Iowa Invoice Template for Event Vendor

Description

How to fill out Invoice Template For Event Vendor?

Are you currently in the situation where you require documents for either business or personal reasons almost all the time.

There are many legal document formats accessible online, but finding reliable ones can be challenging.

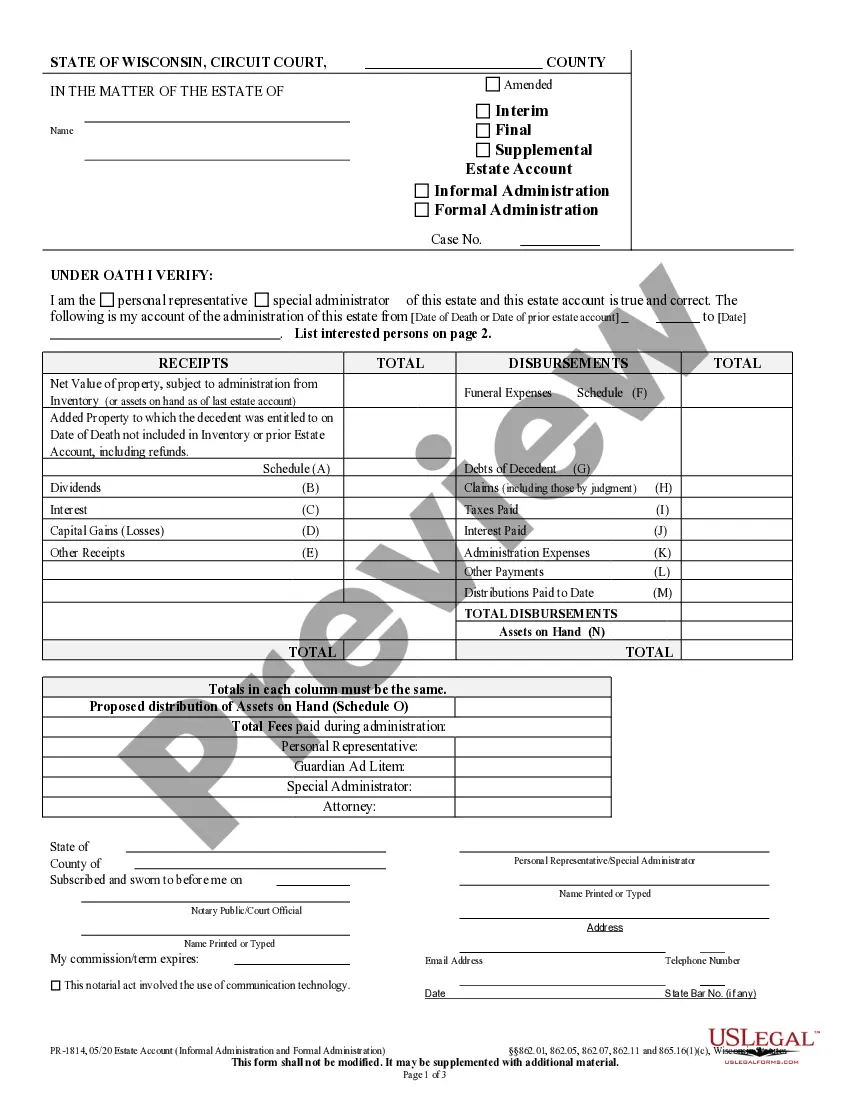

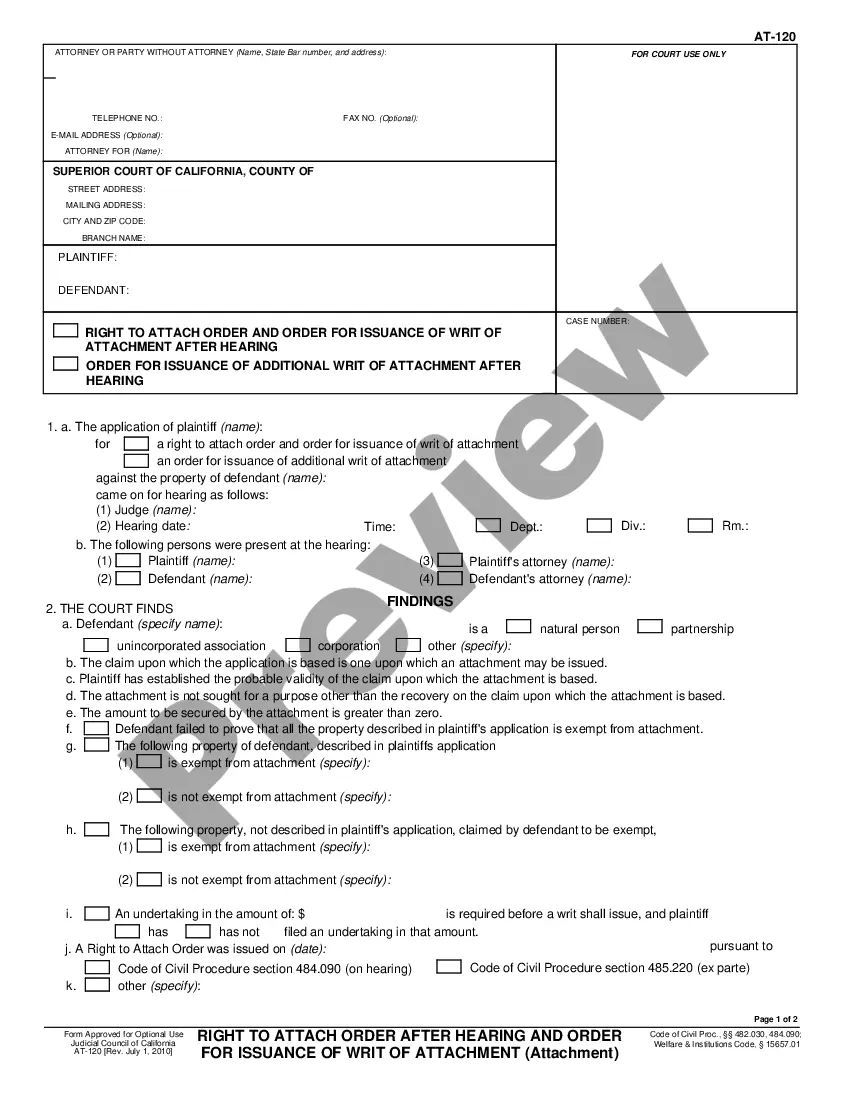

US Legal Forms offers a wide variety of templates, such as the Iowa Invoice Template for Event Vendor, that are designed to comply with state and federal regulations.

Once you have acquired the right document, click Get now.

Choose your preferred pricing plan, provide the necessary information to create your account, and pay for your purchase using your PayPal or Visa or Mastercard. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Iowa Invoice Template for Event Vendor at any time, if needed. Just select the appropriate document to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service provides professionally crafted legal document templates that can serve a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then you can download the Iowa Invoice Template for Event Vendor template.

- If you don't have an account and wish to begin using US Legal Forms, follow these instructions.

- Obtain the document you need and ensure it’s for the correct city/state.

- Utilize the Review button to look over the form.

- Read the description to confirm you have selected the correct document.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Creating an invoice for services provided starts with capturing key details like your and your client’s information. Clearly itemize the services with descriptions and prices, making sure to include total amounts and payment terms. This structure helps both you and the client understand the transaction. An Iowa Invoice Template for Event Vendor can simplify this creation process by providing a ready-made format.

To invoice a client for services, start by clearly marking your invoice with your business name and contact information. Include the client's name and details as well. Then, itemize the services provided, including detailed descriptions and costs. Utilizing an Iowa Invoice Template for Event Vendor can significantly enhance the organization and professionalism of your invoice.

Filling out an invoice template involves entering essential details such as your business information, client details, and a breakdown of services. Make sure to specify quantities, individual charges, and any taxes. Follow the template layout to ensure you do not miss important sections. An Iowa Invoice Template for Event Vendor offers a helpful guide to ensure all necessary information is included.

Filling out a contractor’s invoice requires basic information such as your business name, client name, services rendered, and payment terms. It’s important to maintain clarity about what services were provided and their costs. Including any contract numbers related to the work can also enhance transparency. Using an Iowa Invoice Template for Event Vendor can help standardize your documentation and reduce errors.

To create a bill for services rendered, start by identifying your business details and the client’s information. Clearly list each service rendered, along with its corresponding charges. It’s also helpful to include the total amount due, payment instructions, and deadlines. An Iowa Invoice Template for Event Vendor offers a straightforward format for crafting precise and professional bills.

To write an invoice for services provided, include your business name, contact details, and the client's information. List each service, completing any necessary descriptions and associated costs. Don’t forget to include payment terms and due dates. Utilizing an Iowa Invoice Template for Event Vendor can streamline this process and ensure accuracy.

Processing a vendor invoice starts with capturing the invoice details accurately, using a recognized format like the Iowa Invoice Template for Event Vendor. Next, verify the information against your purchasing records, and enter it into your accounting system for tracking. Finally, schedule the payment and maintain a record for future reference.

Invoice processing typically involves receiving the invoice, verifying its accuracy, recording it in your accounting system, and scheduling it for payment. Start with the Iowa Invoice Template for Event Vendor to ensure all necessary details are included. This methodical approach helps maintain financial clarity.

Managing vendor invoices involves systematic organization and tracking. Utilize the Iowa Invoice Template for Event Vendor as a standard format to maintain consistency. Regularly review and reconcile invoices with your accounting system to avoid errors and ensure timely payments to your vendors.

An invoice is a request for payment for goods or services, while a vendor invoice specifically pertains to purchases made from a vendor. The Iowa Invoice Template for Event Vendor highlights this distinction by providing a format tailored for event-related transactions, ensuring clarity in financial documentation between parties.