Iowa Guaranty of a Lease

Description

How to fill out Guaranty Of A Lease?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the website, you will acquire thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest editions of forms like the Iowa Guaranty of a Lease within minutes.

If you possess a membership, Log In and retrieve the Iowa Guaranty of a Lease from the US Legal Forms repository. The Download button will be displayed on each form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Utilize your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make edits. Fill out, revise, print, and sign the downloaded Iowa Guaranty of a Lease. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Iowa Guaranty of a Lease with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your locality/county.

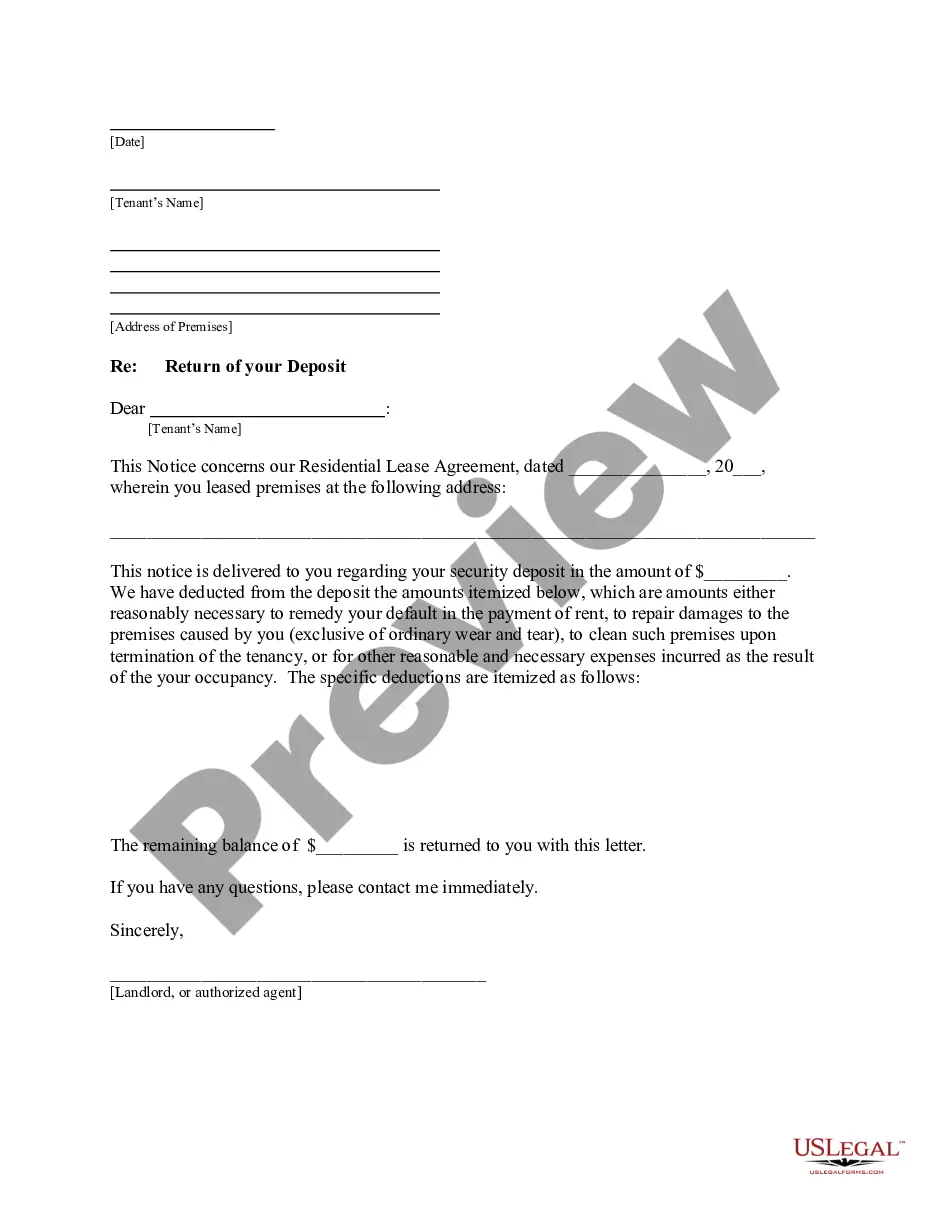

- Click the Preview button to review the form's details.

- Check the form details to confirm that you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you desire and enter your information to register for an account.

Form popularity

FAQ

The guarantee section of a lease outlines the responsibilities of the guarantor, including the extent of their liability. It specifies that the guarantor must cover rent and any associated costs in case the tenant defaults. This section provides vital protection for landlords while assuring tenants that they have support. Reviewing this section carefully is essential for understanding your obligations.

Similar to other agreements, a lease guaranty does not need to be notarized in Iowa for it to be valid. Yet, some landlords may prefer notarized guarantees as a precaution. Notarization helps confirm the identity of the signer, which can prevent disputes later. Always check with your landlord to clarify their expectations.

Yes, a lease can still be legal even if it is not notarized. In Iowa, the essential requirements for a lease to be enforceable include mutual consent and consideration. While notarization adds an extra layer of verification, it is not a legal necessity for a lease agreement in most cases. Always ensure that all parties fully understand their obligations under the lease.

An example of a guaranty of a lease is when a parent signs a lease agreement alongside their adult child who is renting an apartment. The parent commits to paying rent if the child fails to meet their obligations. This arrangement assures the landlord of rent security while aiding the child in securing housing. It’s a common practice that strengthens the lease agreement.

In Iowa, a guaranty of a lease does not generally require notarization. However, some landlords may request a notarized signature for added security and validation. Notarization can help in proving the identity of the guarantor, which may be beneficial in legal situations. Overall, it's best to discuss this with your landlord to understand their specific requirements.

Yes, Iowa has numerous title companies that assist with buying, selling, and leasing properties. These companies play a crucial role in facilitating the Iowa Guaranty of a Lease, ensuring that transactions are conducted securely. When choosing a title company, consider their experience and reputation, as these factors can impact your overall satisfaction. Platforms like USLegalForms can help you find trusted title companies to support your real estate needs.

The Iowa title guaranty program began in 1983, aiming to provide a reliable method for ensuring the security of property titles. This initiative supports the Iowa Guaranty of a Lease, making transactions smoother and more transparent. As a result, both buyers and renters benefit from increased confidence in their property agreements. Understanding this history can enhance your knowledge when navigating any lease agreements.

The guaranty of a lease agreement is an understanding that a third party will be responsible for fulfilling the terms of the lease if the tenant fails to do so. This arrangement protects landlords and provides peace of mind during their leasing process. Utilizing tools like US Legal Forms can streamline the creation of such agreements, ensuring all legal nuances are covered.

A guaranty agreement serves to mitigate risk by assuring landlords that their lease obligations will be met. This legal document provides landlords with recourse if tenants default on their lease. Through the lens of the Iowa Guaranty of a Lease, such agreements help maintain a sense of security in rental transactions.

The minimum guarantee on a lease refers to the lowest amount of financial assurance that a guarantor must provide. This figure often varies depending on the specific terms outlined in the lease agreement. To ensure compliance and understanding, reviewing the Iowa Guaranty of a Lease is crucial for both tenants and landlords.