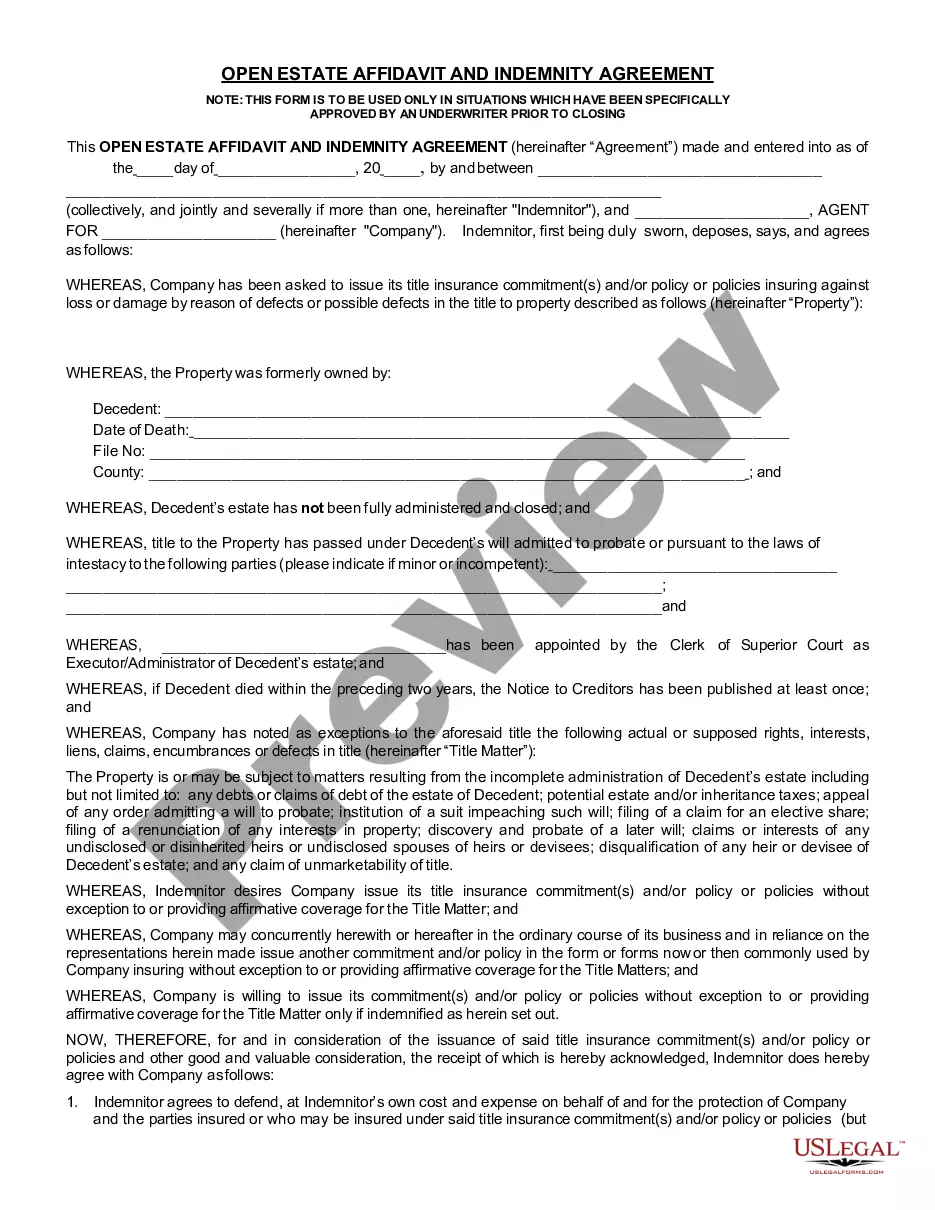

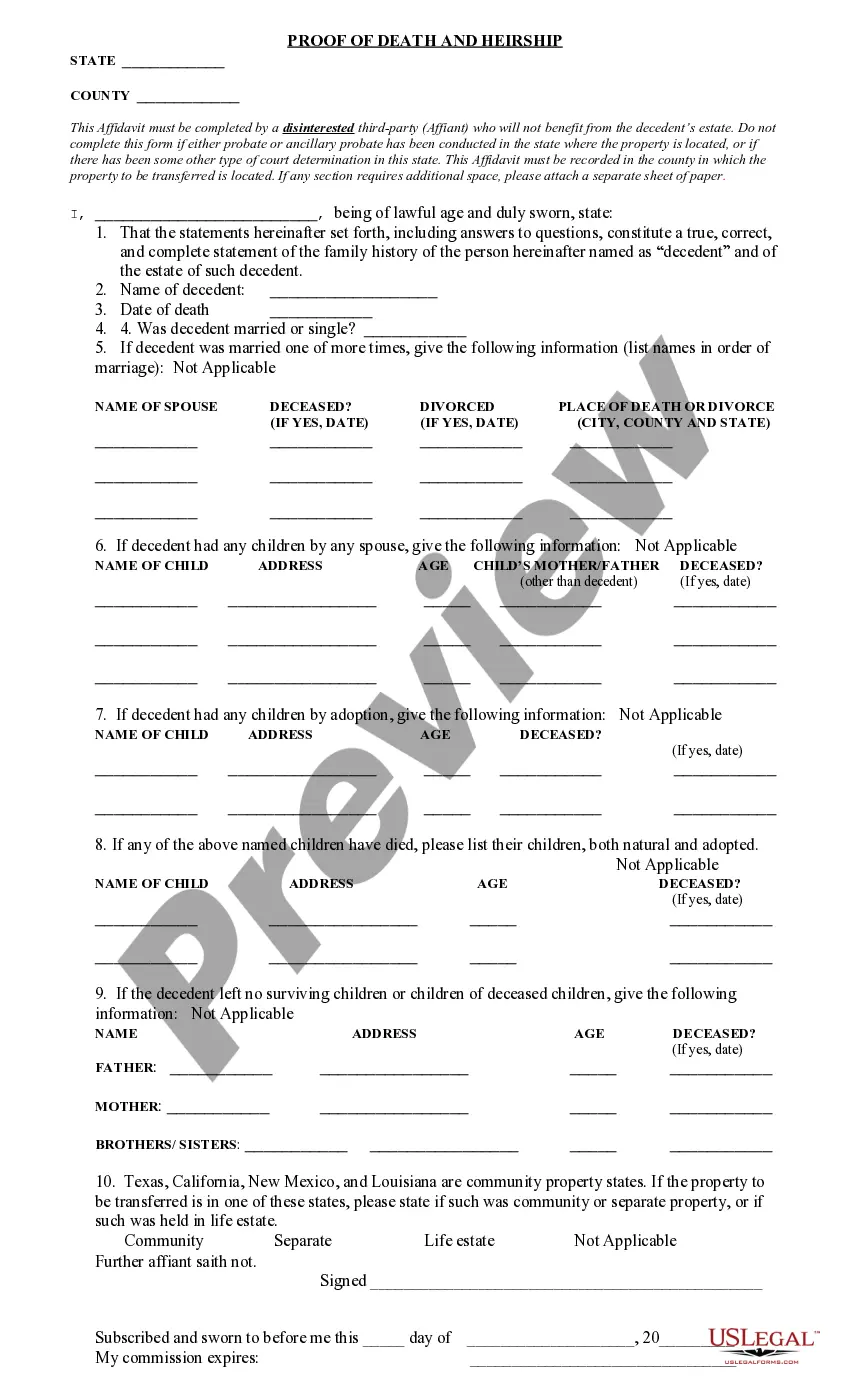

If you have to full, obtain, or produce authorized record web templates, use US Legal Forms, the greatest selection of authorized kinds, which can be found on the Internet. Take advantage of the site`s simple and handy look for to obtain the paperwork you require. Various web templates for enterprise and person uses are sorted by classes and suggests, or keywords. Use US Legal Forms to obtain the Iowa Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in just a number of clicks.

When you are currently a US Legal Forms consumer, log in for your account and click on the Download option to obtain the Iowa Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement. You can also entry kinds you in the past acquired within the My Forms tab of your respective account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for the proper city/land.

- Step 2. Make use of the Preview solution to look through the form`s content. Do not neglect to read through the information.

- Step 3. When you are unsatisfied using the kind, take advantage of the Lookup field on top of the monitor to get other versions from the authorized kind design.

- Step 4. After you have discovered the form you require, click on the Acquire now option. Select the prices plan you like and add your qualifications to register on an account.

- Step 5. Approach the deal. You should use your bank card or PayPal account to perform the deal.

- Step 6. Pick the file format from the authorized kind and obtain it in your product.

- Step 7. Full, modify and produce or sign the Iowa Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Every single authorized record design you buy is your own property for a long time. You may have acces to every single kind you acquired with your acccount. Click the My Forms area and choose a kind to produce or obtain yet again.

Remain competitive and obtain, and produce the Iowa Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms. There are many professional and status-particular kinds you may use for the enterprise or person requires.