Title: Iowa Sample Letter for Tax Exemption — Review of Applications: Everything You Need to Know Introduction: In Iowa, tax exemptions play a crucial role in promoting economic growth and community development. To achieve tax-exempt status, organizations need to submit a well-crafted application accompanied by a sample letter for tax exemption. This article aims to provide a comprehensive understanding of the review process and its various types. I. Overview of Iowa Tax Exemption: The Iowa tax exemption program is designed to benefit eligible nonprofit organizations, religious institutions, charitable trusts, and specific entities engaged in socially helpful activities. These entities can receive certain tax exemptions to aid their operations and support community-based initiatives. II. Importance of Sample Letter for Tax Exemption — Review of Applications: When applying for tax exemption, submitting a sample letter is crucial to demonstrate the organization's eligibility and justify the need for tax exemption. This letter provides the Iowa Department of Revenue (IDR) with important details about the organization's purpose, activities, and financial information. III. Key Components of Iowa Sample Letter for Tax Exemption: 1. Identification Information: — Name, address, and contact details of the organization/applicant. — Confirmation of the entity's nonprofit status under state and federal law. 2. Statement of Purpose: — Clear explanation of the organization's mission, objectives, and how it intends to benefit the community. — Elaboration on the program or services planned to be offered. 3. Financial Information: — Detailed breakdown of the organization's income sources, including donations, grants, fundraising, etc. — A comprehensive budget statement highlighting how the funds will be utilized to achieve the organization's goals. 4. Organizational Structure: — Description of the organization's governing structure, including board members, directors, and officers. — Information about any affiliations, collaborations, or partnerships with other organizations. 5. Compliance with Eligibility Criteria: — Confirmation that the organization meets all the prerequisites for Iowa tax exemption, such as being a registered nonprofit, fulfilling the requirements under the IRS Section 501(c)(3), etc. — Documentation supporting tax-exempt status qualification. IV. Types of Iowa Sample Letters for Tax Exemption: 1. Nonprofit Organizations: — Sample letter template for nonprofits seeking tax exemption, including charities, educational institutions, religious organizations, etc. 2. Religious Institutions: — A specific sample letter template tailored for religious organizations, highlighting their unique practices and services they provide to the community. 3. Charitable Trusts: — A sample letter template for charitable trusts, focusing on their charitable activities, funding sources, and intended benefits. V. Review Process and Additional Considerations: Once the application, along with the sample letter, is submitted, the IDR reviews the documents carefully. They assess the organization's eligibility, financial credibility, and adherence to state and federal requirements. It is important to note that the review process may vary depending on the type of tax exemption sought. Conclusion: Obtaining tax exemption in Iowa can significantly support the growth and sustainability of various organizations dedicated to community welfare. By providing a well-drafted sample letter with all the necessary information, organizations can improve their chances of receiving tax-exempt status. Understanding the requirements, preparing a compelling sample letter, and meeting all eligibility criteria are essential steps towards successful tax exemption in Iowa.

Iowa Sample Letter for Tax Exemption - Review of Applications

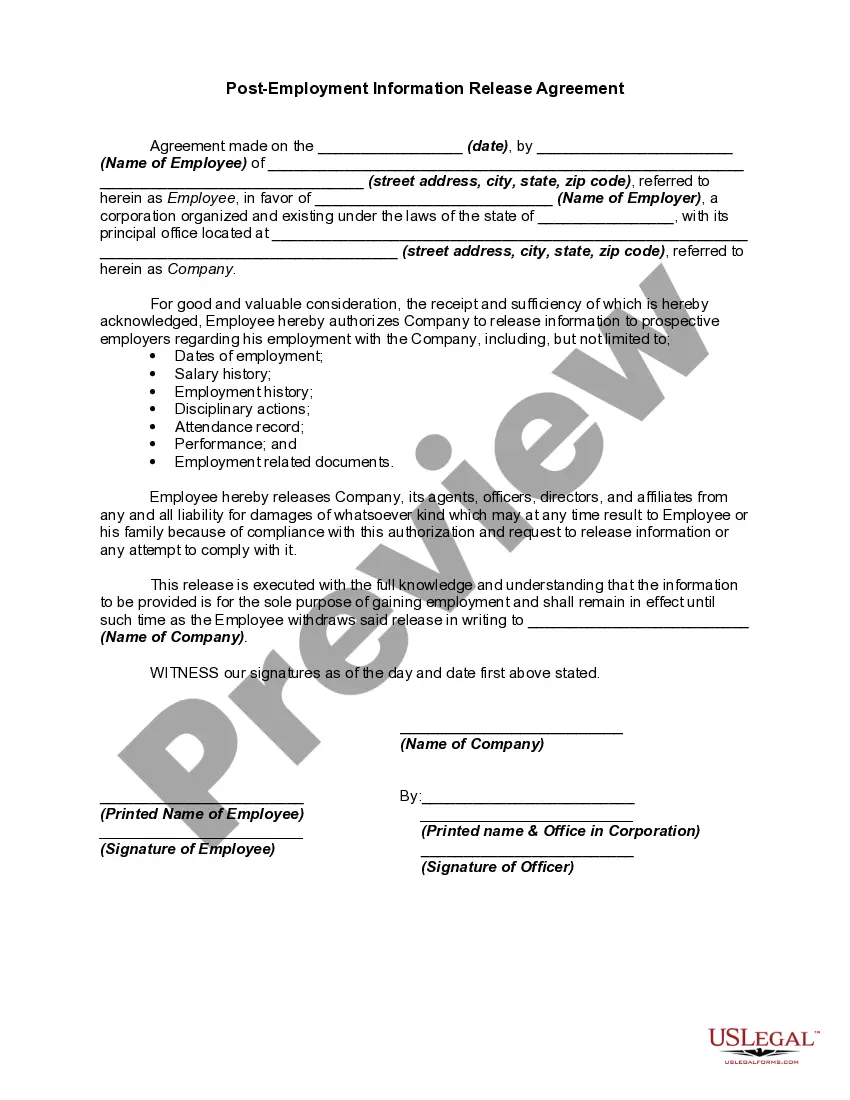

Description

How to fill out Iowa Sample Letter For Tax Exemption - Review Of Applications?

It is possible to invest hrs online trying to find the legitimate record web template that fits the state and federal demands you require. US Legal Forms provides 1000s of legitimate varieties that are reviewed by experts. You can easily acquire or print out the Iowa Sample Letter for Tax Exemption - Review of Applications from my services.

If you already have a US Legal Forms profile, you may log in and click the Acquire button. Afterward, you may comprehensive, revise, print out, or indication the Iowa Sample Letter for Tax Exemption - Review of Applications. Every legitimate record web template you purchase is yours permanently. To acquire yet another backup of any acquired develop, check out the My Forms tab and click the corresponding button.

If you work with the US Legal Forms web site initially, follow the easy guidelines below:

- Initial, make certain you have chosen the correct record web template to the region/metropolis that you pick. Look at the develop explanation to make sure you have picked the right develop. If readily available, use the Review button to look from the record web template as well.

- If you would like get yet another variation in the develop, use the Lookup industry to get the web template that meets your needs and demands.

- After you have identified the web template you want, click Acquire now to carry on.

- Pick the rates prepare you want, type in your qualifications, and sign up for a free account on US Legal Forms.

- Complete the deal. You can utilize your charge card or PayPal profile to purchase the legitimate develop.

- Pick the structure in the record and acquire it in your product.

- Make alterations in your record if possible. It is possible to comprehensive, revise and indication and print out Iowa Sample Letter for Tax Exemption - Review of Applications.

Acquire and print out 1000s of record templates while using US Legal Forms web site, that provides the most important variety of legitimate varieties. Use professional and state-specific templates to take on your company or specific requirements.