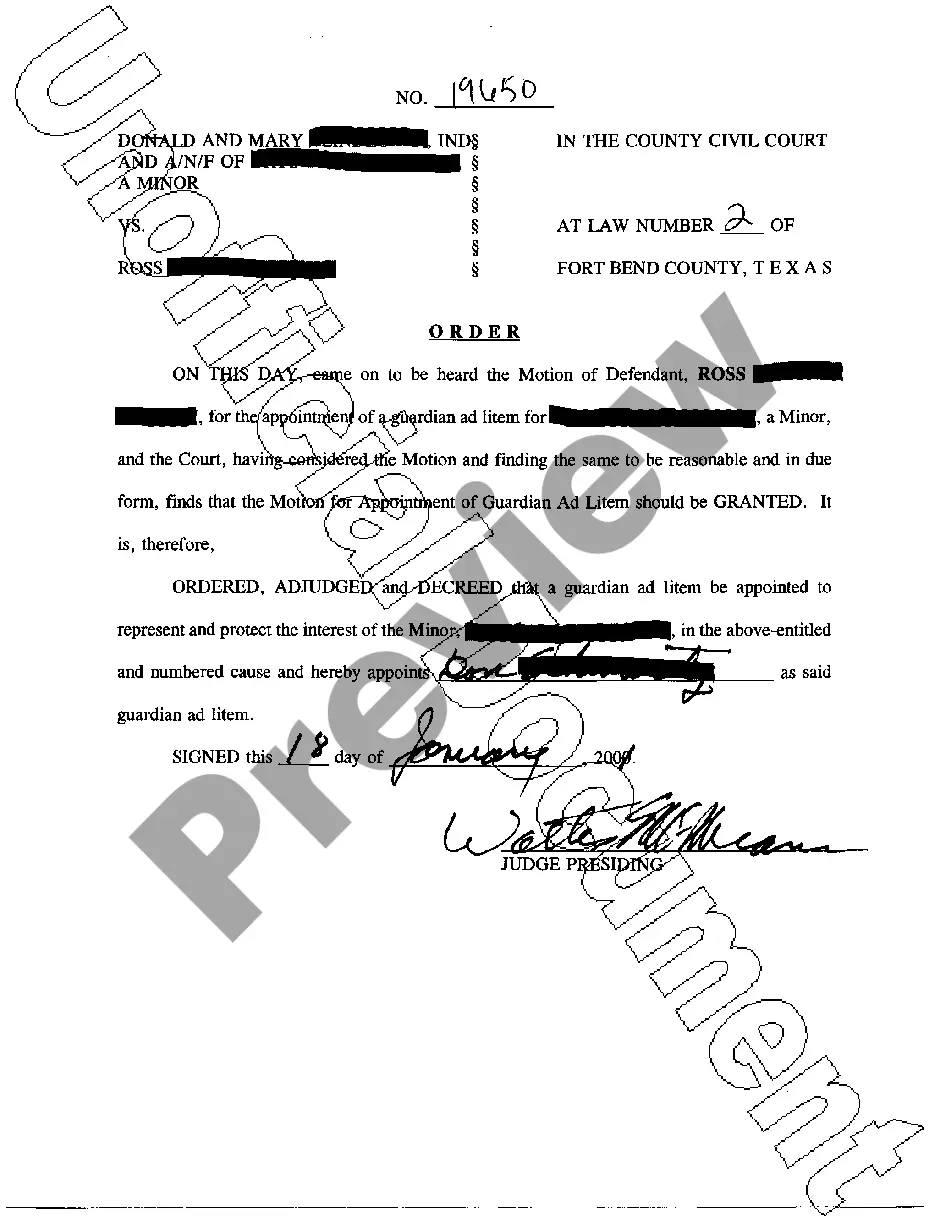

- Initial, ensure you have selected the appropriate form to your metropolis/county. You can look through the form making use of the Preview key and look at the form explanation to make sure it is the right one for you.

- In case the form does not meet up with your requirements, use the Seach area to obtain the correct form.

- When you are positive that the form is suitable, go through the Get now key to obtain the form.

- Pick the pricing strategy you would like and enter the needed information and facts. Design your accounts and purchase the order making use of your PayPal accounts or Visa or Mastercard.

- Choose the document format and download the legitimate papers web template to the system.

- Complete, edit and produce and indicator the obtained Iowa Bill of Sale by Corporation of all or Substantially all of its Assets.

US Legal Forms is definitely the largest catalogue of legitimate forms where you can find different papers themes. Make use of the company to download appropriately-made paperwork that stick to state specifications.