Iowa Invoice Template for Independent Contractor

Description

How to fill out Invoice Template For Independent Contractor?

Selecting the ideal sanctioned document template may be a challenge.

Clearly, there are numerous designs accessible online, but how do you obtain the official form you require? Take advantage of the US Legal Forms website.

The service offers a vast array of templates, including the Iowa Invoice Template for Independent Contractor, suitable for both commercial and personal purposes. All forms are verified by experts and comply with federal and state regulations.

If the form does not meet your needs, use the Search field to find the appropriate document. Once you are confident that the form is correct, click the Acquire now button to obtain it. Select your desired pricing plan and enter the necessary details. Create your account and complete the transaction using your PayPal account or Visa or Mastercard. Choose the file format and download the official document template to your device. Finally, complete, edit, print, and sign the obtained Iowa Invoice Template for Independent Contractor. US Legal Forms is the largest repository of legal documents where you can discover a variety of file templates. Use the service to download professionally crafted papers that adhere to state standards.

- If you are currently a registered user, sign in to your account and click the Download button to access the Iowa Invoice Template for Independent Contractor.

- Use your account to review the official documents you have purchased in the past.

- Navigate to the My documents section in your account to obtain another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, make sure you have selected the correct form for your area/state.

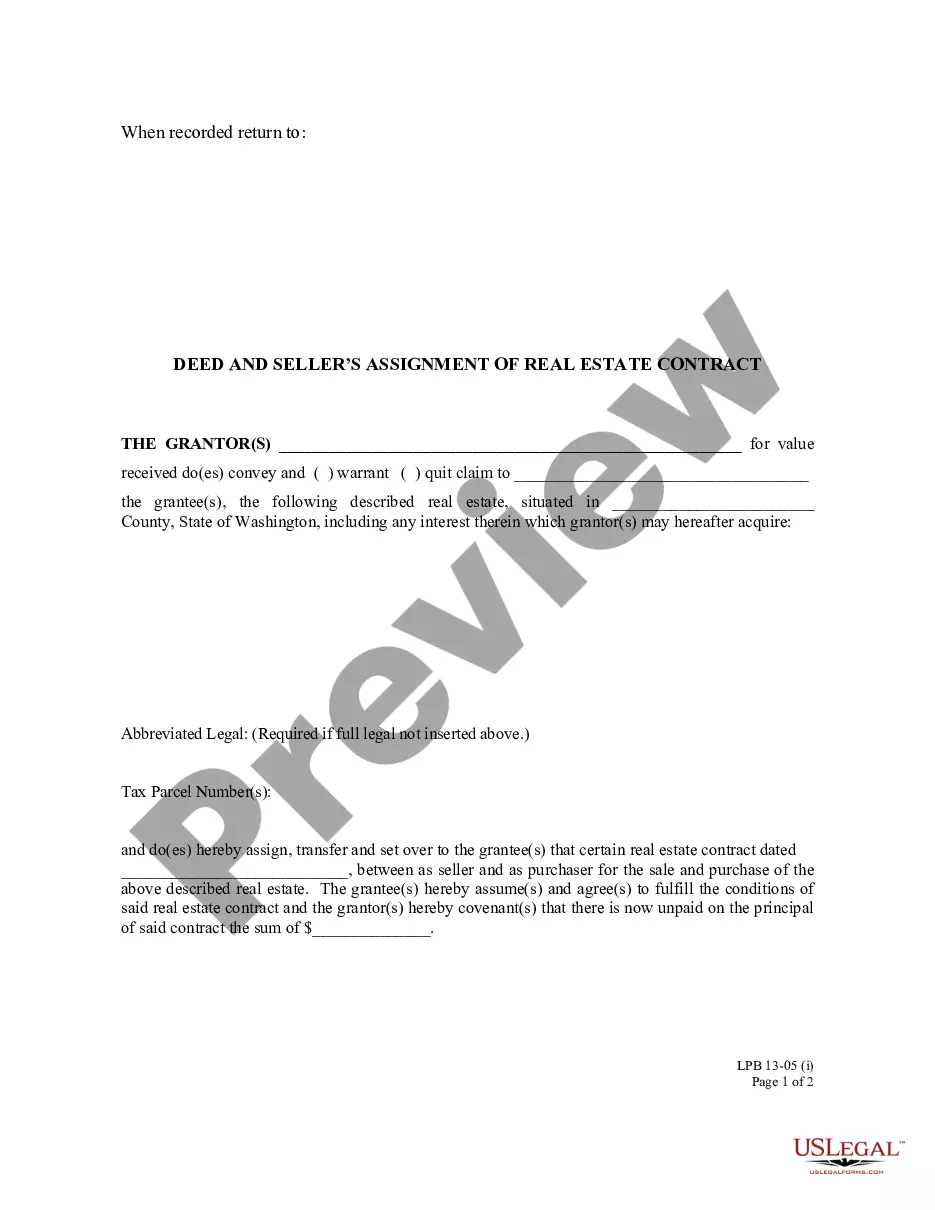

- You can review the document using the Review button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

Writing an invoice as a contractor is straightforward with the right approach. Start by using an Iowa Invoice Template for Independent Contractor, which provides a structured format. Include your contact details, a detailed description of services, the total amount due, and the payment deadline.

Yes, a contractor is generally required to provide an invoice to maintain clarity in business transactions. It serves as a formal request for payment and can prevent disputes. Using an Iowa Invoice Template for Independent Contractor not only simplifies this process but also ensures that you adhere to professional standards.

Submitting an invoice to an independent contractor involves creating a comprehensive document, ideally using an Iowa Invoice Template for Independent Contractor. Ensure the invoice clearly outlines the services rendered, payment terms, and your contact details. You can send it electronically or in print, depending on the contractor's preference.

To file an independent contractor's income, gather all your invoices, including those created using the Iowa Invoice Template for Independent Contractor. Use this information for accurate income reporting on your tax return. Consider consulting a tax professional to ensure you meet all requirements and take advantage of any eligible deductions.

When sending a self-employed invoice, start by utilizing an Iowa Invoice Template for Independent Contractor for a polished look. Clearly list your services, payment amount, and due date. Deliver the invoice via email or standard mail, and consider following up to ensure it was received.

Legally sending an invoice involves following specific guidelines, such as including your business information and having a clear payment schedule. You can utilize an Iowa Invoice Template for Independent Contractor to ensure all legal aspects are covered. Sending the invoice through a reliable method, such as email or certified mail, also enhances its legitimacy.

To send an invoice as an independent contractor, first create a professional document using an Iowa Invoice Template for Independent Contractor. Include essential details like your name, business information, services provided, and payment terms. Once you prepare the invoice, send it via email or postal mail, ensuring the client receives it promptly.

Creating an independent contractor invoice involves using an Iowa Invoice Template for Independent Contractor for efficiency. Start by entering your contact information and your client's details. Clearly list the services provided, along with the corresponding charges. Utilizing a reliable template makes it easier to create consistent, accurate invoices that meet legal and client requirements.

To make an invoice as an independent contractor, you should begin with your information, including your name and contact details. Following that, list your client’s information along with a description of the services provided, the invoice date, and the total due. Remember to include payment terms for clarity. An Iowa Invoice Template for Independent Contractor can assist you in creating a professional and effective invoice quickly.

For beginners, invoicing can start simply. As a first step, use a clear format that includes your details and your client's information. Detail the services, the date, and the total amount due. An Iowa Invoice Template for Independent Contractor can guide you through each step, helping beginners feel confident in their invoicing process.