A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

Iowa Checklist for Limited Security Offering

Instant download

Description

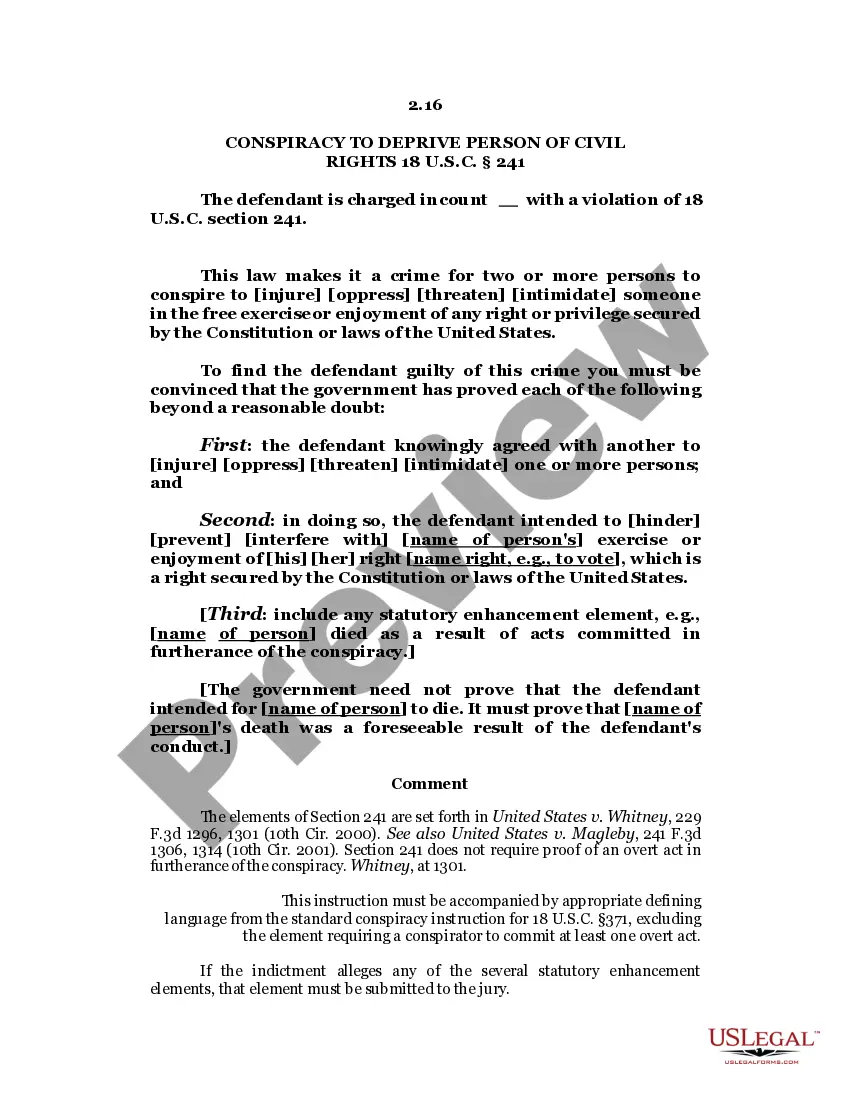

Free preview

How to fill out Checklist For Limited Security Offering?

Have you ever been in a situation where you require documents for occasional business or personal purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones isn't straightforward.

US Legal Forms offers a vast array of document templates, such as the Iowa Checklist for Limited Security Offering, designed to comply with federal and state regulations.

Once you locate the right form, click Buy now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and make the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Iowa Checklist for Limited Security Offering template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct city/county.

- Utilize the Review button to assess the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you are looking for, use the Lookup field to find the form that suits your requirements.