Iowa Expense Report refers to a comprehensive and detailed document that aims to record and document various expenses incurred by individuals or organizations in the state of Iowa. It serves as an important tool for tracking, analyzing, and managing expenses, ensuring transparency and compliance with financial regulations. The Iowa Expense Report includes a variety of relevant keywords such as: 1. Expenses: The report covers a wide range of expenditures, including travel expenses, meal allowances, transportation costs, accommodation fees, and other business-related disbursements. 2. Reimbursement: The report is primarily used for requesting reimbursement of incurred expenses from employers, organizations, or governmental bodies. 3. Documentation: It involves providing supporting documents such as receipts, invoices, tickets, or any other proof of expenditure for each claimed expense. 4. Compliance: The report ensures compliance with Iowa state laws, policies, or guidelines regarding expense management, reimbursement procedures, and financial reporting. 5. Accountability: The report promotes accountability by requiring individuals or organizations to accurately report and justify their expenses, ensuring responsible use of financial resources. 6. Categories: The report may include various categories depending on the nature of the expenses, such as travel expenses, entertainment expenses, equipment purchases, training fees, research expenses, and more. 7. Multiple Forms: Different types of Iowa Expense Reports may exist, depending on the specific purpose or entity using them. For instance, there could be separate reports for businesses, state agencies or departments, educational institutions, or non-profit organizations. 8. Electronic Format: The report may be available in an electronic or paper form, with electronic versions becoming increasingly common due to their convenience and ability to streamline the expense reimbursement process. 9. Approval Process: The report typically goes through an approval process involving supervisors, managers, or designated individuals responsible for verifying and authorizing the claimed expenses. 10. Budget Control: The report helps in monitoring and controlling budgets by identifying areas of excessive spending or potential cost-cutting measures. In conclusion, the Iowa Expense Report is a crucial tool for accurately documenting and managing expenses in Iowa. It plays a significant role in ensuring financial transparency, compliance, and effective budget utilization.

Iowa Expense Report

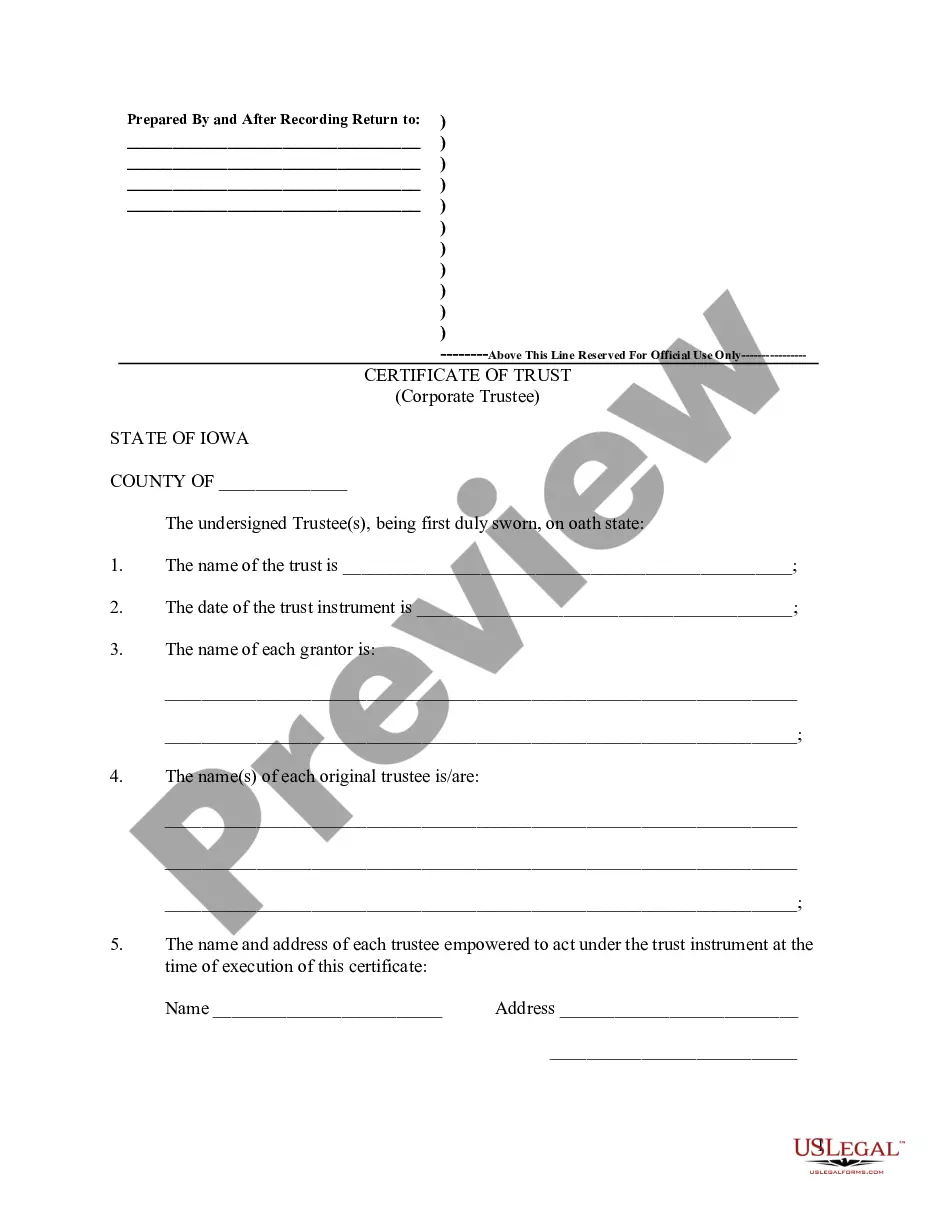

Description

How to fill out Iowa Expense Report?

Choosing the right legitimate document design can be quite a have a problem. Needless to say, there are a lot of layouts available on the Internet, but how would you obtain the legitimate develop you require? Use the US Legal Forms internet site. The services gives a large number of layouts, including the Iowa Expense Report, which you can use for enterprise and personal needs. Each of the varieties are checked out by professionals and fulfill state and federal needs.

In case you are currently signed up, log in to the profile and click on the Obtain option to have the Iowa Expense Report. Make use of profile to look from the legitimate varieties you may have acquired earlier. Proceed to the My Forms tab of the profile and acquire an additional version in the document you require.

In case you are a whole new customer of US Legal Forms, here are basic directions that you can comply with:

- Initially, make certain you have chosen the correct develop for your personal area/county. You can check out the shape making use of the Preview option and browse the shape outline to guarantee it will be the best for you.

- If the develop will not fulfill your preferences, make use of the Seach industry to get the appropriate develop.

- When you are certain that the shape is acceptable, click the Buy now option to have the develop.

- Pick the costs program you would like and type in the required information and facts. Build your profile and pay money for the order with your PayPal profile or credit card.

- Select the document file format and acquire the legitimate document design to the product.

- Comprehensive, edit and print and indication the obtained Iowa Expense Report.

US Legal Forms is definitely the biggest local library of legitimate varieties that you can see various document layouts. Use the company to acquire expertly-created files that comply with express needs.

Form popularity

FAQ

An expense report typically has the following information that you'll need to provide:Name, department, and contact information.List of itemized expense names.Date of purchase for each item.Receipts.Total amount spent.Purpose of the expense.Actual cost of item (subtraction of discounts)Repayment amount sought.More items...?

Information Included in an Expense ReportThe nature of the expense (such as airline tickets, meals, or parking fees) The amount of the expense (matches the amount of the related receipt) The account to which the expense should be charged. A subtotal for each type of expense.

What Is on an Expense Report?The name of the company.Your name.Date range or time period.Columns such as date, description or explanation, code, category columns such as fuel or mileageA list of expenses.Subtotal.Total.An area for the manager to sign off on the expenses.28-Mar-2019

An expense report will usually ask you to itemize (break down into as much detail as possible) all of the expenses included on the report, and to attach any receipts associated with those expenses. It will also usually organize each expense by category, so that it's easy to plug into your company's bookkeeping system.

The employer requires employees to submit paper expense reports and receipts for: 1) any expense over $75 where the nature of the expense is not clear on the face of the electronic receipt; 2) all lodging invoices for which the credit card company does not provide the merchant's electronic itemization of each expense;

The employer requires employees to submit paper expense reports and receipts for: 1) any expense over $75 where the nature of the expense is not clear on the face of the electronic receipt; 2) all lodging invoices for which the credit card company does not provide the merchant's electronic itemization of each expense;

What to include in an expense report. An expense report should always include the following information: Information about who made the purchase, and in the case that the report is being submitted on behalf of someone else, that person's information as well.

What should an expense report include?Information identifying the person submitting the report (department, position, contact info, SSN, etc.)A date and dollar amount for each expense, matching the date and dollar amount on the receipt provided for that expense.A brief description of each expense.More items...?

An expense report tracks expenses that have been incurred during the course of performing necessary job duties. An expense report can be many things: a mileage log used for reimbursement, a receipt of hotel and parking expenses, or an account of meals and entertainment expenses.