28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

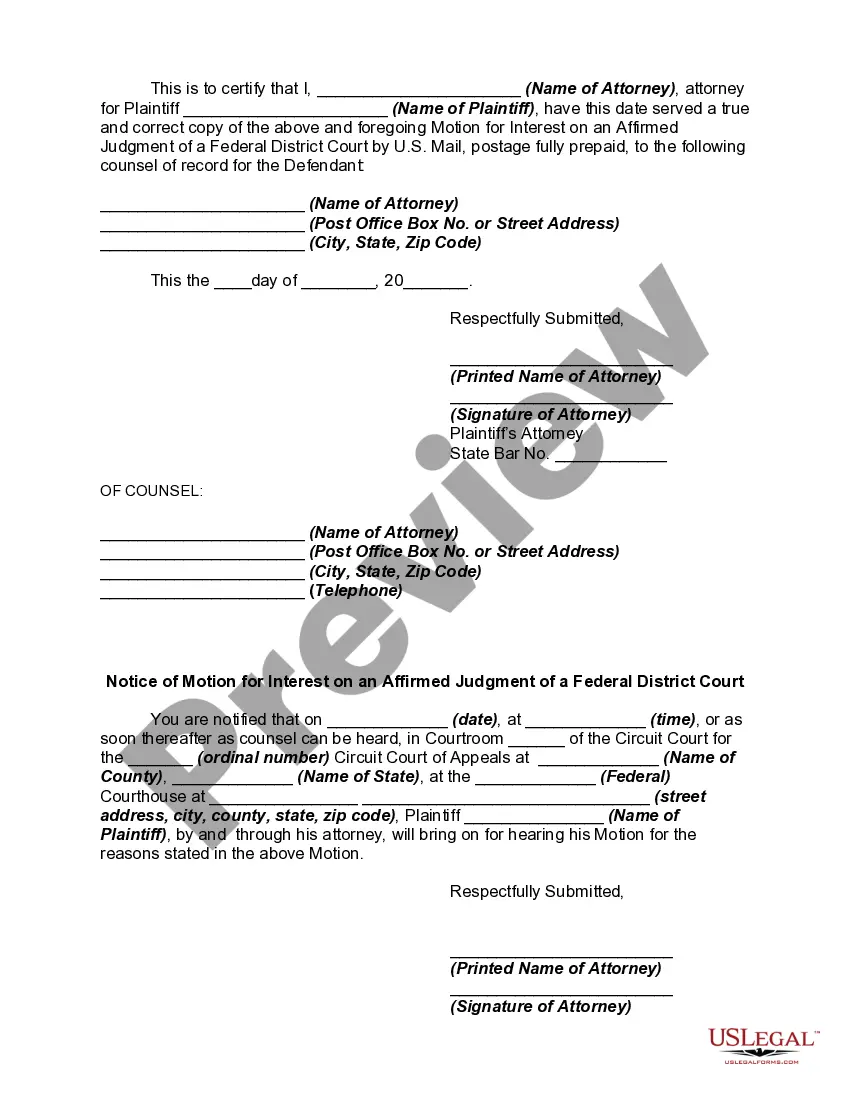

Iowa Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

If you need to complete, down load, or printing legitimate file templates, use US Legal Forms, the greatest assortment of legitimate types, which can be found on the Internet. Use the site`s basic and hassle-free research to discover the paperwork you want. Different templates for enterprise and individual reasons are categorized by types and says, or search phrases. Use US Legal Forms to discover the Iowa Motion for Interest on an Affirmed Judgment of a Federal District Court in a handful of mouse clicks.

If you are previously a US Legal Forms client, log in in your bank account and then click the Acquire switch to have the Iowa Motion for Interest on an Affirmed Judgment of a Federal District Court. You can even access types you in the past saved within the My Forms tab of your own bank account.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for the appropriate area/country.

- Step 2. Use the Preview solution to check out the form`s information. Do not forget about to learn the description.

- Step 3. If you are not happy using the type, make use of the Research industry at the top of the display screen to discover other variations in the legitimate type web template.

- Step 4. Upon having discovered the form you want, click on the Get now switch. Pick the prices strategy you like and include your references to register for the bank account.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Select the structure in the legitimate type and down load it on the product.

- Step 7. Total, change and printing or indicator the Iowa Motion for Interest on an Affirmed Judgment of a Federal District Court.

Each legitimate file web template you buy is the one you have forever. You possess acces to every single type you saved inside your acccount. Click the My Forms segment and choose a type to printing or down load once more.

Contend and down load, and printing the Iowa Motion for Interest on an Affirmed Judgment of a Federal District Court with US Legal Forms. There are thousands of skilled and status-certain types you can utilize for the enterprise or individual needs.

Form popularity

FAQ

The action of a single justice or senior judge may be reviewed by the supreme court upon its own motion or a motion of a party. A party's motion for review of the action of a single justice or senior judge shall be filed within 10 days after the date of filing of the challenged order.

Rule 6.1101 - Transfer of cases to court of appeals (1)Transfer. The supreme court may by order, on its own motion, transfer to the court of appeals for decision any case filed in the supreme court except a case in which provisions of the Iowa Constitution or statutes grant exclusive jurisdiction to the supreme court.

The action of a single justice or senior judge may be reviewed by the supreme court upon its own motion or a motion of a party. A party's motion for review of the action of a single justice or senior judge shall be filed within 10 days after the date of filing of the challenged order.

6.702. Rule 6.702 - Service (1)Filer's duty to ensure service. Documents filed with the clerk of the supreme court must be served on all other parties to the appeal or review and on any nonparty required to be served by these rules unless the appropriate appellate court orders otherwise.

Interest shall be calculated as of the date of judgment at a rate equal to the one-year treasury constant maturity published by the federal reserve in the H15 report settled immediately prior to the date of the judgment plus two percent.

A motion or other similar filing addressed to an appellate court must contain a caption setting forth the name of the court, the title of the case, the file number, a brief descriptive title indicating the purpose of the filing, and the name, address, telephone number, e-mail address, and fax number of counsel or the ...

Rule 6.101 Time for appealing final orders and judgments appealable as a matter of right. 6.101(1) Time for filing a notice of appeal from final orders and judgments. a. Termination-of-parental-rights and child-in-need-of-assistance cases under Iowa Code chapter 232.

An appeal from a final order or judgment in a termination-of-parental-rights or a child-in-need-of-assistance case under Iowa Code chapter 232 is initiated by filing the notice of appeal with the clerk of the district court where the order or judgment was entered within the time provided in rule 6.101(1)(a).